Saratoga Investment Corp. Announces Fiscal Year-End and Fourth Quarter 2020 Financial Results

NEW YORK, May 06, 2020 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2020 fiscal year-end and fourth quarter.

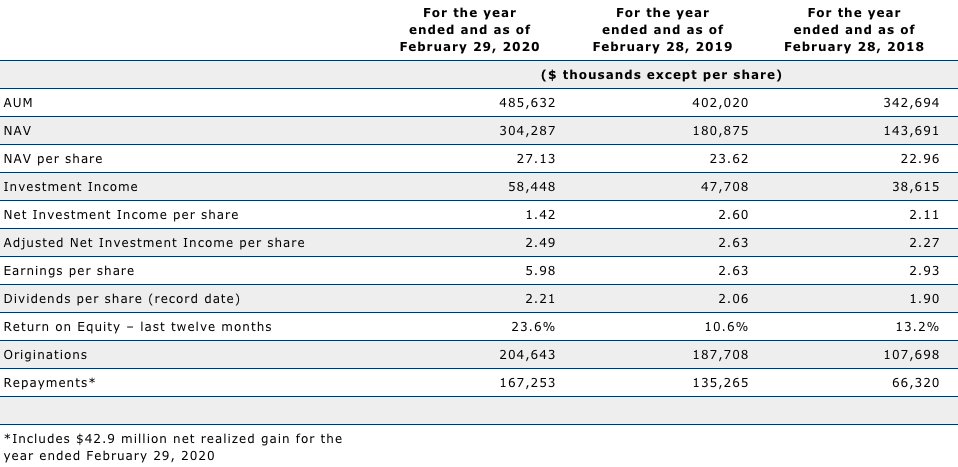

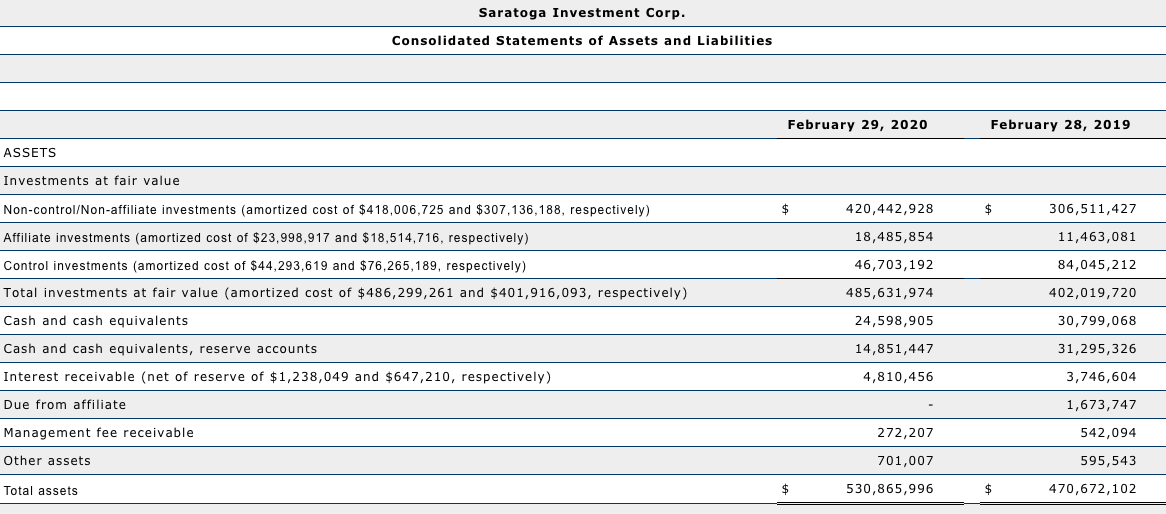

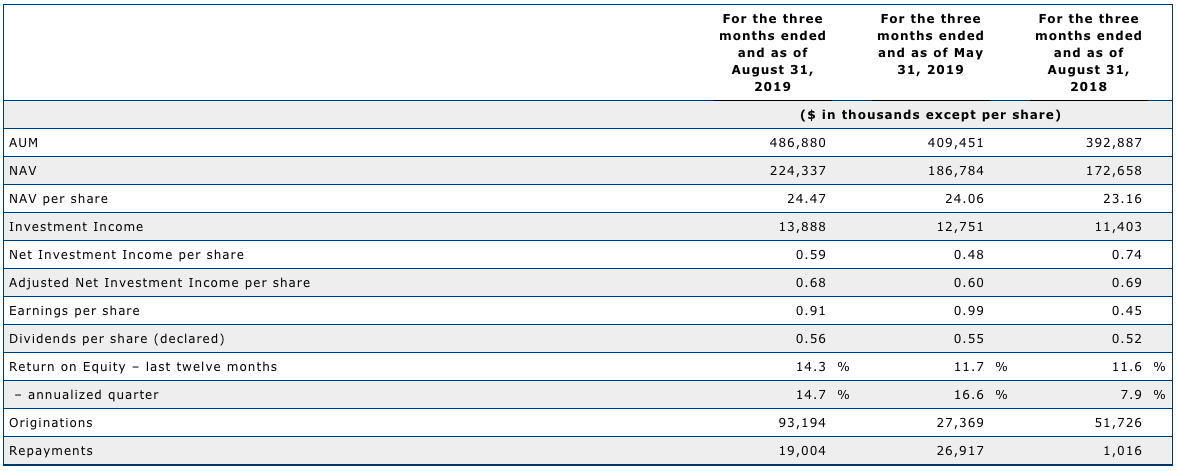

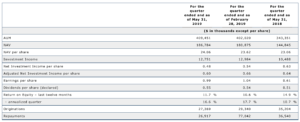

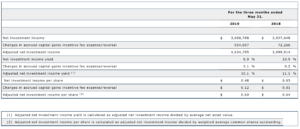

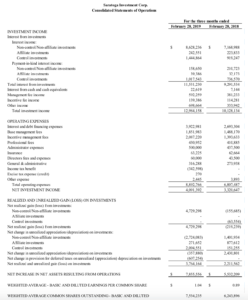

Summary Financial Information

The Company’s summarized financial information is as follows:

“Coming off a record year of achievements and operating performance, we believe Saratoga is in a strong position heading into this calamitous health and economic environment,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “We believe our performance metrics for fiscal 2020 were remarkably strong with LTM return on equity of 23.6%, adjusted NII per share of $2.49 per share, earnings per share of $5.98, and an additional increase in NAV per share this quarter of $1.83, or 7.2%, resulting in a total increase for the year of $3.51, or 14.9%, to $27.13. This NAV number includes the completion of the Easy Ice sale we previously communicated to you, resulting in a $31.2 million realized gain. As we look ahead to the numerous challenges that the COVID-19 pandemic presents to the economy and particularly small businesses, balance sheet strength, liquidity and NAV preservation are paramount. Our current capital structure is the strongest in Saratoga’s history, with $304 million of equity supporting $60 million of long-term covenant-free non-SBIC debt. Our regulatory leverage of 607% substantially exceeds our 150% requirement. Our liquidity and dedicated credit facilities of $260 million at year-end are available to support our portfolio companies, including $175 million of SBIC II facilities dedicated to new opportunities. We had $18 million of committed undrawn lending commitments as of year-end.

In light of the dramatic uncertainties in the economy, and to ensure we retain liquidity to support our portfolio companies and preserve NAV during these challenging times, while remaining positioned to fund attractive new investments for small businesses in need, Saratoga’s Board of Directors believes it is in the best near and long-term interests of our shareholders to maintain a conservative and cautious approach to our dividend policy. The Board of Directors has therefore decided to defer our dividend for the quarter ended February 29, 2020. We will continue to reassess this on at least a quarterly basis as we gain better visibility on the economy and business activities. An important consideration for this decision arises from our historically conservative management of our RIC compliance obligations, such that we have no ordinary income spillover obligations and therefore substantial spillover flexibility and consequent liquidity. This provides us the ability to defer future quarterly dividends and we may choose to do so depending on liquidity, portfolio and overall economic assessment.”

Michael J. Grisius, President and Chief Investment Officer, added, “This fiscal year has again demonstrated how the long-term measured growth of our AUM in strong portfolio companies can result in outsized equity returns, with our $8.0 millionEasy Ice investment resulting in a $31.2 million gain, following directly after our 11x return and $11.3 million realized gain on Censis in Q3, for a total net realized gain of $42.9 million in FY20. We also continued to bring new platform investments into the portfolio, with two investments in new companies added this quarter, in addition to the success we continue to have with follow-ons in existing borrowers. We believe the quality of our asset base remained at an exceptionally high level at year-end, with 99% of credits rated in our highest category, putting our portfolio in a strong position heading into the volatility and uncertainty ahead. With 71.3% of our investments at year-end in first lien debt and generally supported by strong enterprise values and balance sheets in industries that have historically performed well in stressed situations, we remain confident thus far in the durability of our portfolio in these uncertain times. However, we do anticipate that the adverse effects COVID-19 has on market conditions and the overall economy, including, but not limited to, the related declines in market multiples, increases in underlying market credit spreads and company-specific negative impacts on operating performance, will lead to unrealized and potentially realized depreciation being recognized in our portfolio in the coming quarters. We have confidence in our experienced management team, high underwriting standards and time-tested investment strategy and believe we have the resources to weather the economic challenges ahead, and that once these volatile conditions subside and uncertainty is reduced, that our team will be able to continue to steadily grow portfolio size and maintain quality over the long-term.”

Business Update:

Saratoga Investment is focused on ensuring the safety of its employees and the employees of its portfolio companies, while also managing its ongoing business activities. The Company continues to work collaboratively with its employees and portfolio companies to navigate the significant challenges created by the novel coronavirus (“COVID-19”) pandemic.

Saratoga Investment believes it has taken the necessary steps to ensure that its personnel can effectively operate remotely. Its senior management team and staff remain fully engaged and capable of working remotely. Thus far, the Company has not experienced any significant operational limitations, and has been capable of providing the necessary support or service that its portfolio companies have required.

Saratoga Investment has been actively engaged with its portfolio companies and continues to be pleased with the diligent and proactive actions taken by the portfolio company management teams and their ability to respond effectively to the continuing challenges in the current environment. The Company stands ready to assist them as they manage their respective businesses. While virtually every business has had some of level of impact in the near-term, the ultimate impact of COVID-19 on any individual business remains unknown. Notwithstanding these uncertainties, based on the information we have in hand, the Company believes that its portfolio companies are generally taking the right steps to help mitigate both the near and long-term effect of COVID-19 on their businesses. The Company’s lower middle market portfolio companies have also been actively evaluating the programs and relief under the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, stimulus packages that may be available to assist these portfolio companies as they navigate the impact of COVID-19 on their businesses, employees and operations, and many have availed themselves of that relief.

Saratoga Investment believes that its historically conservative approaches to investing, leverage utilization and maintaining solid levels of liquidity, put it in a position of strength going into this uncertain and challenging time. While no business can anticipate with clarity how long the displacement in the market and global economy will last, the Company believes that Saratoga Investment’s capital structure, liquidity and management experience will enable it to effectively navigate the grave challenges presented by COVID-19.

Subsequent Events Update:

Saratoga Investment evaluated subsequent events from February 29, 2020 through May 6, 2020. On March 11, 2020, the World Health Organization declared COVID-19 as a pandemic, and on March 13, 2020 the United States declared a national emergency with respect to COVID-19. The outbreak of COVID-19 has severely impacted global economic activity and caused significant volatility and negative pressure in financial markets. The global impact of the outbreak has been rapidly evolving and many countries, including the United States, have reacted by instituting quarantines, mandating business and school closures and restricting travel. Such actions are creating disruption in global supply chains and adversely impacting a number of industries. The outbreak could have a continued adverse impact on economic and market conditions and trigger a period of global economic slowdown. The rapid development and fluidity of this situation precludes any prediction as to the ultimate adverse impact of COVID-19. Nevertheless, COVID-19 presents material uncertainty and risks with respect to the underlying value of the Company’s portfolio companies, the Company’s business, financial condition, results of operations and cash flows, such as the potential negative impact to financing arrangements, Company decisions to delay, defer and/or modify the character of dividends in order to preserve liquidity, increased costs of operations, changes in law and/or regulation, and uncertainty regarding government and regulatory policy.

As of February 29, 2020, the Company valued its portfolio investments in conformity with U.S. GAAP based on the facts and circumstances known by the Company at that time, or reasonably expected to be known at that time. Due to the overall volatility that the COVID-19 pandemic has caused during the months that followed its February 29, 2020 valuation, any valuations conducted now or in the future in conformity with U.S. GAAP could result in a lower fair value of its portfolio.

The potential impact to Saratoga Investment’s results will depend to a large extent on future developments and new information that may emerge regarding the duration and severity of COVID-19 and the actions taken by authorities and other entities to contain COVID-19 or treat its impact, all of which are beyond our control. Accordingly, the Company cannot accurately predict the extent to which its financial condition and results of operations will be affected at this time.

Discussion of Financial Results for the Year and Quarter ended February 29, 2020:

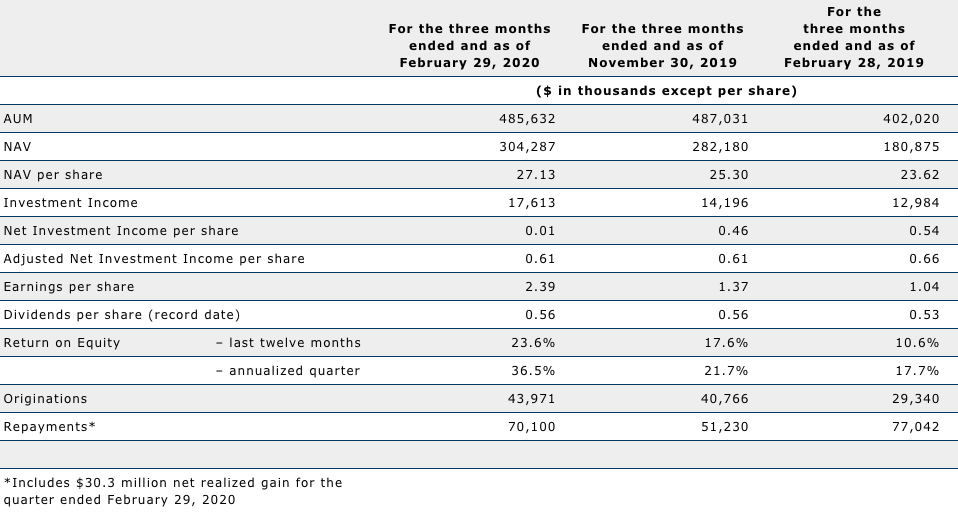

As of February 29, 2020, Saratoga Investment increased its assets under management (“AUM”) to $485.6 million, an increase of 20.8% from $402.0 million as of February 28, 2019, and relatively unchanged from $487.0 million as of November 30, 2019. The annual increase reflects originations of $204.6 million investments during the year ended February 29, 2020, offset by repayments and amortizations of $167.3 million. This past quarter, $44.0 million in originations was offset by repayments and amortizations of $70.1 million, with repayments including the sale of our Easy Ice preferred equity investment that generated a $31.2 million realized gain on a $10.7 million cost basis. Saratoga Investment’s portfolio remains strong, with 71.3% of the portfolio in first liens, and a continued high level of investment quality in loan investments, with 99.0% of its loans this quarter at its highest internal rating. This quarter’s originations include two investments in new platforms, and five follow-ons in existing portfolio companies. Since Saratoga Investment took over the management of the BDC, $474.4 million of repayments and sales of investments originated by Saratoga Investment have generated a gross unlevered IRR of 16.9%.

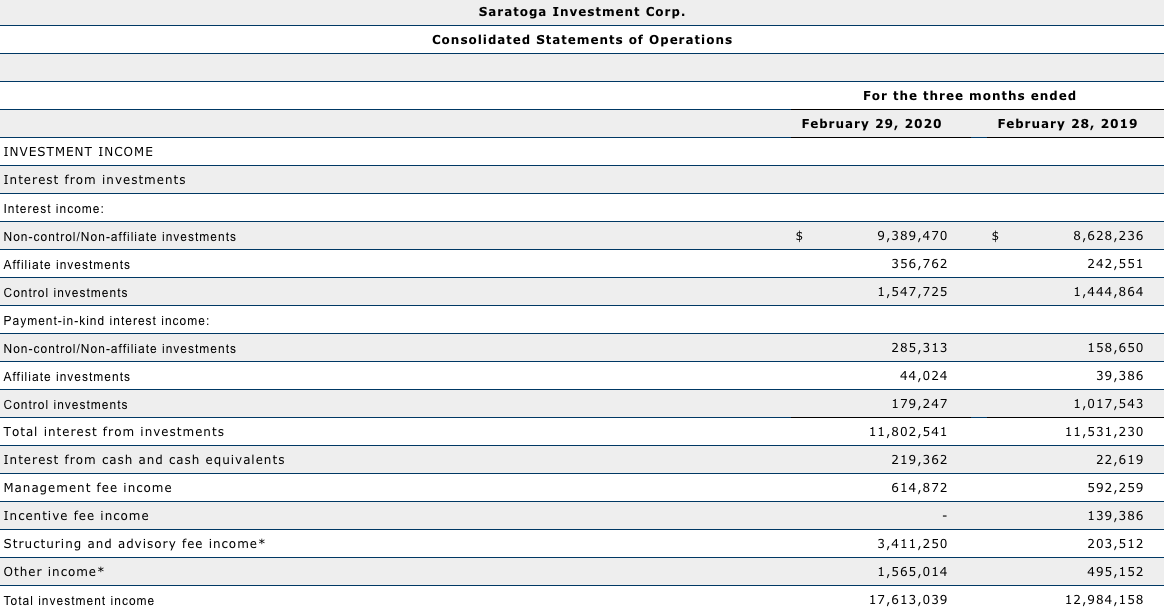

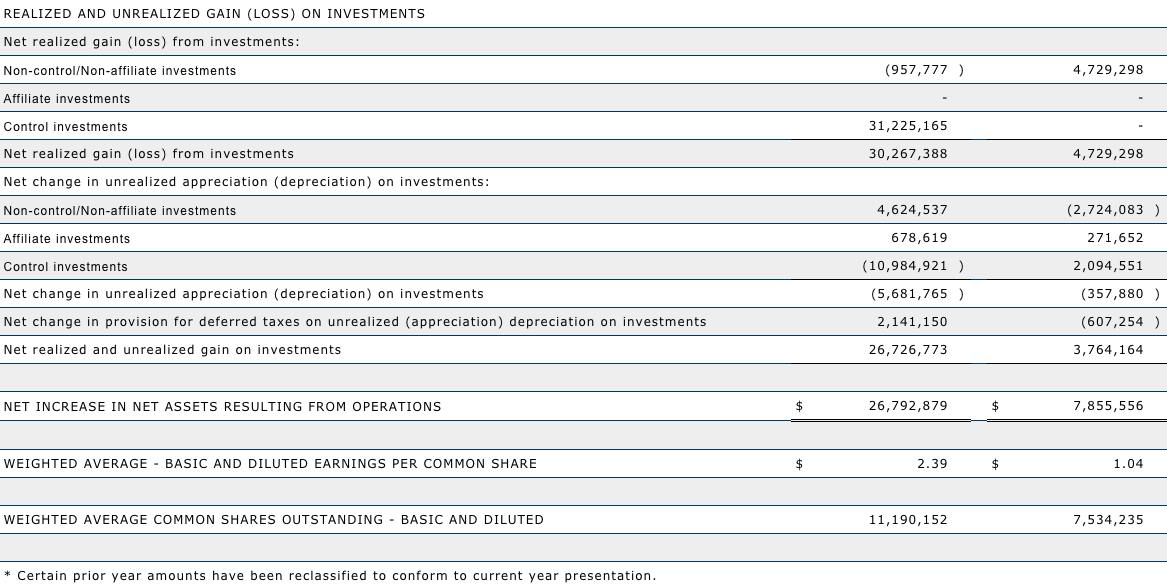

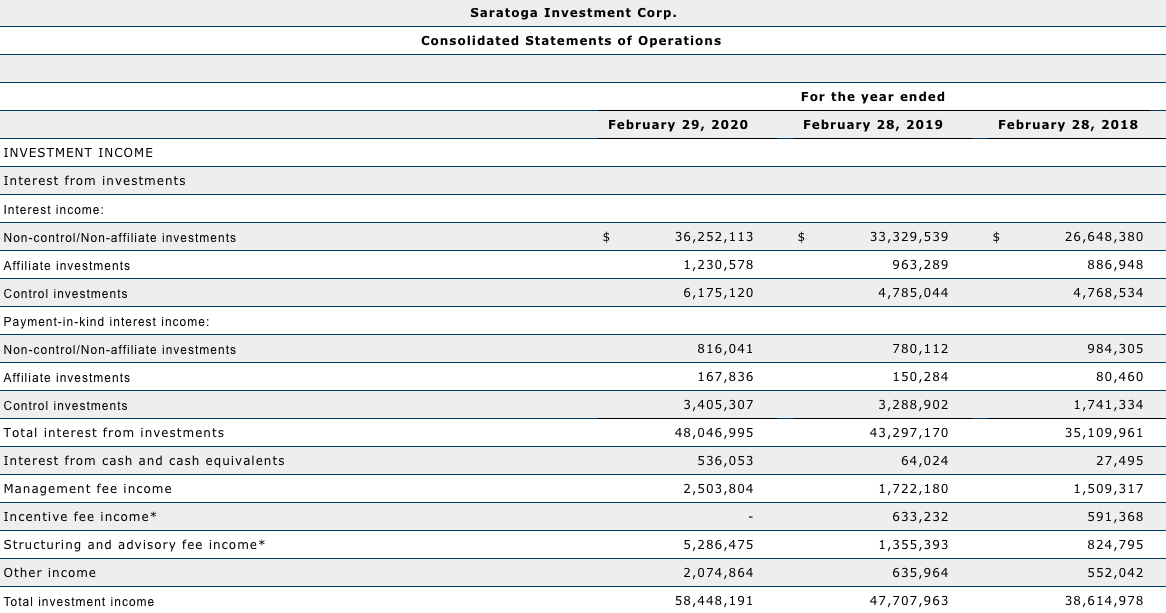

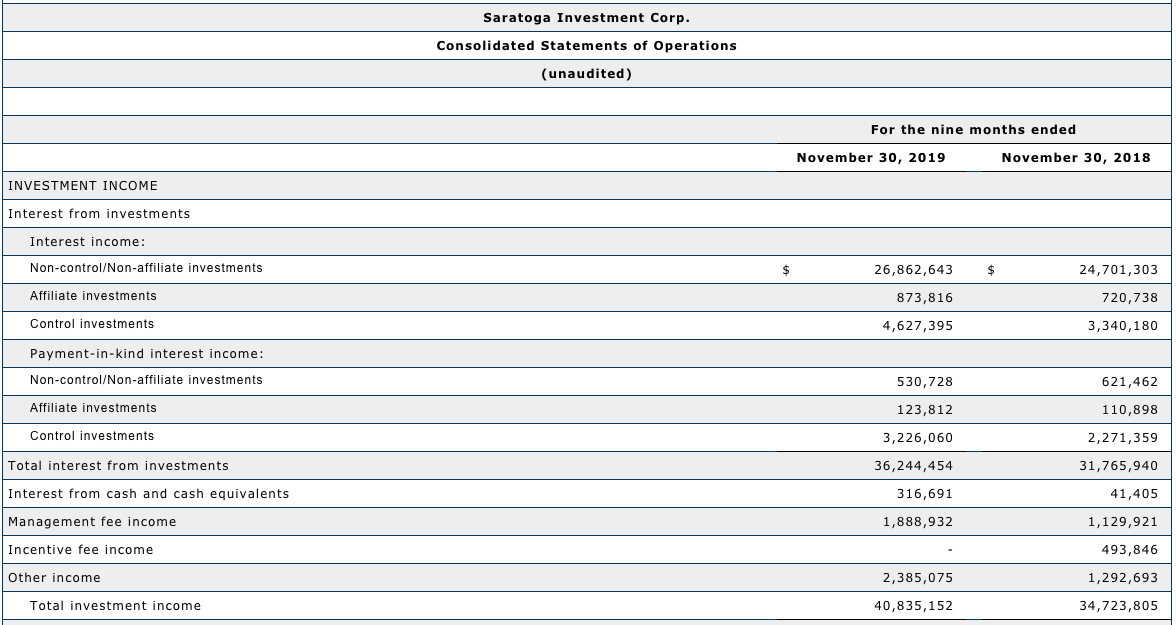

For the year ended February 29, 2020, total investment income increased by $10.7 million to $58.4 million, up 22.5% from $47.7 million for the year ended February 28, 2019. For the three months ended February 29, 2020, total investment income of $17.6 million increased by $4.6 million, or 35.7%, from $13.0 million as compared to the three months ended February 28, 2019, and sequentially by $3.4 million, or 24.0%, compared to $14.2 million for the three months ended November 30, 2019. This increased investment income was generated from an investment base that has grown by 20.8% since last year. In addition, this quarter’s total investment income included $3.0 million of advisory fee income and $1.4 million of prepayment premiums related to the Easy Ice realization. These increases were offset by the weighted average current coupon on non-CLO BDC investments decreasing to 9.8% this quarter from 10.9% last year and 10.1% last quarter. The decrease in the current coupon is primarily due to the reductions in LIBOR over these periods.

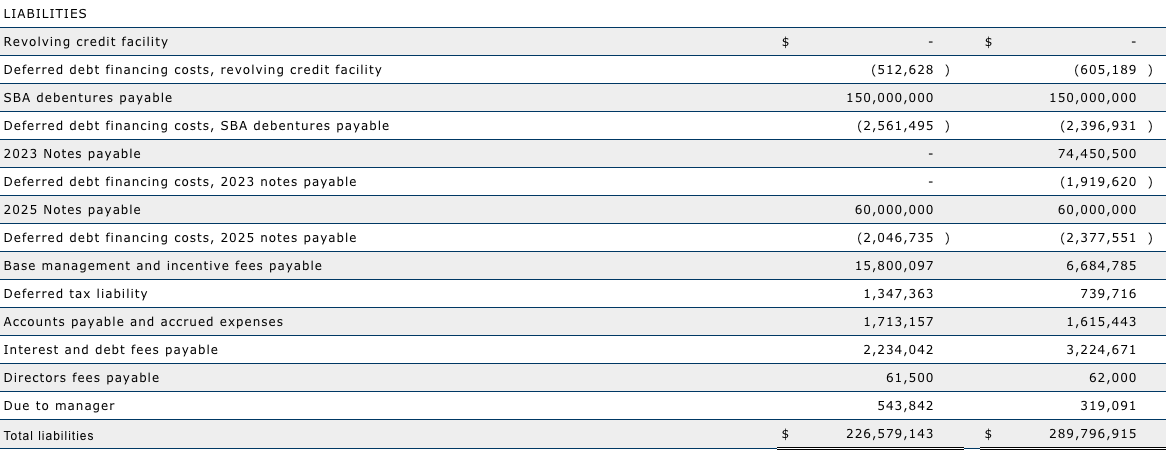

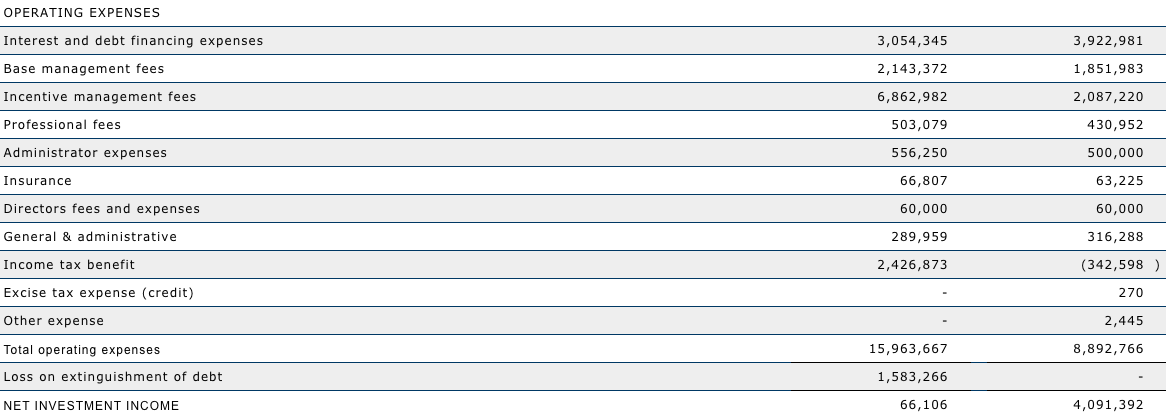

As compared to the year ended February 28, 2019, the investment income increase of $10.7 million was offset by: (i) increased debt and financing expenses, as the growth in AUM this year was partially financed from the $20.0 million baby bond follow-on issuance late last year; and (ii) increased base and incentive management fees generated from the management of this larger pool of investments. As compared to the quarters ended February 28, 2019 and November 30, 2019, the investment income increases of $4.6 million and $3.4 million, respectively, benefitted from the reduction in debt and financing expenses resulting from the full extinguishment of the $74.5 million 2023 notes during the current quarter, while increased base and incentive management fees from the annual growth in AUM partially offset the year-over increases.

Saratoga Investment recognized a $1.6 million loss on extinguishment related to the repayment of the 2023 notes in December 2019 and January 2020.

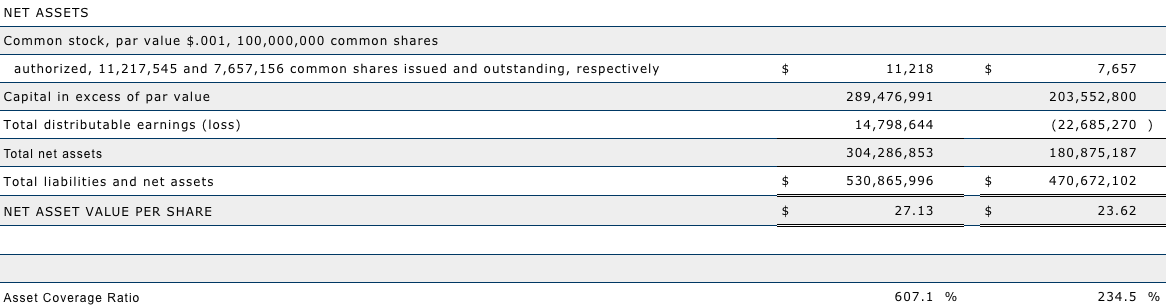

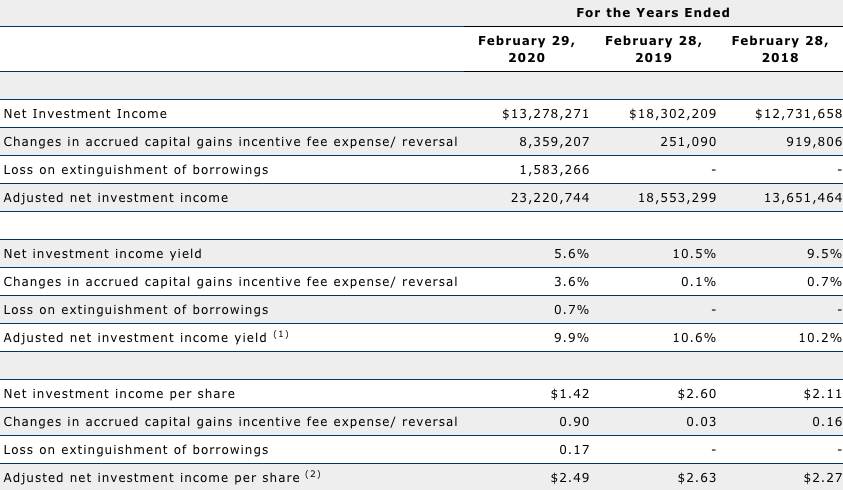

Net investment income on a weighted average per share basis was $1.42 and $0.01 for the year and quarter ended February 29, 2020, respectively. Net investment income includes the second incentive management fee expense directly related to the Censis and Easy Ice realizations, however this excludes the $42.9 million net realized gain that was generated and presented separately. Adjusted for the incentive fee accrual related to net capital gains and the loss on extinguishment of our 2023 notes, the net investment income on a weighted average per share basis was $2.49 and $0.61, respectively. This compares to adjusted net investment income per share of $2.63 and $0.66 for the year and quarter ended February 28, 2019, reflecting a decrease of $0.14 and $0.05, respectively. This also compares to adjusted net investment income of $0.61 per share for the quarter ended November 30, 2019, where there was no change on a quarter-on-quarter basis.

During these periods, weighted average common shares outstanding increased from 7.0 million shares for the year ended February 28, 2019, to 9.3 million shares for the year ended February 29, 2020. In addition, weighted average common shares outstanding increased from 7.5 million shares for the three months ended February 28, 2019, to 10.0 million shares and 11.2 million shares for the three months ended November 30, 2019, and February 29, 2020, respectively. These share increases primarily reflect the 3.4 million shares issued during last year pursuant to the At-the-Market (“ATM”) equity offering program, which was accretive to net asset value (“NAV”) per share.

Net investment income yield as a percentage of average net asset value (“Net Investment Income Yield”) was 5.6% and 0.1% for the year and quarter ended February 29, 2020, respectively. Adjusted for the incentive fee accrual related to net capital gains and the loss on extinguishment of our 2023 notes, the Net Investment Income Yield was 9.9% and 9.3%, respectively. In comparison, adjusted Net Investment Income Yield was 10.6% for the year ended February 28, 2019, and 9.7% and 11.2% for the quarters ended November 30, 2019, and February 29, 2020, respectively.

NAV was $304.3 million as of February 29, 2020, an increase of $22.1 million from $282.2 million as of November 30, 2019, and an increase of $123.4 million from $180.9 million as of February 28, 2019.

- For the twelve months ended February 29, 2020, there were $13.3 million of net investment income, $42.9 million of net realized gain from investments and $0.4 million deferred tax benefit on net unrealized depreciation earned, partially offset by $0.8 million of net unrealized depreciation and $20.1 million of dividends declared. In addition, $3.1 million of stock dividend distributions were made through the Company’s dividend reinvestment plan (“DRIP”), and 3,427,346 shares were sold through the ATM equity offering during the twelve months, for net proceeds of $84.7 million.

NAV per share was $27.13 as of February 29, 2020, compared to $25.30 as of November 30, 2019 and $23.62 as of February 28, 2019.

- The increase in NAV per share includes the $1.6 million, or $0.14 per share loss associated with the extinguishment of our 2023 notes.

- For the twelve months ended February 29, 2020, NAV per share increased by $3.51 per share, primarily reflecting the $35.6 million, or $3.77 per share increase in net assets (net of the $2.21 dividend paid during the year). The $0.26 difference is primarily due to the different share amounts used for the NAV per share and dividend per share calculations throughout the year, with 3.5 million shares were being issued pursuant to the ATM and DRIP programs. The Company made no repurchases of common stock in the open market during this period.

Return on equity for the last twelve months ended February 29, 2020, was 23.6%, compared to 10.6% for the comparable period last year.

Earnings per share for the year and quarter ended February 29, 2020, was $5.98 per share and $2.39 per share, respectively, compared to earnings per share of $2.63 per share and $1.04 per share for the year and quarter ended February 28, 2019, respectively, and $1.37 per share for the quarter ended November 30, 2019.

Investment portfolio activity for the year ended February 29, 2020:

- Cost of investments made during the period: $204.6 million

- Principal repayments and amortizations during the period: $167.3 million

Investment portfolio activity for the three months ended February 29, 2020:

- Cost of investments made during the period: $44.0 million

- Principal repayments during the period: $70.1 million

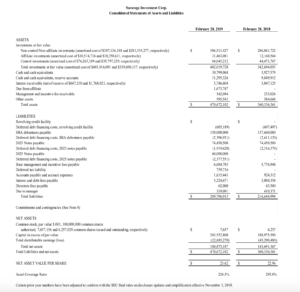

Additional Financial Information

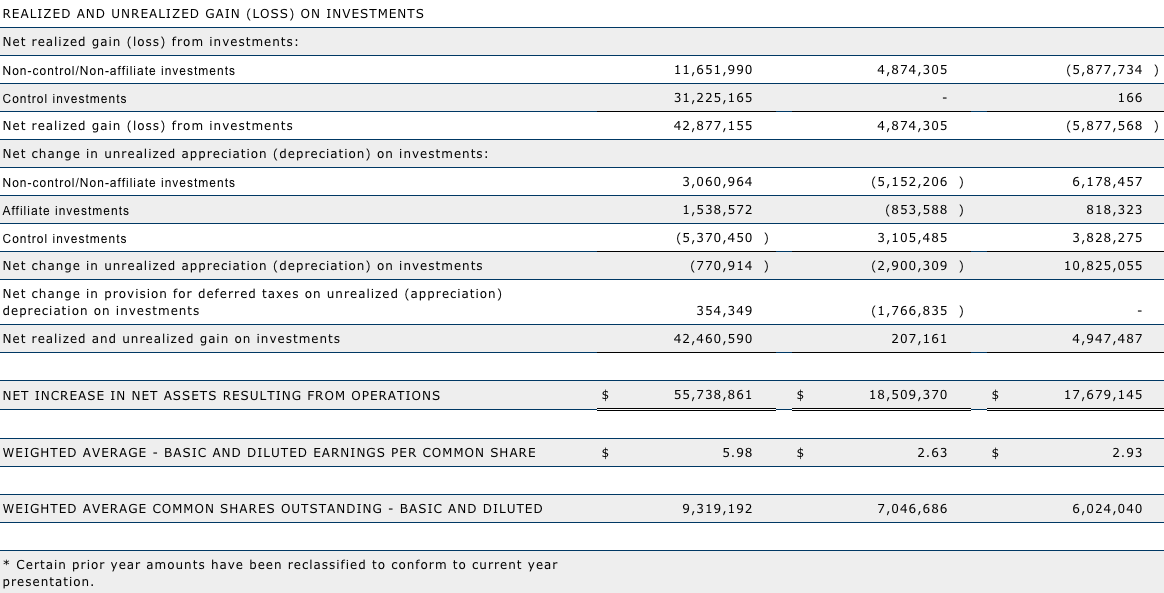

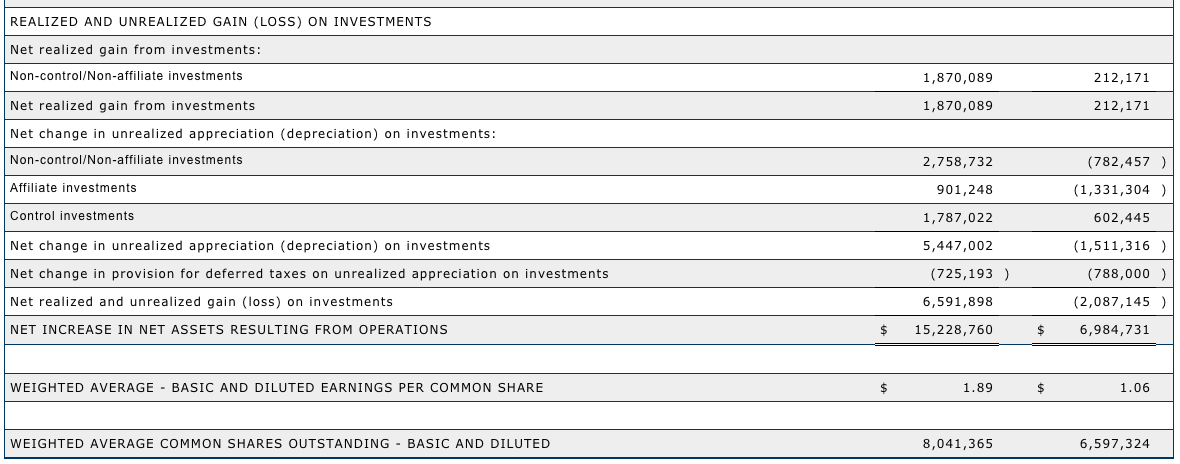

For the fiscal year ended February 29, 2020, Saratoga Investment reported net investment income of $13.3 million, or $1.42 on a weighted average per share basis, and a net gain on investments of $42.5 million, or $4.56 on a weighted average per share basis, resulting in a net increase in net assets from operations of $55.7 million, or $5.98 on a weighted average per share basis. The $42.5 million net gain on investments was comprised of $42.9 million in net realized gain on investments and $0.4 million of net deferred tax benefit on unrealized depreciation on investments in Saratoga Investment’s blocker subsidiaries, offset by $0.8 million in net unrealized depreciation. The net realized gain primarily relates to the $31.2 million gain on the Company’s Easy Ice preferred equity investment realized in this quarter, and the $11.3 million gain on the Company’s Censis Technologies investment realized in the third ended November 30, 2019. The $0.8 million unrealized depreciation primarily reflects a reversal of the previously recognized $3.8 million appreciation following the realization of the Company’s Easy Ice preferred equity investment, offset by (i) $1.3 million unrealized appreciation on the Company’s GreyHeller investment, and (ii) $1.7 million unrealized appreciation on the Company’s Netreo Holdings investment. This compared to the fiscal year ended February 28, 2019, with net investment income of $18.3 million, or $2.60 on a weighted average per share basis, and a net gain on investments of $0.2 million, or $0.03 on a weighted average per share basis, resulting in a net increase in net assets from operations of $18.5 million, or $2.63 on a weighted average per share basis. The $0.2 million net gain on investments consisted of $4.9 million in net realized gains on investments offset by $2.9 million unrealized depreciation and $1.8 million of net deferred tax expense on unrealized gains in Saratoga’s blocker subsidiaries.

Adjusted for the incentive fee accrual related to net capital gains and the loss on extinguishment of our 2023 notes, the net investment income was $23.2 million and $18.6 million for the years ended February 29, 2020, and February 28, 2019, respectively – this is an increase of $4.6 million year-over-year, or 25.2%.

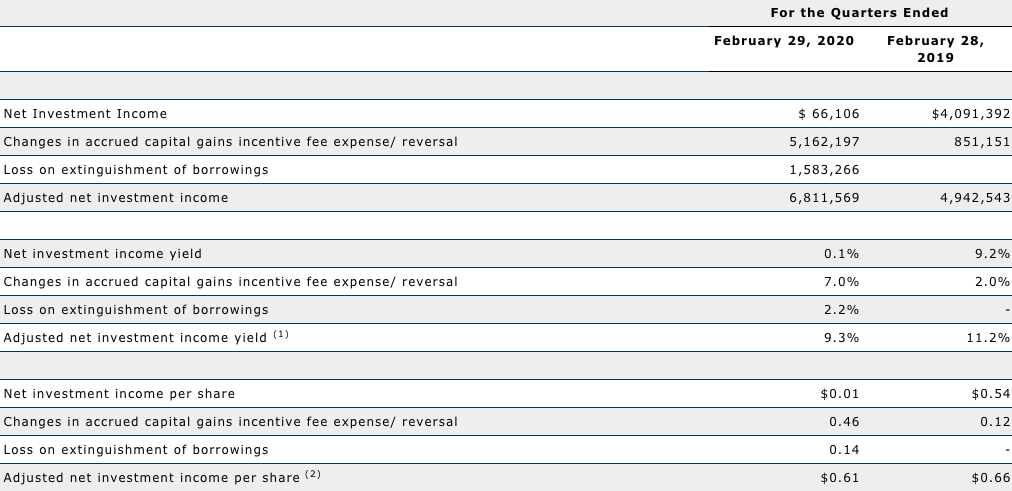

For the fiscal quarter ended February 29, 2020, Saratoga Investment reported net investment income of $0.07 million, or $0.01 on a weighted average per share basis, and net realized and unrealized gain on investments of $26.7 million, or $2.39 on a weighted average per share basis, resulting in a net increase in net assets from operations of $26.8 million, or $2.39 on a weighted average per share basis. The $26.7 million net gain on investments was comprised of $30.3 million in net realized gain on investments and $2.1 million of net deferred tax benefit on unrealized depreciation in Saratoga Investment’s blocker subsidiaries, offset by $5.7 million in net unrealized depreciation on investments.

The $30.3 million net realized gain reflects the $31.2 million gain from the realization of the Company’s Easy Ice preferred equity investment, offset by the $0.9 million realized loss on the Company’s legacy M/C Communications investment. The $5.7 million net unrealized depreciation primarily reflects (i) the $9.5 million reversal of previously recognized appreciation following the realization of the Company’s Easy Ice investment and (ii) $1.4m unrealized depreciation on the Company’s CLO equity and related investments, partially offset by (i) the $1.4 million reversal of previously recognized depreciation following the realization of the Company’s M/C Communications investment, (ii) seven other investments with appreciation of between $0.25 million and $0.4 million, and (iii) numerous other investments with smaller appreciations.

This is compared to the fiscal quarter ended February 28, 2019, with net investment income of $4.1 million, or $0.54 on a weighted average per share basis, and net realized and unrealized gain on investments of $3.8 million, or $0.50 on a weighted average per share basis, resulting in a net increase in net assets from operations of $7.9 million, or $1.04 on a weighted average per share basis. The $3.8 million net gain on investments consisted of $4.7 million in net realized gain, offset by $0.4 million in net unrealized depreciation on investments, and $0.6 million in net deferred tax expense on unrealized gains in Saratoga Investment’s blocker subsidiaries.

Adjusted for the incentive fee accrual related to net capital gains and the loss on extinguishment of our 2023 notes, net investment income was $6.8 million and $4.9 million for the three months ended February 29, 2020, and February 28, 2019, respectively – an increase of $1.9 million year-over-year, or 37.8%.

Total expenses, excluding interest and debt financing expenses, base management fees, incentive fees and income tax benefit, increased from $5.5 million for the year ended February 28, 2019 to $5.7 million for the year ended February 29, 2020, remaining at 1.1% of average assets over both periods. For the quarters ended February 29, 2020 and February 28, 2019, these expenses increased from $1.4 million to $1.5 million.

Portfolio and Investment Activity

As of February 29, 2020, the fair value of Saratoga Investment’s portfolio was $485.6 million (excluding $39.5 million in cash and cash equivalents), principally invested in 35 portfolio companies and one collateralized loan obligation fund (“CLO”). The overall portfolio composition consisted of 71.3% of first lien term loans, 15.1% of second lien term loans, 0.9% of unsecured term loans, 6.7% of subordinated notes in the CLO and 6.0% of common equity.

For the fiscal year ended February 29, 2020, Saratoga Investment invested $204.6 million in new or existing portfolio companies and had $167.3 million in aggregate amount of exits and repayments, resulting in net investments of $37.0 million for the year. For the quarter ended February 29, 2020, Saratoga Investment invested $44.0 million in new or existing portfolio companies, and had $70.1 million in aggregate amount of exits and repayments, resulting in $26.1 million of net exits and repayments for the quarter. Both these repayment numbers include the net realized gains recognized during the periods, primarily related to the sales of our Easy Ice and Censis investments.

As of February 29, 2020, the weighted average current yield on Saratoga Investment’s total portfolio as of year-end is 9.3%, which was comprised of a weighted average current yield of 9.6% on first lien term loans, 10.7% on second lien term loans, 9.3% on unsecured term loans, 11.4% on CLO subordinated notes and 0.0% on equity interests.

Portfolio Update:

Due to the unique developments since Saratoga Investment’s fiscal year-end, the Company is taking the unusual step of providing a post quarter-end update. Subsequent to quarter-end, Saratoga Investment has executed approximately $34.9 million of new originations in one new portfolio company and nine existing portfolio companies, and also had one repayment of approximately $8.5 million, for net investments originated of $26.4 million as of May 6, 2020. This included numerous drawdowns of committed delayed draw facilities totaling $8.5 million that has reduced the Company’s outstanding exposure to committed delayed draw facilities to $9.1 million.

Liquidity and Capital Resources

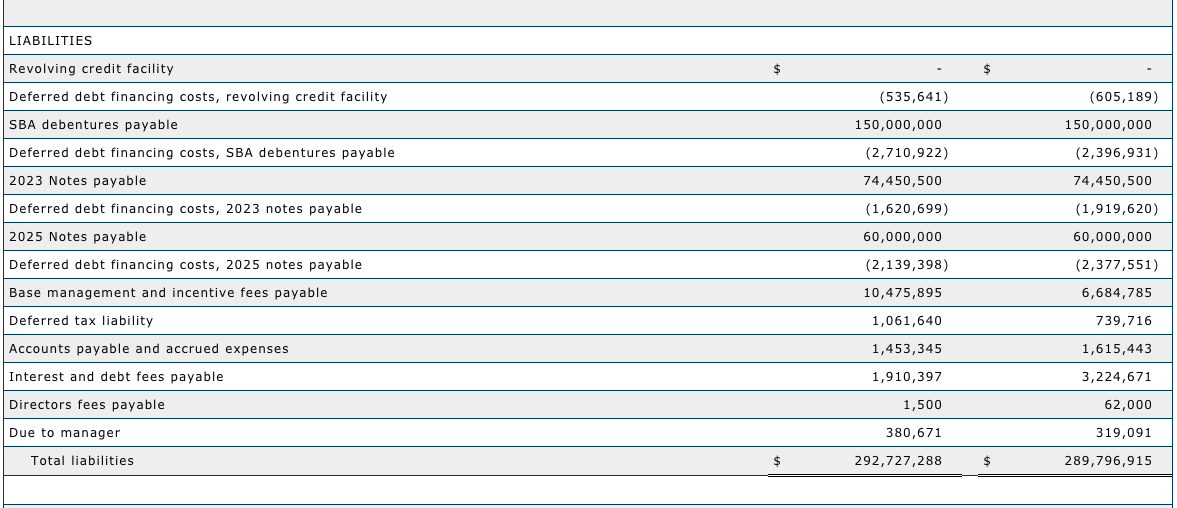

As of February 29, 2020, Saratoga Investment had no outstanding borrowings under its $45 million senior secured revolving credit facility with Madison Capital Funding LLC. At the same time, Saratoga Investment had $150.0 million SBA debentures outstanding, $60.0 million of baby bonds (fair value of $60.6 million) issued and an aggregate of $39.5 million in cash and cash equivalents.

With $45.0 million available under the credit facility, the $39.5 million of cash and cash equivalents and $175.0 million in undrawn SBA debentures from the newly approved second SBIC license, Saratoga Investment has a total of $259.5 million of undrawn borrowing capacity and cash and cash equivalents available as of February 29, 2020. It should be noted that, depending on portfolio company performance, availability under the Madison credit facility might be reduced. In addition, certain follow-on investments in SBIC I and the BDC will not qualify for SBIC II funding. Saratoga Investment also has the ability to issue additional equity or baby bonds through the existing shelf registration statement pursuant to existing market conditions, which are disrupted at this time.

On November 15, 2019, the Company caused notices to be issued to the holders of its 6.75% 2023 baby bonds regarding the Company’s exercise of its option to redeem, in part, the issued and outstanding 2023 baby bonds. The Company redeemed $50.0 million in aggregate principal amount of the $74.5 million in aggregate principal amount of issued and outstanding 2023 baby bonds on December 21, 2019 (the “Redemption Date”). The baby bonds were redeemed at 100% of their principal amount ($25 per baby bond), plus the accrued and unpaid interest thereon from September 30, 2019, through, but excluding, the Redemption Date.

On January 8, 2020, the Company caused notices to be issued to the remaining holders of its 6.75% 2023 baby bonds regarding the Company’s exercise of its option to redeem the remaining $24.45 million in aggregate principal amount of issued and outstanding 2023 baby bonds. The Company redeemed the remaining amount of issued and outstanding 2023 baby bonds on February 7, 2020 (the “Second Redemption Date”). These baby bonds were also redeemed at 100% of their principal amount ($25 per baby bond), plus the accrued and unpaid interest thereon from December 31, 2019, through, but excluding, the Second Redemption Date.

On March 16, 2017, Saratoga Investment entered into an equity distribution agreement with Ladenburg Thalmann & Co. Inc., through which Saratoga Investment may offer for sale, from time-to-time, up to $30.0 million of its common stock through an ATM offering. Subsequent to this, BB&T Capital Markets and B. Riley FBR, Inc were also added to the agreement. On July 11, 2019, the amount of common stock to be offered through this offering was increased to $70.0 million, and on October 8, 2019, the amount of common stock to be offered through this offering was further increased to $130.0 million. As of February 29, 2020, the Company sold 3,922,018 shares for gross proceeds of $97.1 million at an average price of $24.77 for aggregate net proceeds of $95.9 million (net of transaction costs). For the year ended February 29, 2020, the Company sold 3,427,346 shares for gross proceeds of $85.9 million at an average price of $25.06 for aggregate net proceeds of $84.7 million (net of transaction costs).

On April 24, 2020, we entered into a fourth amendment to the Credit Facility with Madison Capital Funding LLC to, among other things:

- permit certain amendments related to the Paycheck Protection Program (“Permitted PPP Amendment”) to Loan Asset Documents;

- exclude certain debt and interest amounts allowed by the Permitted PPP Amendments from certain calculations related to Net Leverage Ratio, Interest Coverage Ratio and EBITDA; and

- exclude such Permitted PPP Amendments from constituting a Material Modification.

Dividend

Saratoga Investment has raised its dividend for the past five years. In light of the dramatic uncertainties currently present in the economy, and to ensure we retain liquidity to not only support our current portfolio companies during these challenged times, but to also create new, important relationships through the provision of critically crucial liquidity in new situations, Saratoga Investment’s Board of Directors (the “Board of Directors”) believes it is in the best near- and long-term interests of our shareholders to maintain a conservative and cautious approach to our dividend policy.

Furthermore, while many BDCs have spillover obligations from prior years, representing taxable income from past obligations yet to be distributed, Saratoga Investment has historically managed its distributions conservatively so it is current with all spillover obligations, other than those related to our Easy Ice and Censis long-term capital gains. This therefore means that Saratoga Investment is not obligated to pay current dividends related to historical earnings and enabling preservation of precious liquidity in this challenging market environment.

The Board of Directors has therefore decided to defer our dividend for the quarter ended February 29, 2020. We will continue to reassess this decision on at least a quarterly basis as we gain more visibility on the economy and business activities.

In fiscal year 2020, the Company declared a quarterly dividend of $0.56 per share for the quarter ended November 30, 2019, $0.56 per share for the quarter ended August 31, 2019, $0.55 per share for the quarter ended May 31, 2019 and $0.54 per share for the quarter ended February 28, 2019. Total dividends declared for the fiscal years ended February 28, 2019, and 2018, were $2.06 per share and $1.90 per share, respectively.

Shareholders have the option to receive payment of dividends in cash or receive shares of common stock, pursuant to the Company’s DRIP.

Share Repurchase Plan

In fiscal year 2015, the Company announced the approval of an open market share repurchase plan that allows it to repurchase up to 200,000 shares of its common stock at prices below its NAV as reported in its then most recently published financial statements. During fiscal year 2017, the share repurchase plan was increased to 600,000 shares of common stock, and during fiscal years 2018, 2019 and 2020, this share repurchase plan was extended for another year at the same level of approval, currently through January 15, 2021. On May 4, 2020, the Board of Directors increased the share repurchase plan to 1.3 million shares of common stock. As of February 29, 2020, the Company purchased 218,491 shares of common stock, at the average price of $16.87 for approximately $3.7 million pursuant to this repurchase plan.

Saratoga Investment made no purchases of common stock in the open market during the three months ended February 29, 2020.

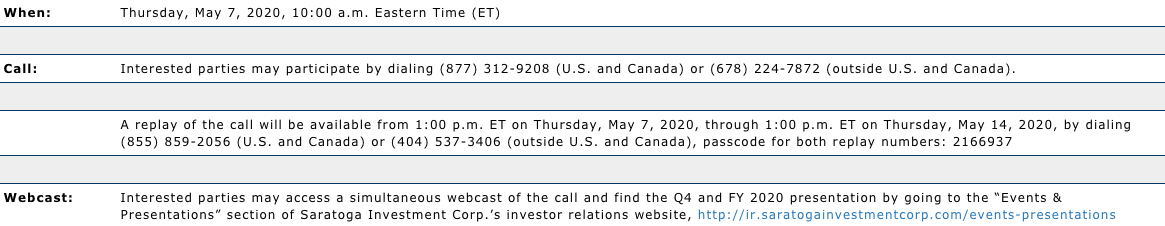

2020 Fiscal Fourth Quarter and Year End Conference Call/Webcast Information

About Saratoga Investment Corp.

Saratoga Investment is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment has elected to be regulated as a business development company under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment owns two SBIC-licensed subsidiaries and manages a $500 million collateralized loan obligation (“CLO”) fund. It also owns 100% of the Class F-R-2, G-R-2 and subordinated notes of the CLO. The Company’s diverse funding sources, combined with a permanent capital base, enable Saratoga Investment to provide a broad range of financing solutions.

Forward Looking Statements

Statements included herein contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events or our future performance or financial condition. Forward-looking statements can be identified by the use of forward looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or negative versions of those words, other comparable words or other statements that do not relate to historical or factual matters. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These statements are not guarantees of future performance, condition or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including but not limited to the impact of the COVID-19 pandemic and the pandemic’s impact on the U.S. and global economy, as well as those described from time to time in our filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made. Saratoga Investment Corp. undertakes no duty to update any forward-looking statements made herein or on the webcast/conference call, whether as a result of new information, future developments or otherwise, except as required by law.

Supplemental Information Regarding Adjusted Net Investment Income, Adjusted Net Investment Income Yield and Adjusted Net Investment Income per share

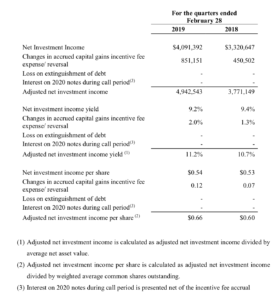

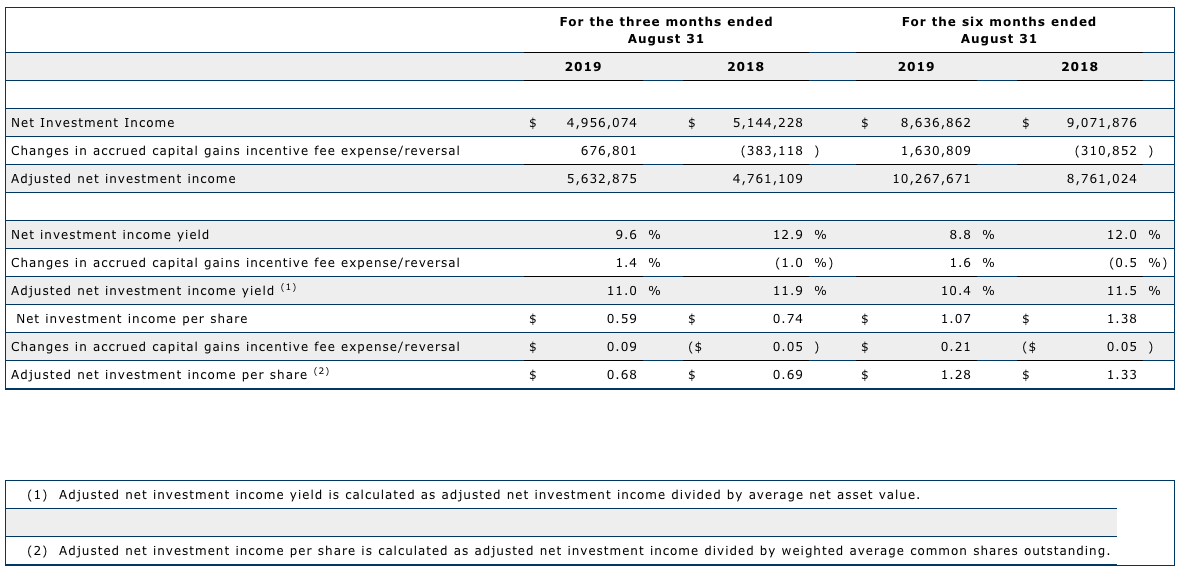

On a supplemental basis, Saratoga Investment provides information relating to adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share, which are non-GAAP measures. These measures are provided in addition to, but not as a substitute for, net investment income, net investment income yield and net investment income per share. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or reversal attributable to realized and unrealized gains. The management agreement with the Company’s advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year. In addition, Saratoga Investment accrues, but does not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. All capital gains incentive fees are presented within net investment income within the Consolidated Statements of Operations, but the associated realized and unrealized gains and losses that these incentive fees relate to, are excluded. As such, Saratoga Investment believes that adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share is a useful indicator of operations exclusive of any capital gains incentive fee expense or reversal attributable to gains. In addition, adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share also excludes the loss on extinguishment of Saratoga Investment’s 2023 Notes. This expense is directly attributable to the repayment of the 2020 Notes, is deemed to be non-recurring in nature and not representative of the operations of Saratoga Investment. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income, net investment income yield to adjusted net investment income yield and net investment income per share to adjusted net investment income per share for the years ended February 29, 2020, February 28, 2019, and February 28, 2018, and the quarters ended February 29, 2020 and February 28, 2019.

(1) Adjusted net investment income is calculated as adjusted net investment income divided by average net asset value.

(2) Adjusted net investment income per share is calculated as adjusted net investment income divided by weighted average common shares outstanding.

(1) Adjusted net investment income yield is calculated as adjusted net investment income divided by average net asset value.

(2) Adjusted net investment income per share is calculated as adjusted net investment income divided by weighted average common shares outstanding.

Contact: Henri Steenkamp

Saratoga Investment Corp.

212-906-7800

Roland Tomforde

Broadgate Consultants

212-232-2222

Source: Saratoga Investment Corp

Saratoga Investment Corp. Announces Fiscal Third Quarter 2020 Financial Results and Quarterly Dividend of $0.56 per Share ($2.24 per Share on an Annualized Basis)

NEW YORK, Jan. 08, 2020 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2020 fiscal third quarter. In addition, the Company announced that its Board of Directors has declared a dividend of $0.56 per share for the fiscal quarter ended November 30, 2019, payable on February 6, 2020, to all stockholders of record at the close of business on January 24, 2020.

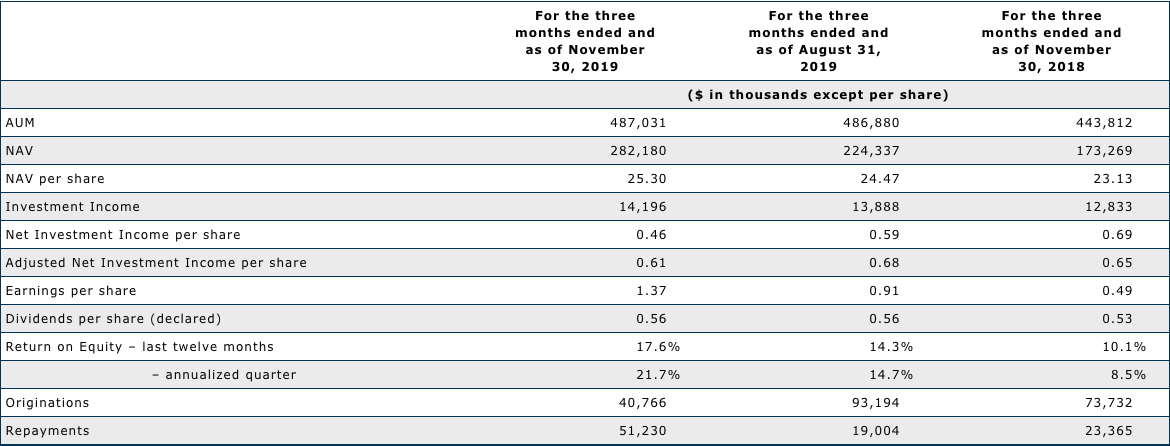

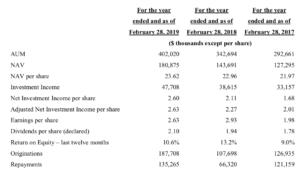

Summary Financial Information

The Company’s summarized financial information is as follows:

“Our third quarter quarterly performance metrics were remarkably strong with LTM return on equity of 17.6%, adjusted NII per share of $0.61 per share, earnings per share of $1.37, and an additional increase in NAV per share this quarter of $0.83, or 3.4%, to $25.30. This quarter included another significant realized gain, with our Censis equity investment recognizing an $11 million gain through a sale,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “Our continued strong price and volume stock market performance also enabled us to issue a further $49.4 million of equity accretively under our existing ATM program this quarter, essentially fully funding the equity requirement for our second SBIC license. Drawing down debt under our second SBIC license at the 2-to-1 leverage ratio, our approximate all-in 3% cost-of-debt would be highly accretive to earnings and drive future earnings growth when invested consistent with our current portfolio. Today we also announced a $0.56 per share dividend for the quarter ended November 30, 2019, unchanged from the prior quarter. Our liquidity is robust, providing us the ability to grow our AUM by a further 52% utilizing the current liquidity and committed credit facilities at our disposal and following the $50.0 million baby bond repayment in December.

In addition, subsequent to quarter-end, our entire investment in Easy Ice was repaid in a change of control transaction, resulting in more than $35 million of proceeds, interest and fees, as well as a repayment of our $28 million second lien term loans and $11 million preferred equity. These proceeds are currently estimated to result in at least a $17 million, or $1.51 per share increase in NAV, with the exact amounts and characterization to be finally determined after completion of the full fourth quarter and incorporating overall operating results.”

Michael J. Grisius, President and Chief Investment Officer, added, “This fiscal quarter has again demonstrated how the long-term measured growth of our AUM in strong portfolio companies can result in outsized equity returns, with our $1.0 million equity investment in Censis resulting in a $11.3 million total realized gain. The quality of our asset base remains exceptionally high, with 99% of credits rated in our highest category. We’ve maintained our forward momentum in the face of macroeconomic conditions and lending dynamics that continue to provide headwinds, with LIBOR again decreasing this quarter. We also continue to bring new platform investments into the portfolio, with another investment in a new company added this quarter, in addition to the success we continue to have with follow-ons in existing portfolio companies. We remain confident that our experienced origination team, exceptional underwriting standards and tested investment strategy and focus will continue to steadily grow portfolio size and maintain quality over the long-term.”

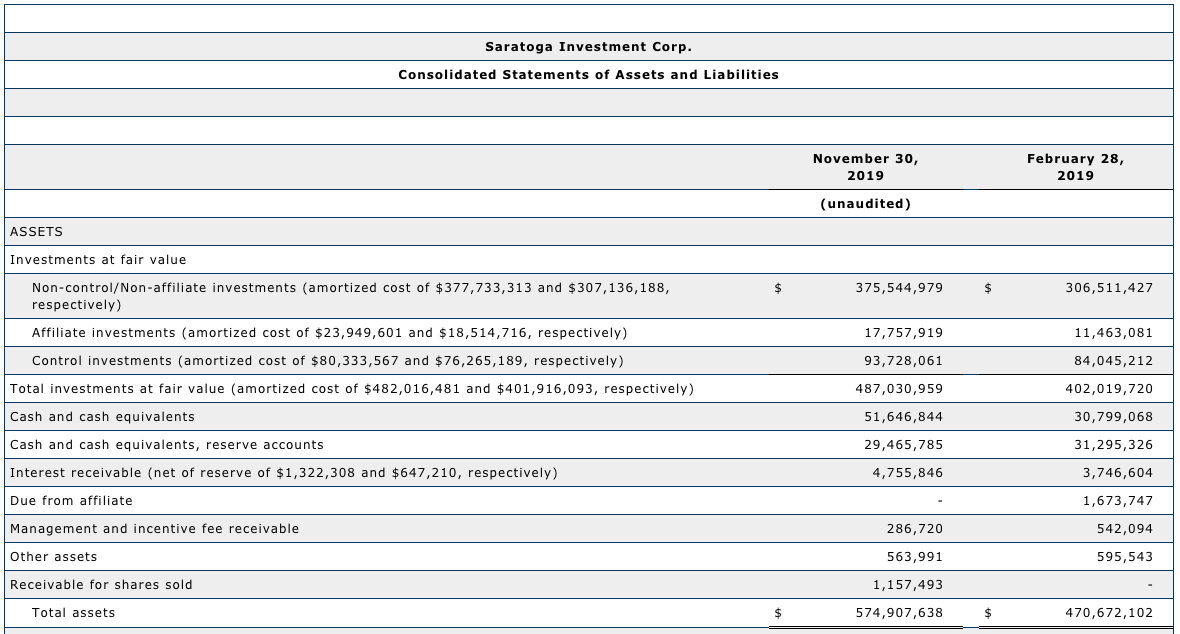

As of November 30, 2019, Saratoga Investment increased its assets under management (“AUM”) to $487.0 million, an increase of 0.03% from $486.9 million as of August 31, 2019, and an increase of 9.7% from $443.8 million as of November 30, 2018. The increase this quarter consists of $40.8 million in originations, offset by repayments and amortizations of $51.2 million, reflecting net repayments and amortizations of $10.4 million. Repayments includes the sale of our Censis equity that generated an $11.3 million realized gain on a $1.0 million cost basis. Saratoga Investment’s portfolio remains strong, with a continued high level of investment quality in loan investments, with 99.0% of its loans this quarter at its highest internal rating. This quarter’s originations include one investment in a new platform, and three follow-ons in existing portfolio companies. Since Saratoga Investment took over the management of the BDC, $435.4 million of repayments and sales of investments originated by Saratoga Investment have generated a gross unlevered IRR of 14.8%.

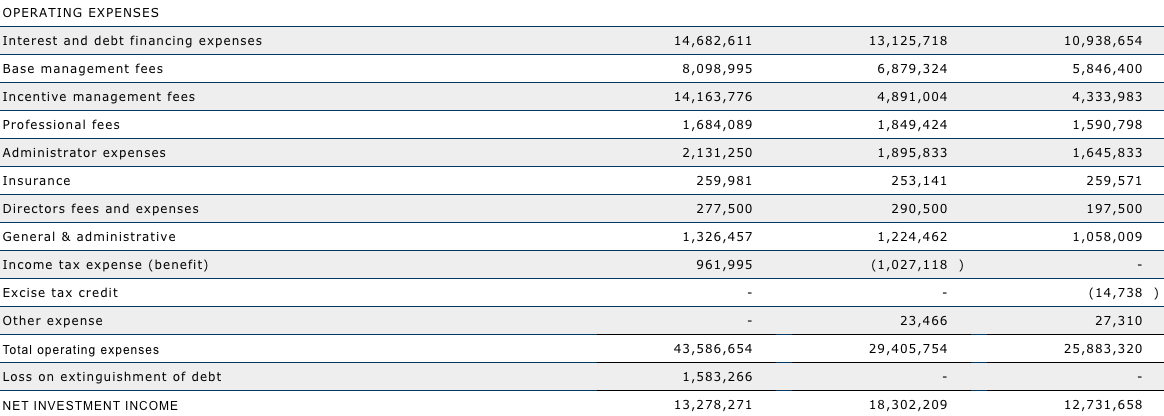

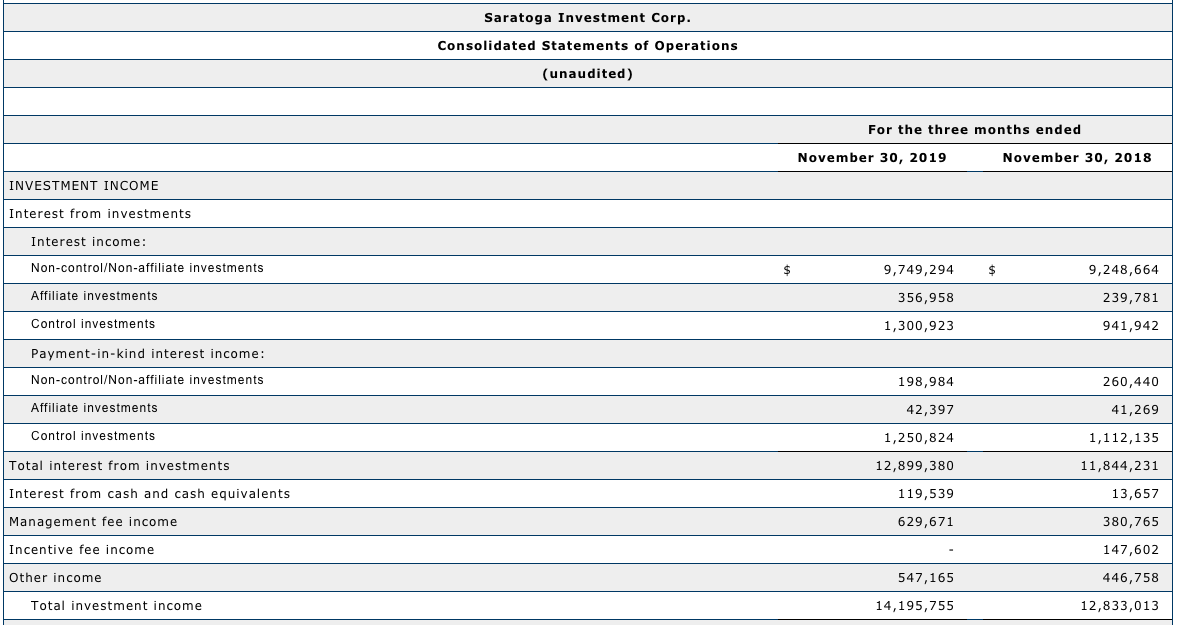

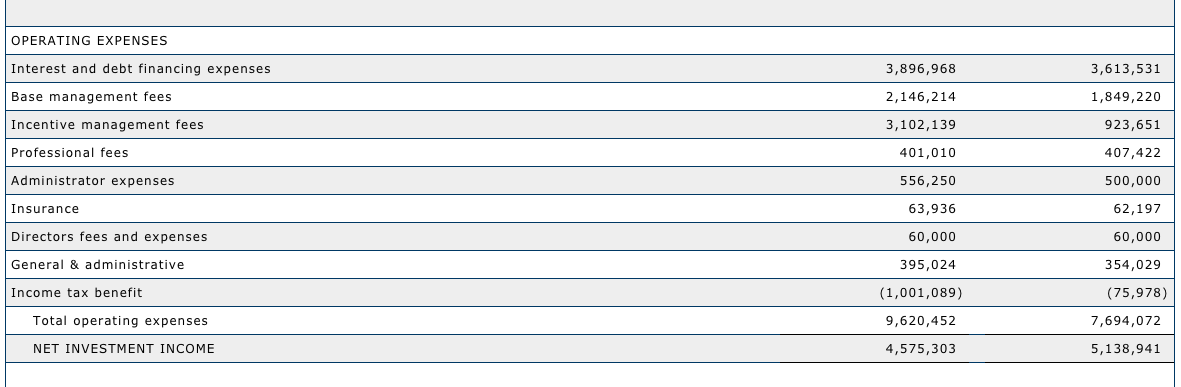

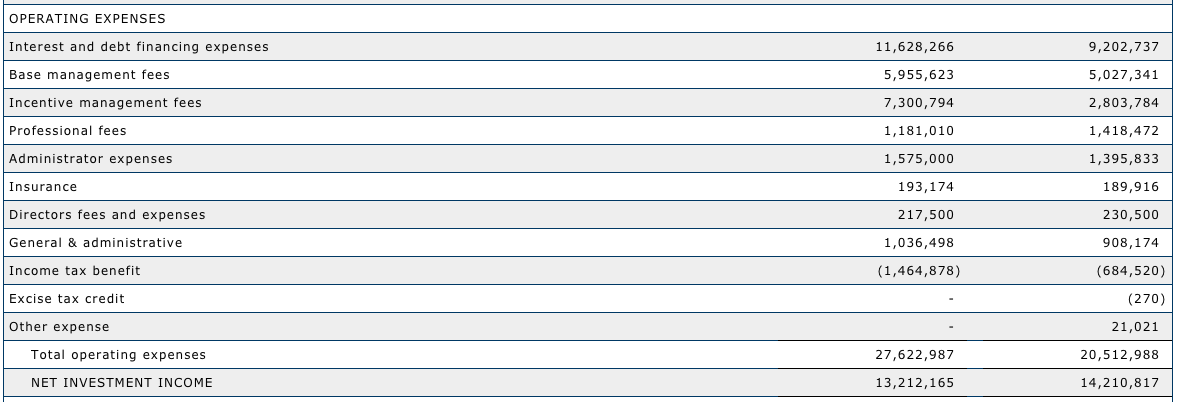

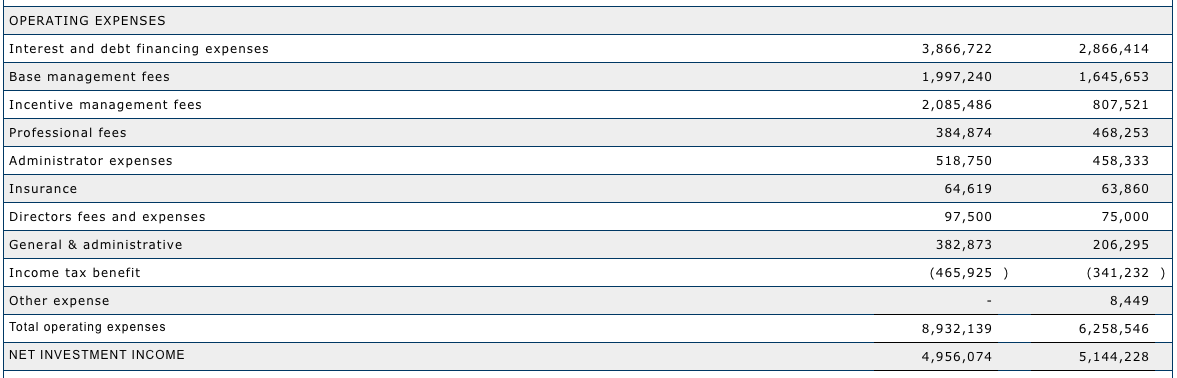

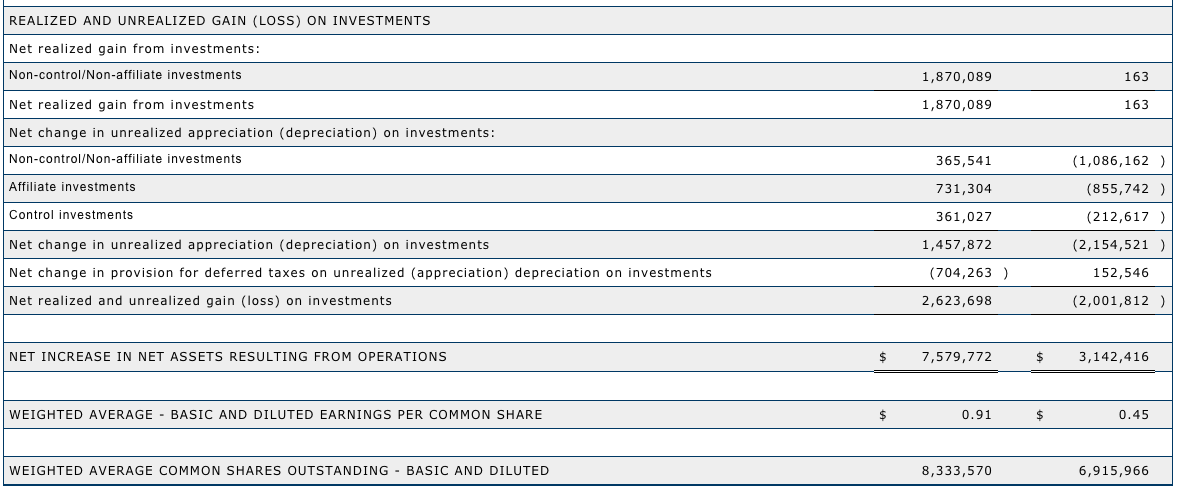

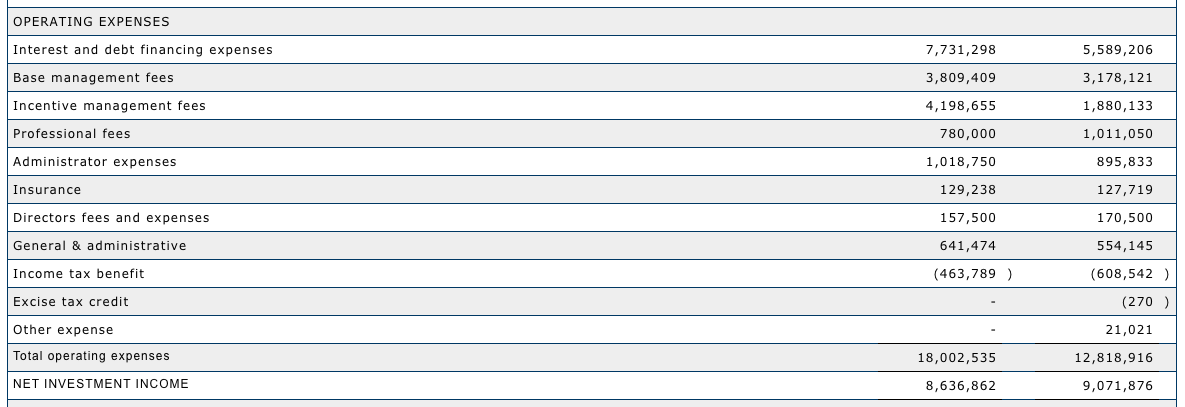

For the three months ended November 30, 2019, total investment income of $14.2 million increased by $1.4 million, or 10.6%, compared to $12.8 million for the three months ended November 30, 2018, and by 2.2% on a quarter-on-quarter basis from $13.9 million for the three months ended August 31, 2019. This increased investment income was generated from an investment base that has grown by 9.7% since last year and was relatively unchanged from last quarter. In addition, these increases were achieved despite the weighted average current coupon on non-CLO BDC investments decreasing to 10.1% this quarter from 11.3% last year and 10.4% last quarter. The decrease in the current coupon is primarily due to the reductions in LIBOR over these periods.

As compared to the three months ended November 30, 2018, the investment income increase of $1.4 million was offset by: (i) increased debt and financing expenses, as the growth in AUM this year was partially financed from the $20.0 million baby bond follow-on issuance last year; and (ii) increased base and incentive management fees generated from the management of this larger pool of investments. Total expenses, excluding interest and debt financing expenses, base management fees, incentive fees and income tax benefit, increased from $1.4 million for the three months ended November 30, 2018, to $1.5 million for the three months ended November 30, 2019.

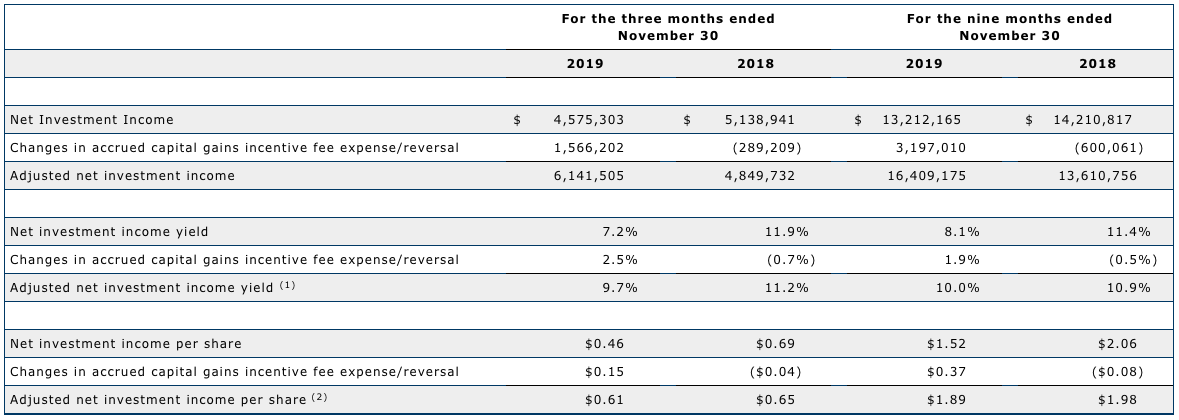

Net investment income on a weighted average per share basis was $0.46 for the three months ended November 30, 2019. Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income on a weighted average per share basis was $0.61. This compares to adjusted net investment income per share of $0.68 for the three months ended August 31, 2019, and $0.65 for the three months ended November 30, 2018. During these periods, weighted average common shares outstanding increased from 7.5 million shares for the three months ended November 30, 2018, to 8.3 million shares and 10.0 million shares for the three months ended August 31, 2019, and November 30, 2019, respectively. These share increases primarily reflect the 1.4 million shares issued last quarter and the 2.0 million shares issued this quarter pursuant to the At-the-Market (“ATM”) equity offering program, both of which were accretive to net asset value (“NAV”) per share.

Net investment income yield as a percentage of average NAV (“Net Investment Income Yield”) was 7.2% for the three months ended November 30, 2019. Adjusted for the incentive fee accrual related to net unrealized capital gains, the Net Investment Income Yield was 9.7%. In comparison, adjusted Net Investment Income Yield was 11.0% and 11.2% for the three months ended August 31, 2019, and November 30, 2018, respectively.

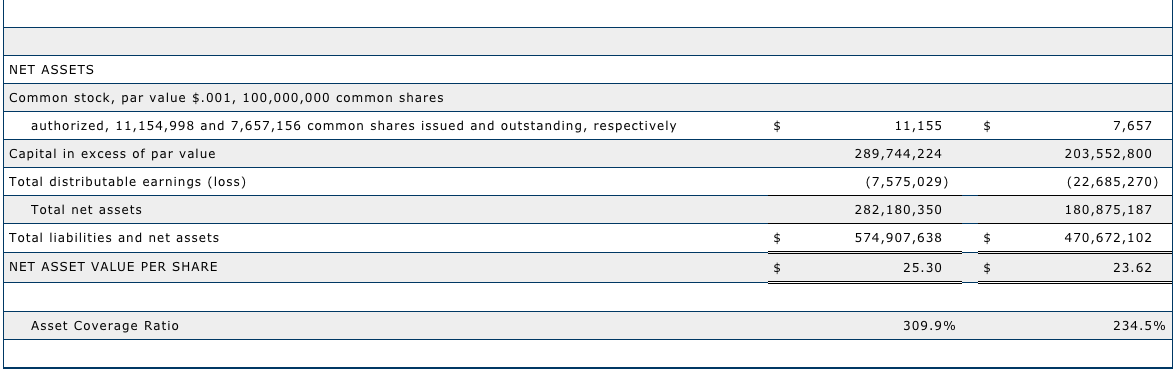

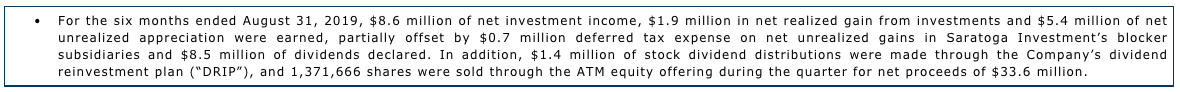

NAV was $282.2 million as of November 30, 2019, an increase of $57.9 million from $224.3 million as of August 31, 2019, an increase of $101.3 million from $180.9 million as of February 28, 2019, and an increase of $108.9 million from $173.3 million as of November 30, 2018.

- For the nine months ended November 30, 2019, $13.2 million of net investment income, $12.6 million in net realized gain from investments and $4.9 million of net unrealized appreciation were earned, partially offset by $1.8 million deferred tax expense on net unrealized gains in Saratoga Investment’s blocker subsidiaries and $13.8 million of dividends declared. In addition, $2.2 million of stock dividend distributions were made through the Company’s dividend reinvestment plan (“DRIP”), and 3,400,481 shares were sold through the ATM equity offering during the nine months, for net proceeds of $84.0 million.

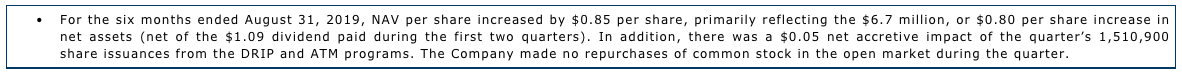

NAV per share was $25.30 as of November 30, 2019, compared to $24.47 as of August 31, 2019, $23.62 as of February 28, 2019, and $23.13 as of November 30, 2018.

- For the nine months ended November 30, 2019, NAV per share increased by $1.68 per share, reflecting the $15.1 million, or $1.68 per share increase in net assets (net of the $1.65 dividend paid during the first three quarters). In addition, there was a $0.02 net accretive impact in this quarter resulting from this quarter’s 1,986,942 share issuances from the DRIP and ATM programs. The Company made no repurchases of common stock in the open market during this period.

Return on equity for the last twelve months ended November 30, 2019 was 17.6%, compared to 10.1% for the comparable period last year.

Earnings per share for the three months ended November 30, 2019, was $1.37, compared to earnings per share of $0.91 for the three months ended August 31, 2019, and $0.49 for the three months ended November 30, 2018.

Investment portfolio activity for the three months ended November 30, 2019:

- Cost of investments made during the period: $40.8 million

- Principal repayments during the period: $51.2 million

Additional Financial Information

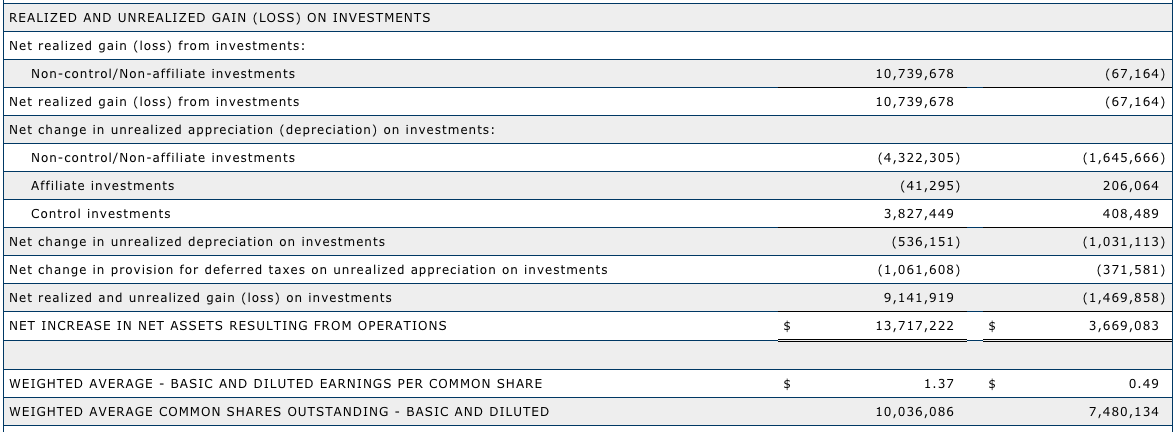

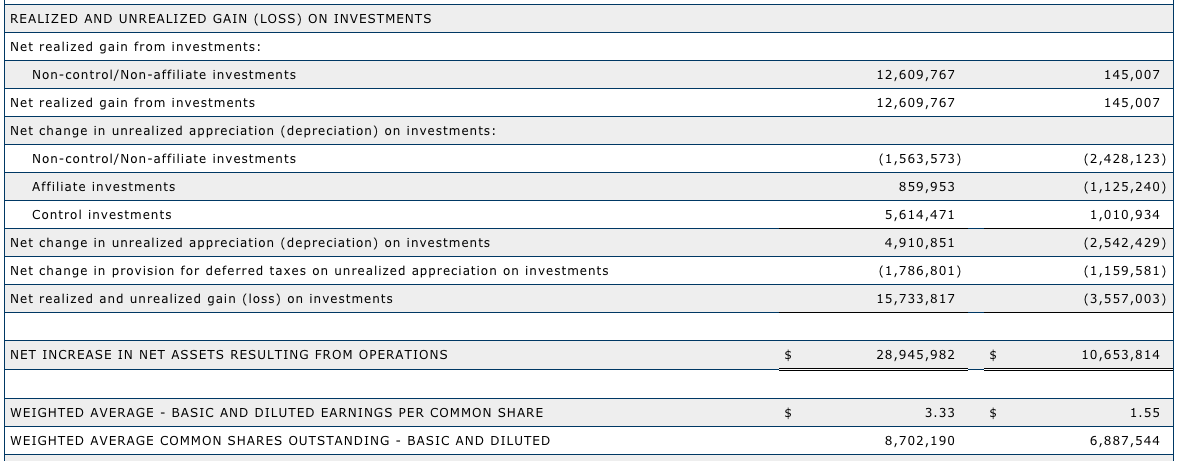

For the fiscal quarter ended November 30, 2019, Saratoga Investment reported net investment income of $4.6 million, or $0.46 on a weighted average per share basis, and a net realized and unrealized gain on investments of $9.1 million, or $0.91 on a weighted average per share basis, resulting in a net increase in net assets from operations of $13.7 million, or $1.37 on a weighted average per share basis. The $9.1 million net gain on investments was comprised of $10.7 million in net realized gain on investments, offset by $0.5 million in net unrealized depreciation on investments and $1.1 million of net deferred tax expense on unrealized gains in Saratoga Investment’s blocker subsidiaries.

The $10.7 million net realized gain reflects the gain from the realization of the Company’s Censis Technologies investment during the quarter.

The $0.5 million net unrealized depreciation primarily reflects the $4.3 million reversal of previously recognized appreciation following the realization of the Company’s Censis Technologies investment, offset by $3.7 million unrealized appreciation on the Company’s Easy Ice investment.

This is compared to the fiscal quarter ended November 30, 2018, with net investment income of $5.1 million, or $0.69 on a weighted average per share basis, and a net realized and unrealized loss on investments of $1.5 million, or $0.20 on a weighted average per share basis, resulting in a net increase in net assets from operations of $3.7 million, or $0.49 on a weighted average per share basis. The $1.5 million net loss on investments consisted of $0.07 million in net realized loss, $1.0 million in net unrealized depreciation on investments, and $0.4 million in net deferred tax expense on unrealized gains in Saratoga Investment’s blocker subsidiaries.

Adjusted for the incentive fee accrual related to net unrealized capital gains, net investment income was $6.1 million and $4.8 million for the three months ended November 30, 2019 and 2018, respectively – an increase of $1.3 million year-over-year, or 26.6%.

Total expenses, excluding interest and debt financing expenses, base management fees and incentive management fees, decreased from $1.3 million for the three months ended November 30, 2018, to $0.5 million for the three months ended November 30, 2019, decreasing from 1.2% to 0.8% of average total assets. The decrease was primarily due to the deferred tax benefit of $1.0 million recognized in the quarter related to the Easy Ice blocker subsidiary.

Portfolio and Investment Activity

As of November 30, 2019, the fair value of Saratoga Investment’s portfolio was $487.0 million (excluding $81.1 million in cash and cash equivalents), principally invested in 38 portfolio companies and one collateralized loan obligation fund (“CLO”). The overall portfolio composition consisted of 62.2% of first lien term loans, 20.8% of second lien term loans, 0.4% of unsecured term loans, 7.0% of subordinated notes in a CLO and 9.6% of common equity.

For the fiscal quarter ended November 30, 2019, Saratoga Investment invested $40.8 million in new or existing portfolio companies and had $51.2 million in aggregate amount of exits and repayments, resulting in net exits and repayments of $10.4 million for the quarter.

As of November, 2019, the weighted average current yield on Saratoga Investment’s total portfolio for the twelve months ended was 9.8%, which was comprised of a weighted average current yield of 10.0% on first lien term loans, 11.4% on second lien term loans, 0.0% on unsecured term loans, 14.9% on CLO subordinated notes and 2.2% on equity interests.

Portfolio Update:

Subsequent to quarter-end, Saratoga Investment’s second lien term loans in Easy Ice, LLC and Easy Ice Masters, LLC were repaid at par, and its preferred equity was sold in a change of control transaction. In addition to the second lien term loans of $27.9 million and the preferred equity of $10.7 million being repaid in full including all accrued interest, Saratoga Investment also received approximately $35.6 million of additional proceeds, interest and fees.

The estimated impact of the Easy Ice sale transaction, on a pro forma basis, would be to increase our existing quarter-end NAV by at least $17.0 million, or $1.51 per share, to a pro forma NAV per share as of November 30, 2019 of at least $26.81 per share. The above pro forma balances are estimates and do not take into consideration Saratoga Investments ongoing business nor does it reflect any other potential transactional impacts that could be the result of other unrelated or unforeseen events. The actual impact of the Easy Ice sale transaction on Saratoga Investment’s Net Investment Income and NAV will be reflected in its financial statements for the quarter and fiscal year ending February 29, 2020.

Liquidity and Capital Resources

As of November 30, 2019, Saratoga Investment had no outstanding borrowings under its $45 million senior secured revolving credit facility with Madison Capital Funding LLC. At the same time, Saratoga Investment had $150.0 million SBA debentures outstanding, $134.5 million of baby bonds (fair value of $138.1 million) issued and an aggregate of $81.1 million in cash and cash equivalents.

With $45.0 million available under the credit facility, the $81.1 million of cash and cash equivalents and $175.0 million in undrawn SBA debentures from the newly approved second SBIC license, Saratoga Investment has a total of $301.1 million of undrawn borrowing capacity and cash and cash equivalents available as of November 30, 2019. Following the $50.0 million baby bond repayment subsequent to quarter-end and noted below, the $251.1 million pro forma undrawn borrowing capacity allows Saratoga Investment to grow current AUM by 52% without any new external financing. The net proceeds from the DRIP and ATM equity programs totaled $50.2 million of equity issuances for the three months ended November 30, 2019. Saratoga Investment also has the ability to issue additional equity or baby bonds through the existing shelf registration statement.

On November 15, 2019, the Company caused notices to be issued to the holders of its 6.75% 2023 baby bonds regarding the Company’s exercise of its option to redeem, in part, the issued and outstanding 2023 baby bonds. The Company redeemed $50.0 million in aggregate principal amount of the $74.5 million in aggregate principal amount of issued and outstanding 2023 baby bonds on December 21, 2019 (the “Redemption Date”). The baby bonds were redeemed at 100% of their principal amount ($25 per baby bond), plus the accrued and unpaid interest thereon from September 30, 2019, through, but excluding, the Redemption Date.

On January 8, 2020, the Company caused notices to be issued to the remaining holders of its 6.75% 2023 baby bonds regarding the Company’s exercise of its option to redeem the remaining $24.45 million in aggregate principal amount of issued and outstanding 2023 baby bonds. The Company will redeem this remaining amount of issued and outstanding 2023 baby bonds on February 7, 2020 (the “second Redemption Date”). These baby bonds will also be redeemed at 100% of their principal amount ($25 per baby bond), plus the accrued and unpaid interest thereon from December 31, 2019, through, but excluding, the Second Redemption Date.

On March 16, 2017, Saratoga Investment entered into an equity distribution agreement with Ladenburg Thalmann & Co. Inc., through which Saratoga may offer for sale, from time-to-time, up to $30.0 million of its common stock through an ATM offering. Subsequent to this, BB&T Capital Markets and B. Riley FBR, Inc were also added to the agreement. On July 11, 2019, the amount of common stock to be offered through this offering was increased to $70.0 million, and on October 8, 2019, the amount of common stock to be offered through this offering was further increased to $130.0 million. As of November 30, 2019, the Company sold 3,895,153 shares for gross proceeds of $96.5 million at an average price of $24.77 for aggregate net proceeds of $95.2 million (net of transaction costs).

Dividend

Today, Saratoga Investment announced a dividend of $0.56 per share for the fiscal quarter ended November 30, 2019, payable on February 6, 2020, to all stockholders of record at the close of business on January 24, 2020. In fiscal year 2020, the Company has paid a quarterly dividend of $0.56 per share for the quarter ended August 31, 2019, $0.55 per share for the quarter ended May 31, 2019, and $0.54 per share for the quarter ended February 28, 2019. Total dividends declared for the fiscal years ended February 28, 2019, and 2018, were $2.10 per share and $1.94 per share, respectively.

Shareholders have the option to receive payment of the dividend in cash or receive shares of common stock, pursuant to the Company’s DRIP.

Share Repurchase Plan

In fiscal year 2015, the Company announced the approval of an open market share repurchase plan that allows it to repurchase up to 200,000 shares of its common stock at prices below its NAV as reported in its then most recently published financial statements. During fiscal year 2017, the share repurchase plan was increased to 600,000 shares of common stock, and during fiscal years 2018, 2019 and 2020, this share repurchase plan was extended for another year at the same level of approval, currently through January 15, 2021. As of November 30, 2019, the Company purchased 218,491 shares of common stock, at the average price of $16.87 for approximately $3.7 million pursuant to this repurchase plan.

Saratoga Investment made no purchases of common stock in the open market during the three months ended November 30, 2019.

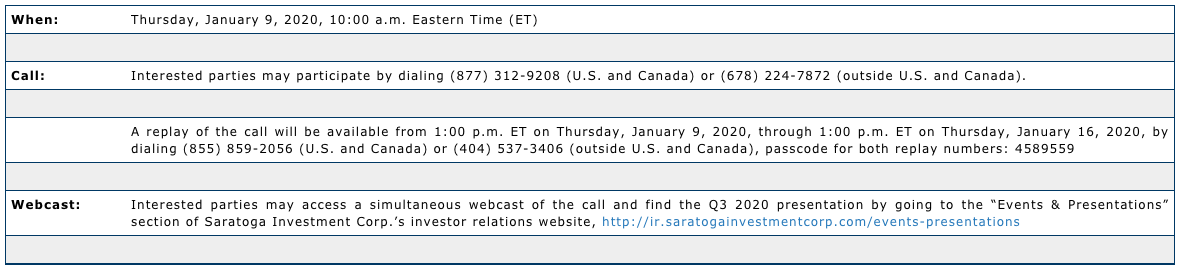

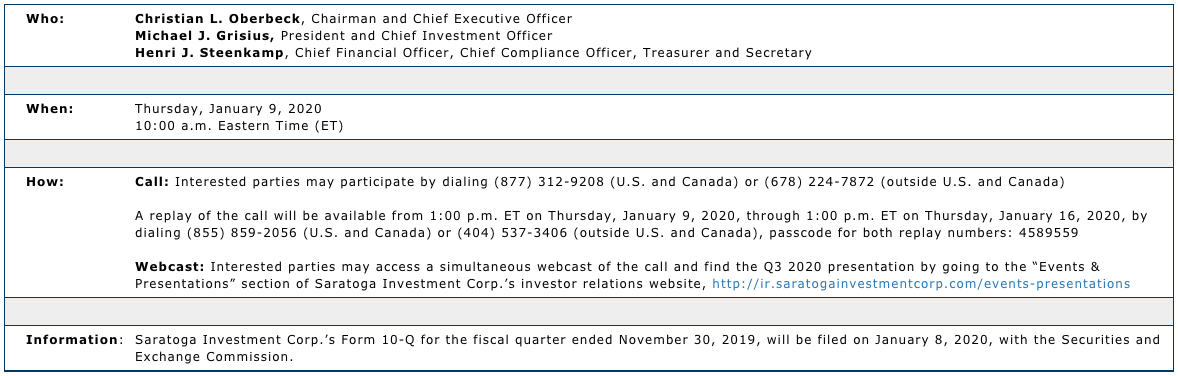

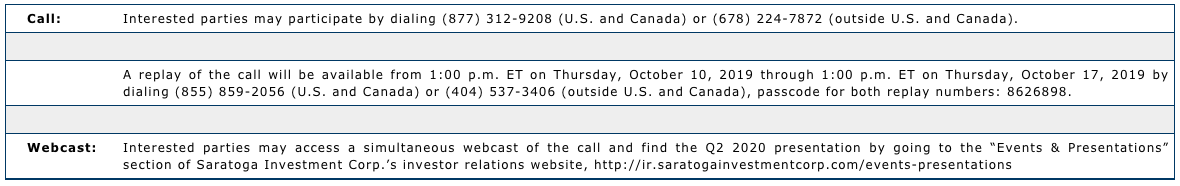

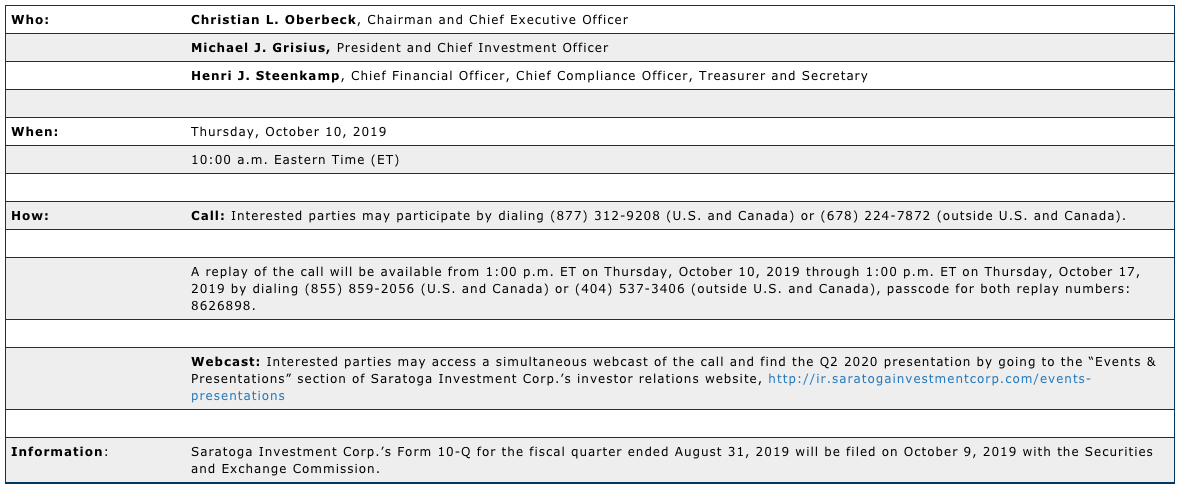

2020 Fiscal Third Quarter Conference Call/Webcast Information

About Saratoga Investment Corp.

Saratoga Investment is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment has elected to be regulated as a business development company under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment owns two SBIC-licensed subsidiaries and manages a $500 million collateralized loan obligation (“CLO”) fund. It also owns 100% of the Class F-R-2, G-R-2 and subordinated notes of the CLO. The Company’s diverse funding sources, combined with a permanent capital base, enable Saratoga Investment to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains certain forward-looking statements. These forward-looking statements are subject to risks and uncertainties and other factors enumerated in this press release and the filings Saratoga Investment makes with the SEC. Saratoga Investment undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Financials

(1) Adjusted net investment income yield is calculated as adjusted net investment income divided by average net asset value.Supplemental Information Regarding Adjusted Net Investment Income, Adjusted Net Investment Income Yield and Adjusted Net Investment Income per share

On a supplemental basis, Saratoga Investment provides information relating to adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share, which are non-GAAP measures. These measures are provided in addition to, but not as a substitute for, net investment income, net investment income yield and net investment income per share. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or reversal attributable to unrealized gains. The management agreement with the Company’s advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year. In addition, Saratoga Investment accrues, but does not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. As such, Saratoga Investment believes that adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share is a useful indicator of operations exclusive of any capital gains incentive fee expense or reversal attributable to unrealized gains. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income, net investment income yield to adjusted net investment income yield and net investment income per share to adjusted net investment income per share for the three and nine months ended November 30, 2019 and November 30, 2018.

(1) Adjusted net investment income yield is calculated as adjusted net investment income divided by average net asset value.

(2) Adjusted net investment income per share is calculated as adjusted net investment income divided by weighted average common shares outstanding.

Saratoga Investment Corp. to Hold Conference Call to Report Fiscal Third Quarter 2020 Financial Results and Announce Third Quarter Dividend

NEW YORK, Dec. 09, 2019 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (NYSE:SAR), a business development company, will report its financial results and announce its dividend for the fiscal quarter ended November 30, 2019, in a conference call to be held on January 9, 2020. Details for the conference call are provided below.

About Saratoga Investment Corp.

Saratoga Investment is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment has elected to be regulated as a business development company under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment owns two SBIC-licensed subsidiaries and manages a $500 million collateralized loan obligation (“CLO”) fund. It also owns 100% of the Class F-R-2, G-R-2 and subordinated notes of the CLO. The Company’s diverse funding sources, combined with a permanent capital base, enable Saratoga Investment to provide a broad range of financing solutions.

Saratoga Investment Corp. Announces Fiscal Second Quarter 2020 Financial Results

NEW YORK, Oct. 09, 2019 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2020 fiscal second quarter.

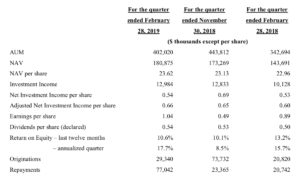

Summary Financial Information

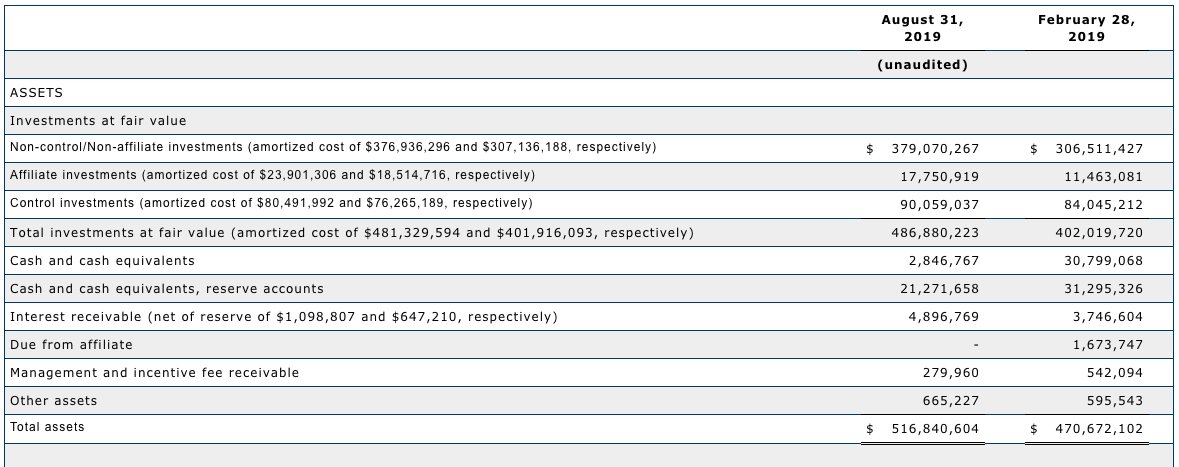

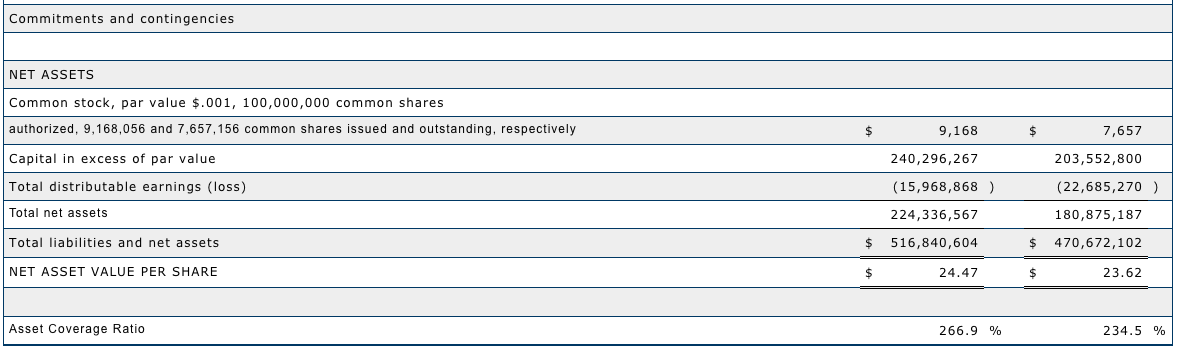

The Company’s summarized financial information is as follows:

“The second fiscal quarter of 2020 has been important for us with many significant accomplishments”, said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “1) We received approval for a second SBIC license, providing us access to up to $175 million in additional long-term, low-cost capital in the form of SBA debentures to further enable us to support our core small business constituency; 2) Our second quarter performance metrics were also exceptionally strong with LTM return on equity of 14.3% and an increase in NAV per share of $0.41 to $24.47. Our adjusted NII per share of $0.68, taking into account our newly issued ATM shares, still over-earned our current $0.56 dividend per share, which was recently increased for the twentieth sequential quarter; 3) Our continued strong price and volume stock market performance enabled us to issue $34.1 million of equity accretively under our existing ATM program in Q2, importantly providing initial equity capitalization for this new second SBIC license; 4) Asset quality and growth were strong this quarter, with $2.6 million of net realized and unrealized gains on investments, and AUM growing by 19% to $486.9 million; and 5) with our new second SBIC license our dry powder has expanded significantly, providing us the ability to grow our AUM by a further 50% utilizing the current liquidity and committed credit facilities at our disposal.”

Michael J. Grisius, President and Chief Investment Officer, added, “This fiscal quarter has again demonstrated our ability to build AUM without sacrificing quality, as our investments grew by 19% from last quarter, while those rated in our highest category remained at 99%. We always emphasize that quarterly portfolio growth can be lumpy and is dependent on various factors, including a robust pipeline, credit quality of deal pipeline, and the level of repayments – this past quarter we benefitted from all three. We’ve accomplished this amid macroeconomic conditions and lending dynamics in the lower middle market that continue to provide headwinds, with LIBOR again decreasing this quarter. We also continue to bring new platform investments into the portfolio, with four more investments in new companies added this quarter, and two more since quarter-end. We remain confident that our experienced origination team, exceptional underwriting standards and tested investment strategy and focus will continue to steadily grow portfolio size and maintain quality over the long-term.”

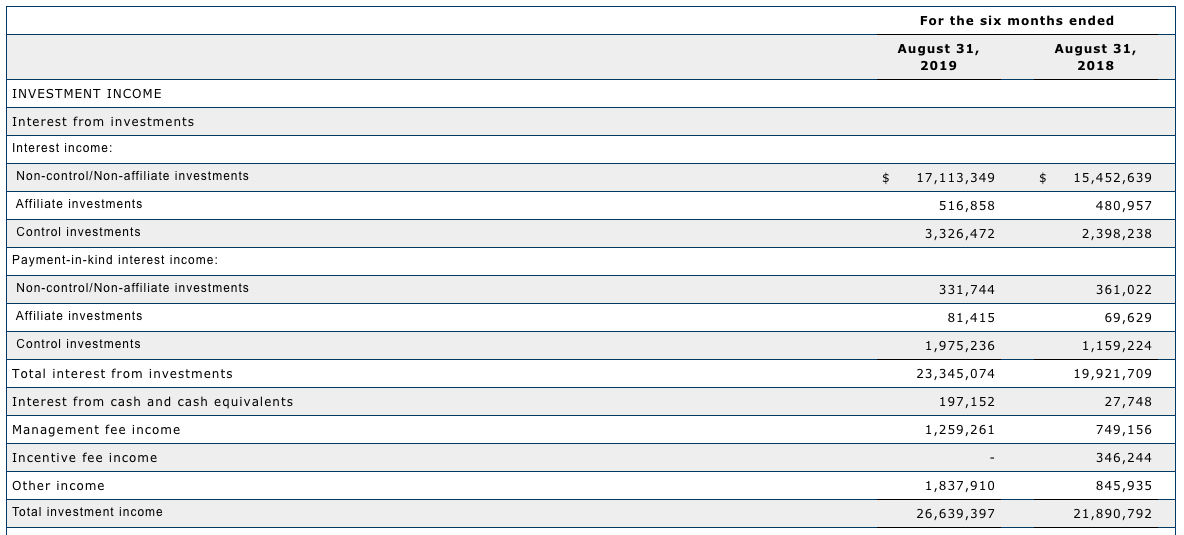

As of August 31, 2019, Saratoga Investment increased its assets under management (“AUM”) to $486.9 million, an increase of 18.9% from $409.5 million as of May 31, 2019, and an increase of 23.9% from $392.9 million as of August 31, 2018. The increase this quarter consists of originations of $93.2 million, partially offset by repayments and amortizations of $19.0 million. Including realized and unrealized gains, Saratoga Investment’s portfolio has grown significantly this quarter and remains strong, with a continued high level of investment quality in loan investments, with 99.0% of its loans this quarter at its highest internal rating. Included in this quarter’s originations are also four investments in new portfolio companies. Since Saratoga Investment took over the management of the BDC, $392.5 million of repayments and sales of investments originated by Saratoga Investment have generated a gross unlevered IRR of 14.0%.

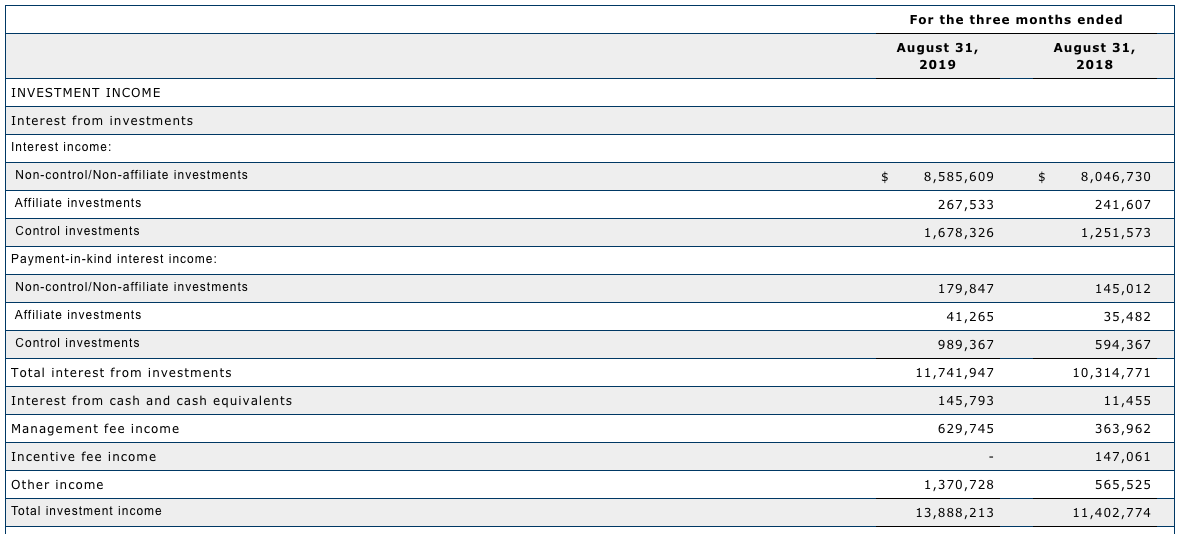

For the three months ended August 31, 2019, total investment income of $13.9 million increased by $2.5 million, or 21.8%, compared to $11.4 million for the three months ended August 31, 2018, and by 8.9% on a quarter-on-quarter basis from $12.8 million for the three months ended May 31, 2019. This increased investment income was generated from an investment base that has grown by 23.9% since last year and by 18.9% from last quarter. In addition, these increases were achieved despite a decrease in interest earned on CLO equity and the weighted average current coupon on non-CLO BDC investments decreasing to 10.5% this quarter from 11.1% last year and 10.8% last quarter. Much of the decrease in the current coupon is due to the reductions in LIBOR over these periods. The impact of the AUM increase is also only partially reflected in this quarter’s results.

As compared to the three months ended August 31, 2018, the investment income increase of $2.5 million was offset by: (i) increased debt and financing expenses, as the growth in AUM this year was partially financed from increased SBA debentures and the $60.0 million baby bond issuance last year; and (ii) increased base and incentive management fees generated from the management of this larger pool of investments. Total expenses, excluding interest and debt financing expenses, base management fees, incentive fees and income tax benefit, increased from $1.3 million for the three months ended August 31, 2018, to $1.4 million for the three months ended August 31, 2019.

Net investment income on a weighted average per share basis was $0.59 for the three months ended August 31, 2019. Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income on a weighted average per share basis was $0.68. This compares to adjusted net investment income per share of $0.60 for the three months ended May 31, 2019, and $0.69 for the three months ended August 31, 2018. During these periods, weighted average common shares outstanding increased from 6.9 million shares for the three months ended August 31, 2018, to 7.7 million shares and 8.3 million shares for the three months ended May 31, 2019, and August 31, 2019, respectively. These share increases primarily reflect the secondary equity offering of 1.15 million shares on July 13, 2018, and the 1.4 million shares issued this quarter pursuant to the At-the-Market (“ATM”) equity offering program, both of which were accretive to net asset value (“NAV”) per share.

Net investment income yield as a percentage of average NAV (“Net Investment Income Yield”) was 9.6% for the three months ended August 31, 2019. Adjusted for the incentive fee accrual related to net unrealized capital gains, the Net Investment Income Yield was 11.0%. In comparison, adjusted Net Investment Income Yield was 10.1% and 11.9% for the three months ended May 31, 2019, and August 31, 2018, respectively.

NAV was $224.3 million as of August 31, 2019, an increase of $43.3 million from $180.9 million as of February 28, 2019, and an increase of $51.7 million from $172.7 million as of August 31, 2018.

NAV per share was $24.47 as of August 31, 2019, compared to $24.06 as of May 31, 2019, $23.62 as of February 28, 2019, and $23.16 as of August 31, 2018.

Return on equity for the last twelve months ended August 31, 2019 was 14.3%, compared to 11.6% for the comparable period last year.

Earnings per share for the three months ended August 31, 2019, was $0.91, compared to earnings per share of $0.99 for the three months ended May 31, 2019, and $0.45 for the three months ended August 31, 2018.

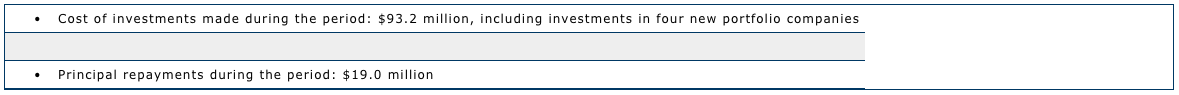

Investment portfolio activity for the three months ended August 31, 2019:

Additional Financial Information

For the fiscal quarter ended August 31, 2019, Saratoga Investment reported net investment income of $5.0 million, or $0.59 on a weighted average per share basis, and a net realized and unrealized gain on investments of $2.6 million, or $0.31 on a weighted average per share basis, resulting in a net increase in net assets from operations of $7.6 million, or $0.91 on a weighted average per share basis. The $2.6 million net gain on investments was comprised of $1.9 million in net realized gain on investments and $1.5 million in net unrealized appreciation on investments, offset slightly by $0.7 million of net deferred tax expense on unrealized gains in Saratoga Investment’s blocker subsidiaries.

The $1.9 million net realized gain reflects (i) a $1.3 million gain from the realization of the Company’s Fancy Chap investment during the quarter, as well as (ii) a $0.6 million gain on the Company’s Censis Technologies investment resulting from the receipt of a dividend recap in excess of the investment’s cost basis.

The $1.5 million net unrealized appreciation primarily reflects (i) $1.3 million unrealized appreciation on the Company’s Censis Technologies investment, (ii) $1.9 million unrealized appreciation on the Company’s Easy Ice investment, (iii) $1.3 million unrealized appreciation on the Company’s Netreo Holdings investment, (iv) $0.6 million unrealized appreciation on the Company’s Grey Heller investment, and (v) numerous smaller unrealized appreciations across the portfolio on various investments. This was offset primarily by (i) $1.2 million reversal of previously recognized appreciation following the realization of the Company’s Fancy Chap investment, and (ii) $2.7 million unrealized depreciation on the Company’s CLO equity investment, reflecting both the equity distribution received during the quarter as well as an increase in the discount rate used to fair value the equity.

This is compared to the fiscal quarter ended August 31, 2018, with net investment income of $5.1 million, or $0.74 on a weighted average per share basis, and a net realized and unrealized loss on investments of $2.0 million, or $0.29 on a weighted average per share basis, resulting in a net increase in net assets from operations of $3.1 million, or $0.45 on a weighted average per share basis. The $2.0 million net loss on investments consisted of $2.2 million in net unrealized depreciation on investments, offset by $0.2 million in net deferred tax benefit on unrealized losses in Saratoga Investment’s blocker subsidiaries.

Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income was $5.6 million and $4.8 million for the three months ended August 31, 2019 and 2018, respectively – an increase of $0.9 million year-over-year, or 18.3%.

Total expenses, excluding interest and debt financing expenses, base management fees and incentive management fees, increased from $0.9 million for the three months ended August 31, 2018, to $1.0 million for the three months ended August 31, 2019, increasing from 0.9% to 1.0% of average total assets.

Portfolio and Investment Activity

As of August 31, 2019, the fair value of Saratoga Investment’s portfolio was $486.9 million (excluding $24.1 million in cash and cash equivalents), principally invested in 36 portfolio companies and one collateralized loan obligation fund (“CLO”). The overall portfolio composition consisted of 62.5% of first lien term loans, 20.5% of second lien term loans, 0.4% of unsecured term loans, 7.4% of subordinated notes in a CLO and 9.2% of common equity.

For the fiscal quarter ended August 31, 2019, Saratoga Investment invested $93.2 million in new or existing portfolio companies and had $19.0 million in aggregate amount of exits and repayments, resulting in net investments of $74.2 million for the quarter.

As of August 31, 2019, the weighted average current yield on Saratoga Investment’s portfolio for the twelve months ended was 10.1%, which was comprised of a weighted average current yield of 10.3% on first lien term loans, 11.6% on second lien term loans, 0.0% on unsecured term loans, 14.7% on CLO subordinated notes and 2.6% on equity interests.

Liquidity and Capital Resources

As of August 31, 2019, Saratoga Investment had no outstanding borrowings under its $45 million senior secured revolving credit facility with Madison Capital Funding LLC. At the same time, Saratoga Investment had $150.0 million SBA debentures outstanding, $134.5 million of baby bonds (fair value of $138.6 million) issued and an aggregate of $24.1 million in cash and cash equivalents.

On August 14, 2019, Saratoga Investment’s application for a second SBIC license was approved. The new license will provide up to $175 million in additional long-term capital in the form of SBA debentures.

With $45.0 million available under the credit facility, the $24.1 million of cash and cash equivalents and $175.0 million in undrawn SBA debentures from the new second SBIC license, Saratoga Investment has a total of $244.1 million of undrawn borrowing capacity and cash and cash equivalents available as of August 31, 2019. This allows Saratoga Investment to grow current AUM by 50% without any new external financing. The net proceeds from the DRIP and ATM equity programs totaled $34.3 million of equity issuances for the three months ended August 31, 2019. Saratoga Investment also has the ability to issue additional equity or baby bonds through the existing shelf registration statement.

On March 16, 2017, Saratoga Investment entered into an equity distribution agreement with Ladenburg Thalmann & Co. Inc., through which Saratoga may offer for sale, from time-to-time, up to $30.0 million of its common stock through an ATM offering. Subsequent to this, BB&T Capital Markets and B. Riley FBR, Inc were also added to the agreement. On July 11, 2019, the amount of common stock to be offered through this offering was increased to $70.0 million, and on October 8, 2019, the amount of common stock to be offered through this offering was increased to $130.0 million. As of August 31, 2019, the Company sold 1,942,786 shares for gross proceeds of $47.1 million at an average price of $24.25 for aggregate net proceeds of $46.5 million (net of transaction costs).

Dividend

On August 27, 2019, Saratoga Investment announced a dividend of $0.56 per share for the fiscal quarter ended August 31, 2019, payable on September 26, 2019, to all stockholders of record at the close of business on September 13, 2019. This increase is the twentieth sequential increase to the Company’s quarterly dividends. On May 28, 2019, Saratoga Investment announced a dividend of $0.55 per share for the fiscal quarter ended May 31, 2019, payable on June 27, 2019, to all stockholders of record at the close of business on June 13, 2019. Total dividends declared for the fiscal years ended February 28, 2019, and 2018, were $2.10 per share and $1.94 per share, respectively.

Shareholders have the option to receive payment of the dividend in cash or receive shares of common stock, pursuant to the Company’s DRIP.

Share Repurchase Plan