Four Closed-End Funds to Feel Good About Even if Rates Rise

Don’t let fears of a Federal Reserve rate hike scare you away from these four promising closed-end funds

The Street’s Gregg Greenberg spoke with special guest and nationally recognized closed-end fund expert John Cole Scott about four closed-end funds that are poised to do well even if rates rise. See John discuss the MFS High Income Municipal Trust (CXE), the Calamos Global Dynamic Income Fund (CHW), The Cushing MLP Total Return Fund (SRV) and the Saratoga Investment Corp. (SAR).

Watch full video on TheStreet.

Will highly leveraged closed-end funds (CEF) be slammed by a December interest rate hike?

“A rate hike will likely impact highly leveraged closed-end funds in the short run, however the lower for longer environment will make them attractive over the long term,” said said John Cole Scott, chief investment officers at Closed-End Fund Advisors.

“The CXE is a good equity hedge in an uncertain market environment and the tax-equivalent yield of around 9% is hard to beat,” said Scott.

Scott is also recommending the Calamos Global Dynamic Income Fund (CHW) , a hybrid CEF that mixes global stocks and bonds. It currently trades at an 11% discount, close to its three year average, and has a leverage of 30%. Yield on the CHW is 11.4% at last check.

“Calamos has experienced active managers so investors can feel comfortable that they are in good hands,” said Scott.

The Cushing MLP Total Return Fund (SRV) pays an 8.4% yield and sports a 31% leverage ratio. The pipeline CEF trades at a discount of 13%, well below its three year average premium of 1%. Scott said the energy play is comprised of 71% midstream outfits so it is “less tied to the price of oil” than many other funds.

Finally, Scott is a fan of the Saratoga Investment Corp. (SAR) , a debt-based business development corporation trading at a 19% discount compared to its three year average of 28%. Saratoga yields a healthy 9.7% in a low-yield environment.

“Saratoga trades at a discount because it is small, not because it is poorly run,” said Scott.

Saratoga Investment Corp. Prices Public Offering of $65 Million 6.75% Notes Due 2023

NEW YORK, NY (December 13, 2016) – Saratoga Investment Corp. (the “Company”) (NYSE: SAR) today announced that it has priced an underwritten public offering of $65 million in aggregate principal amount of 6.75% unsecured notes due 2023. The notes will mature on December 30, 2023, and may be redeemed in whole or in part at any time or from time to time at Saratoga Investment Corp.’s option on or after December 21, 2019. The notes will bear interest at a rate of 6.75% per year payable quarterly on March 30, June 30, September 30 and December 30 of each year, beginning March 30, 2017.

The offering is expected to close on December 21, 2016, subject to customary closing conditions. The Company has granted the underwriters an option to purchase up to an additional $9.75 million in aggregate principal amount of notes. The Notes are expected to be listed on the New York Stock Exchange and to trade thereon within 30 days of the original issue date under the trading symbol “SAB”.

Ladenburg Thalmann & Co. Inc., a subsidiary of Ladenburg Thalmann Financial Services Inc. (NYSE MKT: LTS), BB&T Capital Markets, Compass Point and William Blair are acting as joint book-running managers.

The Company expects to use the net proceeds from this offering to repay all of the outstanding indebtedness under its 7.50% fixed-rate notes due 2020, which amounts to $61.8 million, and for general corporate purposes in accordance with its investment objective and strategies.

Investors are advised to consider carefully the investment objective, risks and charges and expenses of the Company before investing.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, nor will there be any sale of, the Notes referred to in this press release in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. A registration statement relating to these securities was filed and has been declared effective by the Securities and Exchange Commission.

The offering will be made only by means of a prospectus. Copies of the prospectus relating to the offering may be obtained for free by visiting the Securities and Exchange Commission’s website at www.sec.gov or may be obtained from of any of the following investment banks: Ladenburg Thalmann, Attn: Syndicate Department, 570 Lexington Avenue, 11th Floor New York, NY 10022, or by emailing prospectus@ladenburg.com (telephone number 1-800-573-2541); BB&T Capital Markets at 901 East Byrd Street, 3rd Floor, Richmond, VA 23219 Attn: Syndicate Dept. or via email request: prospectusrequests@bbandtcm.com; Compass Point Research & Trading, LLC 1055 Thomas Jefferson Street NW, Suite 303 Washington, D.C. 20007, or email at syndicate@compasspointllc.com; or William Blair & Company, L.L.C., Attention: Prospectus Department, 222 West Adams Street, Chicago, IL 60606, or by telephone at 1-800-621-0687 or email at prospectus@williamblair.com.

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that invests primarily in leveraged loans and mezzanine debt issued by privately owned U.S. middle-market businesses, which the Company defines as companies having annual EBITDA (earnings before interest, taxes, depreciation and amortization) of between $5 million and $50 million, both through direct lending and through participation in loan syndicates. Saratoga Investment Corp.’s objective is to generate current income and, to a lesser extent, capital appreciation from our investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, a New York-based investment firm affiliated with Saratoga Partners, a middle market private equity investment firm. Within the BDC, Saratoga Investment Corporation manages both an SBIC-licensed subsidiary and a Collateralized Loan Obligation (CLO) fund. The Company believes these diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to offer a broad range of financing solutions.

Forward Looking Statements

Statements included herein may contain “forward-looking statements”. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of assumptions, risks and uncertainties, which change over time. Actual results may differ materially from those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by the Company with the Securities and Exchange Commission. Except as required by law, the Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Saratoga Investment Corp.: Healthy Dividend, Lots of Dry Powder

This post was featured on Seeking Alpha December 9th, 2016.

Summary

- After speaking with Saratoga’s CFO earlier this week, we believe this BDC’s 9.2% dividend yield is healthy, and the company has lots of dry powder for continued growth.

- Despite Saratoga’s recent strong price appreciation year-to-date, it still enjoys an attractive valuation, several important competitive advantages, and less exposure to the big risks facing the BDC industry.

- According to Saratoga’s CFO, Henri Steenkamp, “We’re not afraid to not grow in a quarter, our most important thing is not to sacrifice credit quality”.

After speaking with the Chief Financial Officer (Henri Steenkamp) of Saratoga Investment Corp. (NYSE:SAR) for 40 minutes earlier this week, our main takeaway is that the 9.2% dividend yield of this small cap Business Development Company (BDC) is healthy (with room to grow) because the company continues to enjoy an attractive valuation (even after the shares’ strong rally so far this year), several important competitive advantages (for example, access to plenty of low-cost capital, aka “dry powder”), and may actually be less impacted by some of the big risks facing the BDC industry as a whole.

Overview

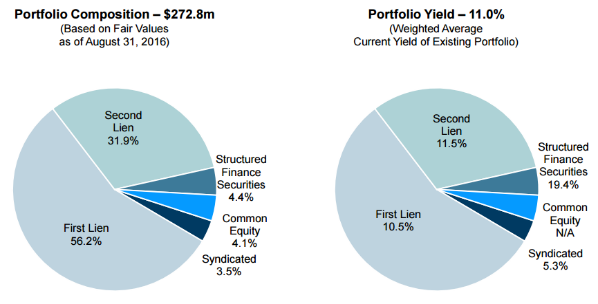

Saratoga Investment Corp. is a publicly traded BDC providing financing solutions to lower middle market companies through its SBIC-licensed subsidiary and a $300 million Collateralized Loan Obligation (CLO) fund. As the following chart shows, Saratoga’s portfolio is composed mainly of first and second liens, and the yields on these financing arrangements are significant (this is how Saratoga supports its healthy dividend).

How CFOs Can Rise to the Occasion in Times of Uncertainty

The Great Recession of 2008 was traumatic, to say the least: 170,000 small businesses failed over the course of two years (2008-2010), and huge corporations like Bear Sterns, Lehman Brothers and Washington Mutual went bankrupt in days (if not hours).

Many reports acknowledge that, despite lingering effects on sectors like education, for the most part the economy and housing market is slowly recovering. Cautious optimism is wise, however, as Brexit and US election of Donald Trump have shown us that even with our recovery, we’re still fraught with difficulties and new challenges.

Among all the confusion and change, the one executive who holds critical influence over a company’s survival or failure may well be the Chief Financial Officer. Believe it or not, a CFO’s role has transformed in recent years, to the point that CFOs have grown beyond their popular image as master accountants, instead becoming an integral part of the boardroom and the decision-making process.

How has the CFO position changed?

In a nutshell, technology and the 2008 recession have altered the CFO role immeasurably, forcing CFOs to broaden their skills to go beyond simple finance and numbers, expanding into the areas of strategic vision, execution, and even market forecasts.

The reason? Companies that were able to navigate their way successfully through the recession shared a number of traits: they invested carefully in staples like healthcare, communications, and consumer staples; they downsized and reduced overhead; and they automated processes and made operations as efficient as possible, while ensuring regulatory compliance.

In each and every success, the CFO played a pivotal role, given their intimate knowledge of the company’s financial health. CFOs didn’t simply sign off on company-wide pivots or nod at the board meetings; instead, many of them offered strategic vision, plotted out the financial impact of every move, and ensured that all changes were financially sound.

Additionally, as EY notes in their report on the evolving role of the CFO, not only do CFOs provide objective financial advice, they are also involved in areas ranging from investor relations to strategic marketing and analysis. Probably the executive most involved and in touch with the broader organization.

Companies must clearly define a CFO’s duties

In this day and age, CFOs have seen their umbrellas rapidly expand to include other duties. But in their “DNA of the CFO” report, EY notes that 51% of CFOs report feeling stretched thin, with another 56% reporting a tension between old duties (finance, compliance) and new ones (strategic priorities).

One key solution to alleviating pressure on CFOs is to clearly define their duties. While all sources are very clear on the fact that CFOs have to move past doing business as usual and move out of their financial comfort zone, their new responsibilities remain ambiguous.

Now, it is true that every company will differ in the responsibilities assigned to their CFOs, and no two companies will assign the exact same duties. However, Deloitte created the Four Faces of the CFO, a handy framework that draws out the broad strokes of what is expected of a CFO. The roles are varied, but have no ambiguity: as a Steward, CFOs see to traditional responsibilities in areas like compliance, finance, and accounting; as an Operator, they preside over financial planning and the daily workings of the company; as a Strategist, they use data to drive growth and vision; and finally, as a Catalyst, they advocate for clever business improvement initiatives.

Until this first step of defining the CFO’s role is handled, there will be many unhappy CFOs with too much on their plate.

How can CFOs balance their new jobs with their old?

This brings us to the next step, of course: how can CFOs maximize their efficiency and stay afloat in a quickly changing environment? Every situation is unique, but there are a few broad suggestions that may help.

Rely on automation where possible, and a larger staff if necessary

First, it is obvious by now that technology has the ability to put certain workers (and even entire industries) out of business. However, automating certain financial activities is actually a labor-saving, cost-cutting tool for CFOs. Simply creating an automated, efficient process that is easy to use and (mostly) bug free may be enough. After all, consider that the ideal actuary and accounting functions are three things: repeatable, error-free, and efficient. While these three characteristics happen to be traits that humans, as a species, are not particularly skilled at, they are an area in which technology excels.

Compliance: why a larger staff is currently necessary

Still, automation is only part of the answer, at least so far. However advanced technology is, it still has not yet reached the point where it can resolve complex legal and compliance disputes. As such, given all the uncertainty and changing government regulations, it’s still very necessary to have a capable, driven compliance department of auditors, lawyers, and other specialists.

This is even more crucial for multinational corporations, who must comply with a huge array of contradictory and conflicting regulations across various borders. As Western Union CFO Raj Agrawal makes very clear, creating a strong culture of compliance requires the right resources in the right locations, something that cannot always be accomplished with the existing technology at hand.

Further, as Deloitte has found, there is no substitute for a strong, positive culture in the compliance department. Implementing any compliance regime requires testing, monitoring, and regular feedback, all of which contain that single, critical element: the human one.

New and improved training and networking

Lastly, CFOs need to network, train, and organize alongside other CFOs. This might sound counterintuitive at first: CFOs in different organizations should be collaborative peers.

Consider this: CFOs all face similar challenges and pressures at work, and it is in their shared interest to present a collective, unified front on how they will address these problems. After all, if CFOs do not stand up and clearly outline what is in their job description (and what isn’t), others will do so for them.

Fortunately, there’s no shortage of summits and conferences, from the prestigious, multi-faceted MIT CFO summit to the nonprofit CFO Summit. It is up to individual CFOs to make or find the time to sharpen their skillset and keep up with industry trends, but such summits are incredibly useful in more ways than one.

In a post-recessionary world filled with uncertainty and risk, the CFO has become more important than ever. But even with a busier schedule and a more uncertain role, CFOs can still take steps to maximize their efficiency, keep their organizations profitable, and importantly, stay sane.

Saratoga to Report Fiscal 2nd Quarter 2017 Financial Results

NEW YORK, Sept. 19, 2016 – Saratoga Investment Corp. (NYSE:SAR), a business development company, will report its financial results for the quarter ended August 31, 2016 on October 12, 2016, after market close. A conference call to discuss the financial results will be held on October 13, 2016. Details for the conference call are provided below.

Who:

- Christian L. Oberbeck, Chairman and Chief Executive Officer

- Michael J. Grisius, President and Chief Investment Officer

- Henri J. Steenkamp, Chief Financial Officer

When:

- Thursday, October 13, 2016

- 10:00 a.m. Eastern Time (ET)

How:

- Call: Interested parties may participate by dialing (877) 312-9208 (U.S. and Canada) or (678) 224-7872 (outside U.S. and Canada).

- A replay of the call will be available from 1:00 p.m. ET on Thursday, October 13, 2016 through 11:59 p.m. ET on Thursday, October 20, 2016 by dialing (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (outside U.S. and Canada), passcode for both replay numbers: 85022494.

Webcast:

- Interested parties may access a simultaneous webcast of the call and find the Q2 2017 presentation by going to the “Events & Presentations” section of Saratoga Investment Corp.’s investor relations website.

Information:

- Saratoga Investment Corp.’s Form 10-Q for the fiscal year ended August 31, 2016 will be filed on October 12, 2016 with the Securities and Exchange Commission.

To learn more, visit SaratogaInvestmentCorp.com.

Saratoga Investment Corp. Announces a Special Dividend of $0.20 per Share

NEW YORK, August 8, 2016 – Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced that its Board of Directors has declared a special dividend of $0.20 per share, payable on September 5, 2016 to all stockholders of record at the close of business on August 24, 2016. Shareholders have the option to receive payment of the dividend in cash, or receive shares of common stock pursuant to the Company’s dividend reinvestment plan.

“The payment of this special dividend brings our fiscal year to date dividends to $1.04 per share and helps fulfill our requirement for dividend distributions as a Regulated Investment Company,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “This past quarter, Saratoga Investment increased its quarterly dividend for the seventh consecutive quarter and by 139% since the establishment of our dividend policy in 2014. We have also overearned our dividend every quarter, which distinguishes us from many other BDCs by giving us one of the higher dividend coverages in the industry.”

On September 24, 2014, Saratoga Investment announced the decision made by its Board of Directors to adopt a new dividend policy to pay a regular quarterly cash dividend to shareholders. Since then, the Company has paid increasing quarterly dividends. During fiscal year 2016, Saratoga Investment declared and paid dividends of $2.36 per share, composed of $0.27 for the quarter ended February 28, 2015, $0.33 per share for the quarter ended May 31, 2015, $0.36 per share for the quarter ended August 31, 2015, $0.40 per share for the quarter ended November 30, 2015, and a special dividend of $1.00 per share in the first quarter of fiscal year 2016. Thus far in fiscal year 2017 and including this special dividend of $0.20 per share, Saratoga Investment declared and paid dividends of $1.04 per share, including a dividend of $0.41 per share for the quarter ended February 29, 2016 and $0.43 per share for the quarter ended May 31, 2016, which will be paid on August 9, 2016.

Saratoga Investment shareholders who hold their shares with a broker must affirmatively instruct their brokers prior to the record date if they prefer to receive this dividend and future dividends in common stock. The number of shares of Common Stock to be delivered shall be determined by dividing the total dollar amount by 95% of the average of the market prices per share at the close of trading on the ten (10) trading days immediately preceding (and including) the payment date.

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans, mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment Corp.’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment Corp. owns an SBIC-licensed subsidiary and manages a $300 million Collateralized Loan Obligation (CLO) fund. It also owns 100% of the subordinated notes of the CLO. These diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains certain forward-looking statements. These forward-looking statements are subject to risks and uncertainties and other factors enumerated in this press release and the filings Saratoga Investment Corp. makes with the SEC. Saratoga Investment Corp. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Saratoga Investment Corp. to Report Fiscal First Quarter 2017 Financial Results and Hold Conference Call

NEW YORK, June 14, 2016 /PRNewswire/ — Saratoga Investment Corp. (NYSE: SAR), a business development company, will report its financial results for the quarter ended May 31, 2016 on July 13, 2016, after market close. A conference call to discuss the financial results will be held on July 14, 2016. Details for the conference call are provided below.

Who:

Christian L. Oberbeck, Chairman and Chief Executive Officer

Michael J. Grisius, President and Chief Investment Officer

Henri J. Steenkamp, Chief Financial Officer

When:

Thursday, July 14, 2016

10:00 a.m. Eastern Time (ET)

How:

Call: Interested parties may participate by dialing (877) 312-9208 (U.S. and Canada) or (678) 224-7872 (outside U.S. and Canada).

A replay of the call will be available from 1:00 p.m. ET on Thursday, July 14, 2016 through 1:00 p.m. ET on Thursday, July 21, 2016 by dialing (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (outside U.S. and Canada), passcode for both replay numbers: 32861778.

Webcast: Interested parties may access a simultaneous webcast of the call and find the Q1 2017 presentation by going to the “Events & Presentations” section of Saratoga Investment Corp.’s investor relations website:

http://www.saratogainvestmentcorp.com/investor.html

Information:

Saratoga Investment Corp.’s Form 10-Q for the fiscal year ended May 31, 2016 will be filed on July 13, 2016 with the Securities and Exchange Commission.

Source: Saratoga Investment Corp.

How the Rise of SaaS has Changed the Role of CFOs

As many companies transition to cloud-based computing to handle both business operations and internal communication activities, CFOs are learning that they have to adapt to these changes and, in some cases, adopt new roles. Cloud-based enterprise resource planning (ERP) suites are especially useful for today’s CFO since they allow for fast data consolidation and reporting. Since SaaS simplifies many activities and provides real-time data, CFOs can make important revenue-generating business decisions and complete financial forecasts with a high degree of accuracy. Here’s a closer look at the rise of SaaS and how this is changing the roles of CFOs:

Streamlining Data Reporting Processes

CFOs now have more easy access to data and business information than ever before. Instead of requesting reports and data from different departments, the CFO can log in to a dashboard and view information in real-time through SaaS services. This can reduce the need for crashing through thousands of pages, or having to send continuous email communications between departments. It also helps the CFO stay up-to-date on both internal and external activities. Having easy access to a dashboard of activities and being able to generate all types of financial reports in a few clicks can make it easier for a CFO to review operations, sales, and other departmental reports and information at their leisure.

Efficient Cost Management Review

CFOs are often tasked with analyzing and managing costs. This may entail coordinating meetings with multiple departments to review budgets and expense reports regularly. Using cloud-based platforms can help the CFO review financial activities across all departments in real-time and make key decisions when they are needed. Departments can simply upload reports, such as expense reports, monthly budget analyses, performance reports, and other key documents to a main hub that is accessible by all executives.

Streamlining Portfolio Management Analysis

Many CFOs are responsible for monitoring the financial firm’s portfolio companies. Having access to performance metrics and other key data in a centric dashboard can make it easier to review company performance of individual companies or clients, retrieve contact information, and identify any strengths and weaknesses that may need to be addressed. Using a cloud-based program means the CFO will be able to review monthly reports and cross-reference other departmental reports, such as top performers and details about potential clients, in order to make important decisions.

Optimizing Accounting and Tax Reporting Processes

The CFO must make sure all financial activities comply with accounting rules and may also be involved with auditing various internal processes. Using a cloud-based software program can help with these tasks and optimize all accounting-related and tax reporting processes. This can improve productivity so the CFO has more time to dedicate to other activities.

Faster Decision Making

When it’s time to make pivotal decisions for the company, from managing capital costs to executing a financial strategy, the CFO needs to use current and accurate data. They may need certain types of information at the last minute which can be impossible to locate in a company’s intranet or from the mass of e-mail distributions, or when certain documents are housed in a department’s folders and are password-protected. Using an ERP suite eliminates a lot of the searching and retrieval activities of reports, spreadsheets, and other company data, which means the CFO can gather information he or she needs quickly to thereby make timely decisions.

The rise of SaaS in the business world and the rapid adaptation of cloud-based ERP suites are changing the roles of today’s CFO. From streamlining data reporting to optimizing accounting processes, CFOs can enjoy numerous benefits from working with a cloud-based system. Security of these systems are obviously of critical importance, but those who acquire the skills and knowledge to navigate a SaaS dashboard and learn how to use all the tools available within an ERP suite can simplify many daily and monthly activities that help them make more informed decisions.

Photo Credit: Flickr/Perspecsys Photo

How to Prepare for an Earnings Call

For any CFO, the first earnings calls have the potential to be a daunting undertaking. It requires a distinct focus on every aspect. From facts and figures to word choice and pacing, the more attention and preparation you put in, the more likely it is to be a success.

But how do you make it a success? With so many components to factor into your call, it’s best to make this a team effort. That includes going beyond the scope of your fellow executives. I remember my first call, and here is how my team and I made it a success.

Prepare, Prepare, Prepare

Let’s skip the first fact: the details. If you don’t have the correct figures in place, step back from the drawing board immediately and make sure the right numbers are on hand and to know them well.

Good. Now we can focus on the intangibles that might not come as naturally to CFOs.

My company brought in a scriptwriter to help craft our words so that they not only conveyed our message but did it in a way that would keep our audience’s attention. Some people don’t realize that the flow is just as important as the numbers and message. Numbers may not always excite everyone. Do what you can to make your presentation interesting and easy to follow. It should help create a better Q&A, or at the very least, an optimally informed group.

The scriptwriter also helped structure our wording from a visual setting. If your slides don’t state key messages, it’s time to revise. If you want a slide to explain how your company’s assets continue to grow, don’t title it “Total Assets.” It should be “Assets Continue to Grow.”

Once we had the right words where they needed to be, we prepped by reading the script over and over. I can’t stress how important it is to read the script to yourself and others out loud, and get as much feedback as you can. You don’t want a bored audience, but even more important, you don’t want a confused one. If you don’t test out the dialogue beforehand, you risking a tricky word choice that could veer your message off course.

Another good way to prepare is to sit in on some other calls. If you’ve risen through the ranks at your company, hopefully you’ve been able to hear how it’s been done in the past. If you don’t have that advantage or are new to the company, review transcripts from past presentations and get feedback from colleagues who were there.

Nuts and Bolts

With the proper flow and word choice, it’s time to prepare for what might happen. With other executives, analysts, investors, and the media all potentially on the call, it’s best to be as prepared for their questions as you are for the rest of your presentation.

The first step is to plan your agenda. How will everything run? Is it going to end with a Q&A portion? Will media be present? Knowing exactly who and what will be on your call is a can’t-miss part of your preparation.

With your message and key details cemented, you can anticipate most of the questions you will be asked. Take proactive steps to rehearse your answers. When asked a question, remember to pause and think, even if you know the answer right away. Going unprepared into a response can result in misspeaking or omitting a key point. Always pause, think, and then speak. Some questions may be tough to answer. Have your colleagues grill you on them.

Expect the Unexpected

Calls, as structured as they may be, don’t have set rules. Anything can happen. Technical glitches (even after checking your systems’ performance) and other slip-ups can happen.

Be sure to find a quiet area to make your call. You don’t want outside noise to become a distracting factor. Inside the room, remind yourself and everyone else to stay on script, because what you say is public record. What might be off the cuff and casual to one person might be a complete lack of decorum to another. Best to play it safe.

In the end, every call will boil down to your preparation. Know the facts. Know what you’ll be saying. And know that while the unexpected can happen, you can control only what’s within your bandwidth.

Best of luck.

This post was originally published on CFO.com

Saratoga Investment Corp. to Host Investor Day on June 1, 2016

NEW YORK, May 2, 2016 – Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced it will host an Investor Day in New York City on Wednesday, June 1, 2016 at 10:00 ET. Management will discuss a range of topics on all aspects of the Company’s financials, operations and investment strategy.

Led by senior management of Saratoga Investment, including Christian L. Oberbeck, Chairman and Chief Executive Officer, Michael J. Grisius, President and Chief Investment Officer, and Henri J. Steenkamp, Chief Financial Officer and Chief Compliance Officer, this forum will provide attendees with a strategic overview and review of the Company. There will also be CEOs of the Company’s portfolio companies in attendance and presenting.

Interested Parties

Individuals interested in attending can contact Adam Prior of The Equity Group Inc. at aprior@equityny.com or by calling (212) 836-9606.

Webcast

The presentation portion of the day will be archived on the Company’s website and available via the “Investor Relations” section of Saratoga’s website at http://saratogainvestmentcorp.com/.

Forward Looking Statements

This press release contains certain forward-looking statements. These forward-looking statements are subject to risks and uncertainties and other factors enumerated in this press release and the filings Saratoga Investment Corp. makes with the SEC. Saratoga Investment Corp. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.