Saratoga's Fiscal Q3 2016 Financial Results

Saratoga Investment Corp. will report its financial results for the fiscal quarter ended November 30, 2015 on January 13, 2016, after market close. A conference call to discuss the financial results will be held on January 14, 2016. Details for the conference call are provided below.

Who:

- Christian L. Oberbeck, Chief Executive Officer

- Michael J. Grisius, President and Chief Investment Officer

- Henri J. Steenkamp, Chief Financial Officer

When:

Thursday, January 14, 2016 10:00 a.m. Eastern Time (ET)

How:

Call: Interested parties may participate by dialing (877) 312-9208 (U.S. and Canada) or (678) 224-7872 (outside U.S. and Canada).

A replay of the call will be available from 1:00 p.m. ET on Thursday, January 14, 2016 through 1:00 p.m. ET on Thursday, January 21, 2016 by dialing (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (outside U.S. and Canada), passcode for both replay numbers: 9568370.

Webcast:

Interested parties may access a simultaneous webcast of the call and find the Q3 2016 presentation by going to the “Events & Presentations” section of Saratoga Investment Corp.’s investor relations website.

Information:

Saratoga Investment Corp.’s Form 10-Q for the fiscal quarter ended November 30, 2015 will be filed on January 13, 2016 with the Securities and Exchange Commission.

For more information, visit Saratoga Investment Corp. online.

Are BDCs Better Than Banks?

“Philadelphia: First Bank of the US” via Wally Gobetz

A recent Seeking Alpha article asks, Are Business Development Companies Better Than Banks? As the CFO of a BDC, you might think my answer would be a resounding ‘yes.’

However, ‘better’ is rather subjective in this sense, which is why my answer is maybe.

In an overarching explanation, the article makes great points that BDCs are indeed in a position to provide higher quality financing to the middle market. Its additional points that point out banks face new requirements and regulations that forced some to exit some asset classes, while some BDCs can take on larger transactions, certainly demonstrate the optimism many in the sector feel. However, when it comes to individuals and businesses the answer isn’t as clear.

On the business side, both a BDC and a potential portfolio company need to scrutinize the deal they are about to enter into. In some cases, the BDC may opt to not acquire a business that appears to pose too much of a risk to its portfolio. If a company’s earnings, stability, market evaluation and future performance fail to show its proven record and potential, a BDC will likely choose to not add a company to its portfolio. Conversely, a business owner must evaluate if their business is ready, or in the need, for BDC investing. There are certainly tons of advantages for both sides, but investment might not be the best option every time.

Getting back to the Seeking Alpha piece, the article clearly lays out the growth potential of the sector, to which I agree, but I hope my points help those unfamiliar with BDCs that the term “better” is a loose descriptor for all parties involved. If you and your business fit the mold to invest or join a reputable BDC, do so by all means. However, if you go in without understanding all the criteria and risks, you could be doing more harm than good for your venture. In short, BDC investment requires thorough risk assessment prior to making the plunge into the space.

Once it becomes clear that you are ready to invest or forge an agreement with a BDC, I do believe that you will find that a BDC is better than banks in several facets that the Seeking Alpha article lays out quite well. Regardless of what route you eventually take, the best way to determine the ‘better’ option for your money and/or business comes down to research, analysis and patience to make the correct decision. With the proper steps taken, you will make the best decision for your venture.

Saratoga CEO Chris Oberbeck Interview: Helping Private Companies Raise Capital

The regulatory environment is still an issue for small and middle-market businesses struggling to get financing from traditional banks. At Saratoga, we help private companies overcome this problem.

This morning, Saratoga’s CEO, Chris Oberbeck, was interviewed on Fox Business to discuss the regulatory environment, rising interest rates, and more.

Take a look and share it around!

Watch the latest video at video.foxbusiness.com

Saratoga Announces Q2 2016 Financial Results: Further Increases Quarterly Dividend to $0.36 from $0.33 per share

NEW YORK, October 13, 2015 – Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2016 fiscal second quarter.

Summary Financial Information

- Net asset value (“NAV”) was $125.3 million as of August 31, 2015, a $1.8 million increase from an NAV of $123.5 million as of May 31, 2015 and a $2.7 million increase from an NAV of $122.6 million as of February 28, 2015.

- For the six months ended August 31, 2015, $8.7 million of dividends declared was more than offset by $5.4 million of net investment income, $3.8 million of net realized gains and $3.0 million of stock dividend distributions.

- NAV per share was $22.42 as of August 31, 2015, compared to $22.70 as of February 28, 2015.

- Net investment income on a weighted average per share basis of $0.66 for the quarter ended August 31, 2015. Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income on a weighted per share basis was $0.52, an increase of $0.09, or 21% from the quarter ended August 31, 2014.

- Earnings per share for the quarter ended August 31, 2015 was $0.22, a decrease of $0.37 from the quarter ended August 31, 2014 – the increase in net investment income from $2.1 million last year to $3.7 million this year was offset by a net loss on investments of $2.4 million this quarter as compared to a net gain of $1.1 million last year. The $2.4 million net loss for the quarter ended August 31, 2015 consists of $3.7 million net realized gains offset by $6.1 million net unrealized depreciation.

- Net investment income of $3.7 million for the quarter ended August 31, 2015. Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income was $2.9 million, an increase of $0.6 million, or 26% from the quarter ended August 31, 2014.

- Net investment income yield as percentage of average net asset value (“Net Investment Income Yield”) was 11.8% for the quarter ended August 31, 2015. Adjusted for the incentive fee accrual related to net unrealized capital gains, the Net Investment Income Yield was 9.3%, an increase of 150 bps from the quarter ended August 31, 2014.

- Return on equity for the quarter ended August 31, 2015 was 4.0%.

- Investment portfolio activity for the quarter ended August 31, 2015:

- Cost of investments made during the period: $18.9 million

- Principal repayments during the period: $27.4 million

Saratoga Investment Corp. to Report Fiscal Second Quarter 2016 Financial Results and Hold Conference Call

NEW YORK, Sept. 23, 2015 /PRNewswire/ — Saratoga Investment Corp. (NYSE: SAR), a business development company, will report its financial results for the fiscal quarter ended August 31, 2015 on October 13, 2015, after market close. A conference call to discuss the financial results will be held on October 14, 2015. Details for the conference call are provided below.

Who:

Christian L. Oberbeck, Chief Executive Officer

Michael J. Grisius, President and Chief Investment Officer

Henri J. Steenkamp, Chief Financial Officer

When:

Wednesday, October 14, 2015

10:00 a.m. Eastern Time (ET)

How:

Call: Interested parties may participate by dialing (877) 312-9208 (U.S. and Canada) or (678) 224-7872 (outside U.S. and Canada).

A replay of the call will be available from 1:00 p.m. ET on Wednesday, October 14, 2015 through 11:59 p.m. ET on Wednesday, October 21, 2015 by dialing (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (outside U.S. and Canada), passcode for both replay numbers: 48340801.

Webcast: Interested parties may access a simultaneous webcast of the call and find the Q2 2016 presentation by going to the “Events & Presentations” section of Saratoga Investment Corp.’s investor relations website,http://www.saratogainvestmentcorp.com/investor.html

Information:

Saratoga Investment Corp.’s Form 10-Q for the fiscal quarter ended August 31, 2015 will be filed on October 13, 2015 with the Securities and Exchange Commission.

Read the full press release for more details.

Predictive Analytics and CFOs Go Hand in Hand

Predictive analytics is an immensely helpful facet of CFO’s role. For those unfamiliar, predictive analytics is a practice used by boards that extracts pertinent information to determine trends and behavioral patterns relating to the past, present and future of a business–though it is predominantly used for forecasting the future of a business.

Overall, two of the most compelling reasons to implement predictive analytics is profit and growth. With a forward-thinking leadership in place, predictive analytics help the board set short and long-term goals as it strives to reach its next milestone in business.

When harnessed properly, predictive analytics begin to embody the principles of its board. Without implementing this sort of analytics, it certainly is hard for a board to consider itself forward thinking. By looking at its entire history and setting a course for the future, a board demonstrates how they understand the business at an intimate level.

With that knowledge in hand, the business’ entire operation can be accurately scrutinized. From marketing efforts to supply management, the CFO is able to pinpoint on areas of the operation that could benefit from refining.

However, predictive analytics go beyond profit and growth potential for a business–it also creates new questions. These questions help a board, and specifically its CFO, hone in on issues that could become pressing in the near or distant future. By properly zeroing in key statistics now, the board proactively seeks out answers well ahead of crunch time. Furthermore, with forward thinking implemented there is less room for uncertainty and gray area. By reducing these hazy areas, the business can continue to move forward as confidently as possible.

If your company doesn’t utilize predictive analytics, it may be worth exploring to see why. Whether you are a business with a clear growth plan established, or one looking to make the right moves to succeed, predictive analytics could be the key to pointing you in the right direction.

Why CEOs Should Know About BDCs Now More Than Ever

Last year, my colleague and Saratoga Investment Chief Executive Officer Christian Oberbeck wrote an article for Chief Executive on Why CEOs Should Know About BDCs. While this endorsement does appear a bit biased, I couldn’t agree with Christian more on this point. Furthermore, since its publishing, the sector has surged. If you are a company with the potential to join a BDC’s portfolio, the benefits can prove to be immense. That is why your CEO must be up to date with every viable fundraising stream.

Straight away, Christian’s article lays out a key reason why CEOs need to know about BDCs. In an era where banks face stricter regulations, meeting the financial needs of fund seekers might not be possible. Meanwhile, BDCs are capable of providing capital to everything from office suppliers to sales rep firms. Since its inception in 1980, the sector has focused on the capital needs of businesses not in the high-level market. When the banking well is going through a draught, much of the BDC sector is able to quench a thirsty revenue stream.

In the current landscape, the aforementioned restrictions banks face limit their risk ability. Conversely, a BDC has the room to make riskier investments under the right terms–potentially providing the fund seekers a more ideal solution. Just because they can take on a bit more risk, BDCs still scrutinize every aspect of risk internally and externally before investing.

Not only can a BDC take on more risk, it is able to meet the needs of its portfolio companies with a more fluid financial structure. When banks are restricted, BDCs have more wiggle room while still operating under regulations. With banks in large shifting to more conservative approaches, a BDC can discuss the needs of a company and find a structure that benefits all parties.

Furthermore, while this is all business–a BDC wants to maintain relationships with its portfolio companies that ensures the best production all around. That relationship begins when closing the deal, a “high certainty” once a BDC approves of its potential portfolio company. Once the paperwork is signed, an ideal BDC relationship continues just like any healthy relationship that embraces healthy communication and reliability. With a staff of skilled professionals capable of managing the needs of every participant in the deal, a CEO can ensure a personal, professional experience with a quality BDC.

With this knowledge at their hands, your CEO may recognize the benefits of an alternative fundraising effort that often provides deeper funds and relationship management throughout.

The Key to CFO Success is Constant Attention

When it comes to the role of a CFO, day-to-day management is just as crucial as keeping focus on the big picture. While these long-term issues certainly can keep a CFO up at night wondering how to resolve any troubles their company may face, it’s the daily operational duties that often showcase an exceptional CFO.

As we’ve discussed in the past, a CFO’s role is evolving to involve an increasing amount of tasks. Issues like efficiency, growing business and maintaining ample visibility are just a few of the responsibilities that fall into the hands of a CFO. It is essential that the correct strategy is implemented and its execution be performed as precise as possible.

For any CFO looking to improve production, there are a few ways to go. When it comes to efficiency measurement, the issue can get sensitive. That’s because streamlining or replacing staff with a more qualified team could be in the mix for a struggling business. For a company not dealing with these kinds of issues, but still looking to boost productivity, they may choose to focus on improving other aspects of the company like business processes and technology.

Additionally, efficiency could mean streamlining costs. When this is the case, a CFO needs to ensure they are working with the correct data and cost analysis. If they do not, they could put the company further in the red. To find where your efficiency could improve, the CFO must keep their attention on these matters in an ongoing matter.

While amplifying visibility and growing the business may not seem like the ideal responsibilities of a CFO, today’s modern officer knows that these are two key segments to hone in on. If your business is global, there are multiple levels that require constant research and analysis. They include supply management, differences in business culture and even laws and regulations that are uncommon to your home location.

When it comes to visibility, this may not be a CFO’s direct responsibility. However, this is where they can once again demonstrate their keen eye for analysis and management. By looking at the data, ideally real-time but the old spreadsheet method works fine as well, the ideal CFO can pinpoint where areas of the business can improve or given extra attention to reach its full potential.

As the business landscape continues its evolution, the role of the CFO will most likely continue to shift with it. Regardless, a superb CFO knows that proactivity, foresight and proper execution are keys to growing a business. With the proper person at the helm, your business will be in capable hands regardless the issue.

Is Your Business Ready for a BDC or Crowdfunding?

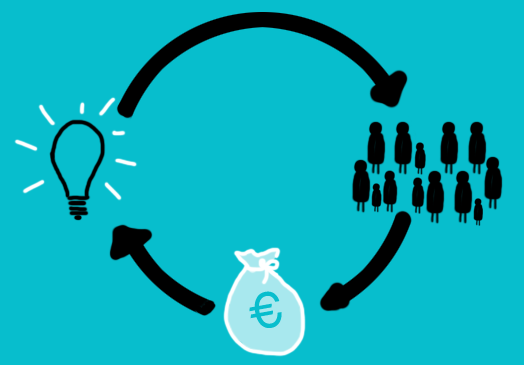

The rise of crowdfunding has allowed for emerging entrepreneurs and businesses an entirely new avenue to gain funds for their venture. For these aspiring business leaders, one successful round of funding can take their promising plan into a viable business with ample revenue to work with. Those looking to go the crowdfunding route have numerous credible platforms to choose from. A quick Google search will come back with names like Kickstarter, Indiegogo and GoFundMe as starters.

For some with less experience in the fundraising realm may think that crowdfunding is comparable to BDC investing. However, just because your business is viable for one potential form of fundraising, it doesn’t mean you are qualified for the other. If you find yourself uncertain of which path fits your business better, consider the characteristics.

When it comes to crowdfunding, a business that is ready to move forward has a couple of characteristics laid out in their business. Consider it a part of their identity. This portion of its business identity reflects its competency, consistency and foresight. Regardless of company ethos, traits like a goal-oriented vision indicate that your business is ready to raise upwards of millions of dollars–and you know how to use it. But you don’t succeed merely on goals. A viable crowdfunding business also has a plan. This plan incorporates your targeted fundraising goal and how each cent goes into the business.

Is your business a lone wolf? Do you lack a network? If so, consider expanding your network before going forward with fundraising. A solid network not only increases your chances of having a successful fundraising campaign, it provides you with a reliable network of like-minded individuals in similar scenarios as you are. This increases your marketability, which is integral in getting the word out about your campaign.

Whether you are a newcomer or a seasoned veteran to crowdfunding, these four characteristics serve as a solid foundation for building your campaign upon.

Going with a business development corporation is a bit of a different route. Additionally, the BDC may choose to not go down that route with you. That’s because while BDCs support the ambitions of crowdfunded ventures, they look for more of an established track record before committing to a new portfolio company. For a business with a successful round of funding under its belt, they may want to consider a BDC at that point.

These companies embrace the same methodology of a successful crowdfunding campaign, but it also requires intangibles that mirror almost any relationship in life. BDCs thrive on healthy relationships, where crowdfunding depends less on this quality. With quite a bit of communication between a BDC and a portfolio company, communication must be open and healthy.

Consistent communication is just one facet of consistency that an ideal portfolio company possesses. That consistency extends to a company’s performance when it comes to managing risk, staff and a key statistic, the bottom line. If a potential portfolio company fails to demonstrate its consistency, there is a high probability that most BDCs will elect not to pursue your company at this time. Additionally, there is the “secret sauce” of BDC investing. The secret sauce is the ideal candidate–revenue between $8 million and $150 million, most likely privately held and have significant capital needs that bank loans cannot satisfy.

If your business falls in line with the above criteria, now may be the time to explore becoming a portfolio company. Regardless of the decision you choose, this should be a meticulously explored venture. Making the wrong choice can harm your financial, and potentially, industry standing. Both routes require extensive analysis, risk assessment and internal inquiry. If all these traits begin to highlight your business, it may be time for you to take the next step in this process.

Saratoga Celebrates 5 Year Anniversary by Ringing NYSE’s Closing Bell®

Saratoga Investment Corp. announced today that it will visit the New York Stock Exchange (“NYSE”) to ring the Closing Bell® in celebration of the Company’s five year anniversary. Saratoga Investment’s Chairman and Chief Executive Officer Christian Oberbeck, who will be joined by the Company’s Board of Directors and members of the management team, will ring the Closing Bell® on Thursday, July 23, 2015 at 4:00 p.m.

“All of us at Saratoga Investment are extremely proud of what we’ve accomplished over the past five years,” said Mr. Oberbeck. “Since 2010, we have been guided by a very clear, long-term strategy of building a best-in-class BDC with an exceptional management team, expanding our assets under management, and broadening our investor base. Our goal has always been to create a strong investment company with a distinctive franchise in the BDC marketplace that provides superior returns to the investment community.”

For the full release, please visit Saratoga Investment Corp.

Update: Check out the video below to see us ringing in the Closing Bell! It was a great time.