Saratoga Investment Corp. Increases Quarterly Dividend to $0.54 per Share Represents the 18th Sequential Quarterly Dividend Increase

NEW YORK, Feb. 26, 2019 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced that its Board of Directors has declared an increased quarterly dividend of $0.54 per share for the fiscal quarter ended February 28, 2019, payable on March 28, 2019, to all stockholders of record at the close of business on March 14, 2019.

This increase is the eighteenth sequential increase to the Company’s quarterly dividends. Total dividends declared for the fiscal years ended February 28, 2019 and 2018 was $2.10 per share and $1.94 per share, respectively. The Company paid a quarterly dividend of $0.53 per share for the quarter ended November 30, 2018, $0.52 per share for the quarter ended August 31, 2018, and $0.51 per share for the quarter ended May 31, 2018. Throughout fiscal year 2018, the Company paid a quarterly dividend of $0.50 per share for the quarter ended February 28, 2018, $0.49 per share for the quarter ended November 30, 2017, $0.48 per share for the quarter ended August 31, 2017, and $0.47 per share for the quarter ended May 31, 2017.

“The increased size and continued high quality of our asset base over time has enabled us to generate strong investment income and increased net asset value,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “Our ability to increase our dividend payment for more than four straight years sets us strongly apart from our BDC competition and underscores the value of our high quality management team, ample available liquidity, disciplined credit analysis and robust investment sourcing pipeline.”

Strong financial performance has enabled Saratoga Investment to increase regular quarterly dividends each of the past eighteen quarters from $0.18 per share for the third quarter of fiscal 2015 to $0.54 per share for this fourth quarter of fiscal 2019.

Shareholders will have the option to receive payment of the dividend in cash, or receive shares of common stock pursuant to the Company’s dividend reinvestment plan (“DRIP”). Saratoga Investment shareholders who hold their shares with a broker must affirmatively instruct their brokers prior to the record date if they prefer to receive this dividend and future dividends in common stock. The number of shares of common stock to be delivered shall be determined by dividing the total dollar amount by 95% of the average of the market prices per share at the close of trading on the ten (10) trading days immediately preceding (and including) the payment date.

About Saratoga Investment

Saratoga Investment is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment has elected to be regulated as a business development company under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment owns an SBIC-licensed subsidiary and manages a $500 million collateralized loan obligation (“CLO”) fund. It also owns 100% of the Class F-R-2, G-R-2 and subordinated notes of the CLO. The Company’s diverse funding sources, combined with a permanent capital base, enable Saratoga Investment to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains certain forward-looking statements. These forward-looking statements are subject to risks and uncertainties and other factors enumerated in this press release and the filings Saratoga Investment makes with the SEC. Saratoga Investment undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact: Henri Steenkamp

Saratoga Investment Corp.

212-906-7800

Roland Tomforde

Broadgate Consultants

212-232-2222

Saratoga Investment Corp. Announces Offering of Additional 6.25% Notes Due 2025

Jan 31, 2019

NEW YORK, NY, Jan. 31, 2019 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (the “Company”) (NYSE: SAR) announced the commencement of a registered public offering of additional 6.25% Notes due 2025 (the “Notes”). The Notes constitute a further issuance of, rank equally in right of payment with, and form a single series with the $40 million in aggregate principal amount of the 6.25% Notes due 2025 that the Company initially issued on August 28, 2018 (the “Existing Notes”).

The Existing Notes currently trade on the NYSE under the symbol “SAF.” The Company intends to list the additional Notes under the same trading symbol.

Ladenburg Thalmann & Co. Inc., a subsidiary of Ladenburg Thalmann Financial Services Inc. (NYSE American: LTS), and Compass Point Research & Trading, LLC are acting as the joint book-running managers, and BB&T Capital Markets, a division of BB&T Securities, LLC, is acting as lead manager for the offering.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, nor will there be any sale of, the Notes referred to in this press release in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. A registration statement relating to the Notes was filed and has been declared effective by the Securities and Exchange Commission.

This offering is being made solely by means of a written prospectus and related prospectus supplement forming part of the effective registration statement, which may be obtained from Ladenburg Thalmann, Attn: Syndicate Department, 277 Park Avenue, 26th Floor, New York, NY 10172, or by emailing prospectus@ladenburg.com (telephone number 1-800-573-2541) The prospectus and related prospectus supplement contain a description of these matters and other important information about the Company and should be read carefully before investing.

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment Corp.’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment Corp. owns an SBIC-licensed subsidiary and manages a $500 million Collateralized Loan Obligation (CLO) fund. It also owns 100% of the Class F-R-2, G-R-2 and subordinated notes of the CLO. These diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to provide a broad range of financing solutions.

Forward Looking Statements

Statements included herein may contain “forward-looking statements”. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of assumptions, risks and uncertainties, which change over time. Actual results may differ materially from those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by the Company with the Securities and Exchange Commission. Except as required by law, the Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Saratoga Investment Corp. Announces Fiscal Third Quarter 2019 Financial Results

Jan 9, 2019

NEW YORK, Jan. 09, 2019 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2019 fiscal third quarter.

Summary Financial Information

The Company’s summarized financial information is as follows:

“Our third fiscal quarter of 2019 continued the growth of our high quality asset base and sustained industry leadership in key performance metrics,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “This quarter reflects the full impact of July’s $28.75 million equity offering and August’s new $40.0 million baby bonds issuance, all of which was deployed by the end of this quarter. This has contributed to the increased interest income generated this quarter. We also again increased our dividend for the seventeenth consecutive quarter, a $0.01 increase to $0.53 per share, while continuing to over-earn our dividend by 23% as compared to this quarter’s adjusted NII per share. We remain well-structured for rising rates, with 83% of our interest earning investments having floating-rates and through their LIBOR floors, and all of our debt, except for our Madison credit facility, being fixed-rate. And subsequent to quarter-end, we successfully refinanced our CLO and upsized it to $500 million of assets, with a corresponding increase to interest and management fee income.”

Michael J. Grisius, President and Chief Investment Officer, added, “During this fiscal quarter, we were able to originate a healthy $73.7 millionof investments and grow our assets under management by 13%, without sacrificing the strength and the quality of the credits in our portfolio. The fact that we’ve been able to consistently accomplish this underscores the continued growth of our sourcing pipeline, and the strength of our originations team and their investment judgement. We have added eight new portfolio companies since May this year. We remain confident that sticking to our long-term strategy of identifying and underwriting high quality credits will continue to garner positive results.”

As of November 30, 2018, Saratoga Investment increased its assets under management (“AUM”) to $443.8 million, an increase of 13.0% from $392.9 million as of August 31, 2018, and an increase of 31.0% from $338.8 million as of November 30, 2017. The increase this quarter reflects originations of $73.7 million, offset by amortizations and repayments of $23.4 million. Saratoga Investment’s portfolio has grown this quarter and credit quality remains strong, with a continued high level of investment quality in loan investments, with 98.6% of the loans this quarter at Saratoga Investment’s highest internal rating. Included in this quarter’s originations is also an investment in one new portfolio company. Since Saratoga management has taken over the management of the BDC, $299.1 million of repayments and sales of investments originated by Saratoga have generated a gross unlevered IRR of 13.4%.

For the three months ended November 30, 2018, total investment income of $12.8 million increased $3.3 million, or 34.7%, compared to $9.5 million for the three months ended November 30, 2017. This increased investment income was generated from an investment base that has grown by 31.0% since last year. The weighted average current coupon on all investments decreased slightly to 10.8%, primarily due to an increase in equity positions on which there is generally no interest income, which increased to 8.7% of the total portfolio from 8.4% last year. In addition, this quarter’s investment income was up 12.5% on a quarter-over-quarter basis from $11.4 million for the quarter ended August 31, 2018.

As compared to the three months ended November 30, 2017, the investment income increase was offset by (i) increased debt and financing expenses, as the growth in AUM this year was partially financed from increased SBA debentures and the recently issued $40.0 million baby bond issuance, and (ii) increased base management fees generated from the management of this larger pool of investments.

Net investment income on a weighted average per share basis was $0.69 for the quarter ended November 30, 2018. Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income on a weighted average per share basis was $0.65. This compares to adjusted net investment income per share of $0.69 for the quarter ended August 31, 2018 and $0.54 for the quarter ended November 30, 2017, reflecting a quarter-on-quarter decrease of $0.04 and a year-on-year increase of $0.11.

Net investment income yield as a percentage of average net asset value (“Net Investment Income Yield”) was 11.9% for the quarter ended November 30, 2018. Adjusted for the incentive fee accrual related to net unrealized capital gains, the Net Investment Income Yield was 11.2%. In comparison, adjusted Net Investment Income Yield was 11.9% and 9.6% for the quarters ended August 31, 2018 and November 30, 2017, respectively.

Net Asset Value (“NAV”) was $173.3 million as of November 30, 2018, an increase of $29.6 million from $143.7 million as of February 28, 2018, and an increase of $34.5 million from $138.8 million as of November 30, 2017.

- For the nine months ended November 30, 2018, $14.2 million of net investment income and $0.1 million of net realized gains were earned, offset by $1.2 million of deferred tax expense on net unrealized gains in Saratoga Investment’s blocker subsidiaries, $2.5 million net unrealized depreciation on investments and $10.2 million of dividends declared. In addition, $27.6 million of common stock was issued, net of offering costs, and $1.6 million of stock dividend distributions were made through the Company’s dividend reinvestment plan (“DRIP”). 10,373 shares were sold through the Company’s At-the-Market (“ATM”) equity program during the year.

NAV per share was $23.13 as of November 30, 2018, compared to $23.16 as of August 31, 2018, $22.96 as of February 28, 2018 and $22.58 as of November 30, 2017.

- For the nine months ended November 30, 2018, NAV per share increased by $0.17 per share, primarily reflecting (i) the $0.12 accretive impact of the last nine months 1,233,154 share issuances, including the equity offering, the ATM and the DRIP, and (ii) the $0.4 million, or $0.05 per share increase in net assets resulting from operations (net of the $1.53 dividend paid during the nine months of fiscal 2019).

Return on equity for the last twelve months ended November 30, 2018 was 10.1%, compared to 10.2% for the comparable period last year.

Earnings per share for the quarter ended November 30, 2018 was $0.49, compared to earnings per share of $0.45 for the quarter ended August 31, 2018 and $0.71 for the quarter ended November 30, 2017.

Investment portfolio activity for the quarter ended November 30, 2018:

- Cost of investments made during the period: $73.7 million

- Principal repayments and amortizations during the period: $23.4 million

Additional Financial Information

For the fiscal quarter ended November 30, 2018, Saratoga Investment reported net investment income of $5.1 million, or $0.69 on a weighted average per share basis, and a net realized and unrealized loss on investments of $1.5 million, or $0.20 on a weighted average per share basis, resulting in a net increase in net assets from operations of $3.7 million, or $0.49 on a weighted average per share basis. The $1.5 million net loss on investments was comprised of $1.0 million in net unrealized depreciation on investments, $0.4 million of net deferred tax expense on unrealized gains in Saratoga Investment’s blocker subsidiaries, and $0.07 million in net realized loss from investments. The $1.0 millionunrealized depreciation is primarily due to (i) $1.6 million of unrealized depreciation on Saratoga Investment’s CLO equity investment, mostly reflecting the transaction fees of the refinancing and upsizing post quarter-end , (ii) $0.4 million unrealized depreciation on the Company’s Roscoe Medical investment, and (iii) $0.7 million unrealized depreciation on the Company’s Health Media Network investment, reflecting a partial reduction of previously recognized unrealized gains to reflect the value that has actually been realized subsequent to quarter-end. These depreciations were offset by $1.2 million unrealized appreciation on the Company’s Easy Ice investment, most notably the participating preferred equity, and $0.7 million unrealized appreciation on the Company’s Netreo Holdings investment. This compared to the fiscal quarter ended November 30, 2017 with net investment income of $3.0 million, or $0.50 on a weighted average per share basis, and a net realized and unrealized gain on investments of $1.2 million, or $0.21 on a weighted average per share basis, resulting in a net increase in net assets from operations of $4.3 million, or $0.71 on a weighted average per share basis. The $1.2 million net gain on investments consisted of $1.2 million in net unrealized appreciation on investments and $0.02 million in net realized gain.

Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income was $4.8 million and $3.3 million for the quarters ended November 30, 2018 and November 30, 2017, respectively – an increase of $1.5 million year-over-year, or 49.0%.

Total expenses, excluding interest and debt financing expenses, base management fees and incentive management fees, increased from $1.2 million for the quarter ended November 30, 2017 to $1.3 million for the quarter ended November 30, 2018, decreasing from 1.4% to 1.2% of average total assets.

Portfolio and Investment Activity

As of November 30, 2018, the fair value of Saratoga Investment’s portfolio was $443.8 million (excluding $4.2 million in cash and cash equivalents), principally invested in 36 portfolio companies and one collateralized loan obligation fund (“CLO”). The overall portfolio composition consisted of 53.6% of first lien term loans, 29.2% of second lien term loans, 5.0% of unsecured term loans, 3.5% of subordinated notes in a CLO, and 8.7% of common equity.

For the fiscal quarter ended November 30, 2018, Saratoga Investment invested $73.7 million in new or existing portfolio companies and had $23.4 million in aggregate amount of exits and repayments, resulting in net investment of $50.4 million for the quarter.

As of November 30, 2018, the weighted average current yield on Saratoga Investment’s portfolio for the twelve months ended was 10.8%, which was comprised of a weighted average current yield of 11.2% on first lien term loans, 12.1% on second lien term loans, 10.1% on unsecured term loans, 13.3% on CLO subordinated notes, and 3.4% on equity interests.

As of November 30, 82.6% of Saratoga Investment’s interest earning portfolio is in floating rate debt, with many of these investments having floors. For all of these investments, the relevant 1-month or 3-month LIBOR rate is currently above the floors. Pursuant to the disclosure included in Item 3 of Saratoga Investment’s Form 10-Q for the quarter ended November 30, 2018, assuming that the investments as of November 30, 2018 were to remain constant for a full fiscal year and no actions were taken to alter the existing interest rate terms, a hypothetical change of 1.0% in interest rates would cause a corresponding increase of approximately $3.3 million to interest income over twelve months.

Liquidity and Capital Resources

As of November 30, 2018, Saratoga Investment had $11.8 million in outstanding borrowings under its $45 million senior secured revolving credit facility with Madison Capital Funding LLC. At the same time, Saratoga Investment had $150.0 million SBA debentures outstanding, $114.5 million of baby bonds (fair value of $116.7 million) issued and an aggregate of $4.2 million in cash and cash equivalents.

With $33.2 million available under the credit facility and the $4.2 million of cash and cash equivalents, Saratoga Investment has a total of $37.4 million of undrawn borrowing capacity and cash and cash equivalents available as of November 30, 2018. The proceeds from the ATM and DRIP programs totaled $0.8 million of equity investments in the third fiscal quarter of 2019. Saratoga Investment also has the ability to issue additional equity or baby bonds through the existing shelf registration statement.

On September 27, 2018, the SBA issued a “green light” letter inviting us to file a formal license application for a second SBIC license. If approved, the additional SBIC license would provide the Company with an incremental source of long-term capital by permitting us to issue, subject to SBA approval, up to $175.0 million of additional SBA-guaranteed debentures in addition to the $150.0 million already approved under the Company’s first license. Receipt of a green light letter from the SBA does not assure an applicant that the SBA will ultimately issue an SBIC license and the Company has received no assurance or indication from the SBA that it will receive an additional SBIC license, or of the timeframe in which it would receive an additional license, should one ultimately be granted.

On March 16, 2017, Saratoga Investment entered into an equity distribution agreement with Ladenburg Thalmann & Co. Inc. and B. Riley FBR, Inc., through which Saratoga may offer for sale, from time to time, up to $30.0 million of its common stock through an ATM offering. As of November 30, 2018, the Company sold 358,496 shares for gross proceeds of $8.1 million at an average price of $22.54 for aggregate net proceeds of $8.0 million (net of transaction costs).

On December 3, 2018, the Company completed the third refinancing of the Saratoga CLO. This refinancing, among other things, extended its reinvestment period to January 2021, and extended its legal maturity to January 2030. A non-call period of January 2020 was also added. In addition and as part of the refinancing, the CLO has also been upsized to approximately $500 million from its prior $300 million in assets. As part of this refinancing and upsizing, the Company invested an additional $13.8 million in all of the newly issued subordinated notes of the CLO, as well as also purchased $2.5 million in aggregate principal amount of the Class F notes tranche and $7.5 million in aggregate principal amount of the Class G notes at par. Concurrently, the existing $4.5 million of Class F notes and $20.0 million CLO 2013-1 Warehouse Loan was repaid.

Dividend

On November 27, 2018, Saratoga Investment announced a dividend of $0.53 per share for the fiscal quarter ended November 30, 2018, payable on January 2, 2019, to all stockholders of record at the close of business on December 17, 2018. Since the end of fiscal year 2018, Saratoga Investment has paid three dividends, $0.52 per share for the quarter ended August 31, 2018, $0.51 per share for the quarter ended May 31, 2018 and $0.50 per share for the quarter ended February 28, 2018.

During fiscal year 2018, Saratoga Investment declared and paid dividends of $1.90 per share, composed of $0.46 for the quarter ended February 28, 2017, $0.47 per share for the quarter ended May 31, 2017, $0.48 per share for the quarter ended August 31, 2017, and $0.49 per share for the quarter ended November 30, 2017.

Shareholders have the option to receive payment of the dividend in cash, or receive shares of common stock, pursuant to the Company’s DRIP.

Share Repurchase Plan

In fiscal year 2015, the Company announced the approval of an open market share repurchase plan that allows it to repurchase up to 200,000 shares of its common stock at prices below its NAV as reported in its then most recently published financial statements. During fiscal year 2017, the share repurchase plan was increased to 600,000 shares of common stock, and during both fiscal years 2018 and 2019, this share repurchase plan was extended for another year, most recently through January 2020, at the same level of approval. As of November 30, 2018, Saratoga purchased 218,491 shares of common stock, at the average price of $16.84 for approximately $3.7 million pursuant to this repurchase plan.

2019 Fiscal Third Quarter Conference Call/Webcast Information

| When: | Thursday, January 10, 2019, 10:00 a.m. Eastern Time (ET) |

| Call: | Interested parties may participate by dialing (877) 312-9208 (U.S. and Canada) or (678) 224-7872 (outside U.S. and Canada). |

A replay of the call will be available from 1:00 p.m. ET on Thursday, January 10, 2019 through 1:00 p.m. ET on Thursday, January 17, 2019 by dialing (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (outside U.S. and Canada), passcode for both replay numbers: 7596939.

| Webcast: | Interested parties may access a simultaneous webcast of the call and find the Q3 2019 presentation by going to the “Events & Presentations” section of Saratoga Investment Corp.’s investor relations website, http://ir.saratogainvestmentcorp.com/events-presentations |

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment Corp.’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment Corp. owns an SBIC-licensed subsidiary and manages a $500 million Collateralized Loan Obligation (CLO) fund. It also owns 100% of the Class F-R-2, G-R-2 and subordinated notes of the CLO. These diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains certain forward-looking statements. These forward-looking statements are subject to risks and uncertainties and other factors enumerated in this press release and the filings Saratoga Investment Corp. makes with the SEC. Saratoga Investment Corp. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Financials

Saratoga Investment Corp.

Consolidated Statements of Assets and Liabilities

Saratoga Investment Corp.

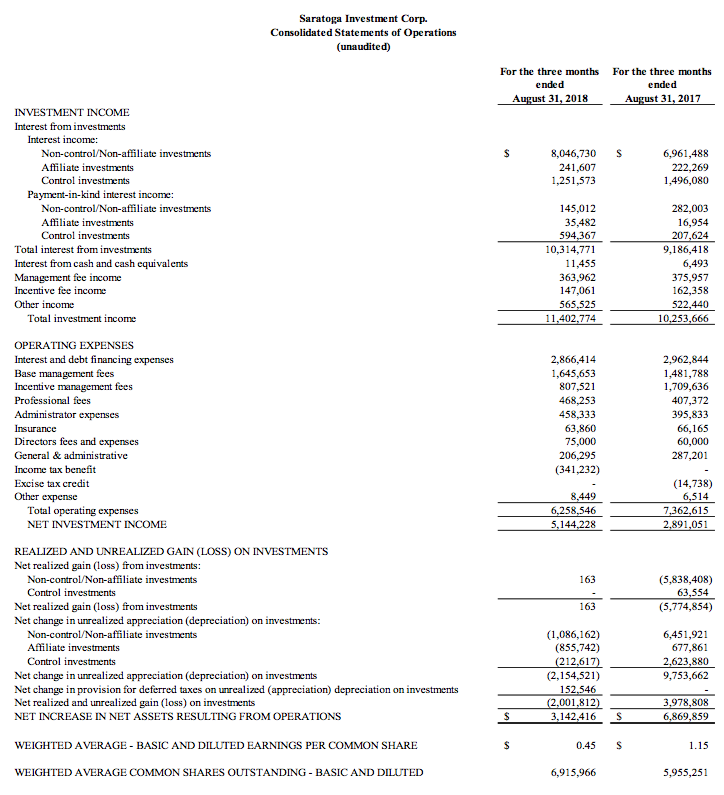

Consolidated Statements of Operations

(unaudited)

Saratoga Investment Corp.

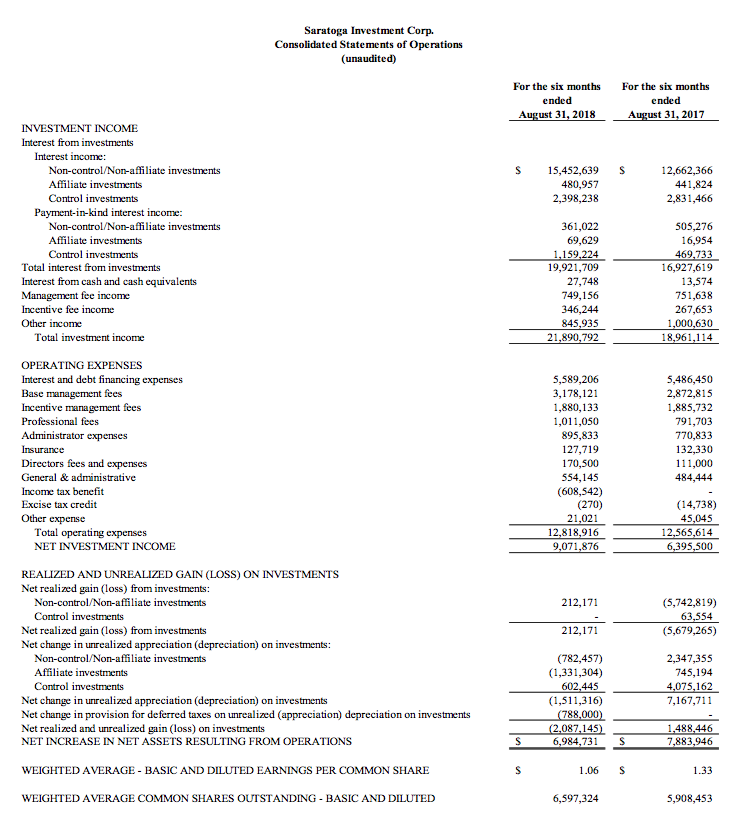

Consolidated Statements of Operations

(unaudited)

Supplemental Information Regarding Adjusted Net Investment Income, Adjusted Net Investment Income Yield and Adjusted Net Investment Income per share

On a supplemental basis, Saratoga Investment provides information relating to adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share, which are non-GAAP measures. These measures are provided in addition to, but not as a substitute for, net investment income, net investment income yield and net investment income per share. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or reversal attributable to unrealized gains. The management agreement with our advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year. In addition, Saratoga Investment accrues, but do not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. As such, Saratoga Investment believes that adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share is a useful indicator of operations exclusive of any capital gains incentive fee expense or reversal attributable to unrealized gains. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income, net investment income yield to adjusted net investment income yield and net investment income per share to adjusted net investment income per share for the three and nine months ended November 30, 2018 and November 30, 2017.

- Adjusted net investment income yield is calculated as adjusted net investment income divided by average net asset value.

- Adjusted net investment income per share is calculated as adjusted net investment income divided by weighted average common shares outstanding.

Contact: Henri Steenkamp

Saratoga Investment Corp.

212-906-7800

Roland Tomforde

Broadgate Consultants

212-232-2222

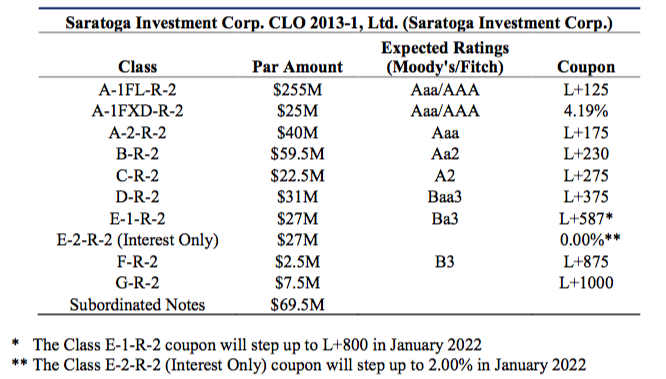

Saratoga Investment Corp. Resets its Existing CLO Upsized to $500 million

NEW YORK, December 3, 2018 – Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced pricing of its reset of the existing Saratoga Investment Corp. CLO 2013-1, Ltd. (“Saratoga CLO”). In addition and as part of the reset, the Saratoga CLO has also been upsized to approximately $500 million from its prior $300 million in assets.

The transaction is structured as follows:

The non-call period expires on January 20, 2020, the reinvestment period expires on January 20, 2021, and the legal final date is January 20, 2030.

The anticipated closing date is December 14, 2018.

Saratoga Investment will own 100% of the F-R-2, G-R-2 and Subordinated Notes on the closing date.

The Notes have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

About Saratoga Investment

Saratoga Investment is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment has elected to be regulated as a business development company under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC- registered investment advisor focusing on private credit and equity-driven strategies. Saratoga Investment owns an SBIC-licensed subsidiary and manages the Saratoga CLO. It also owns 100% of the Class F-R and Subordinated Notes of the existing Saratoga CLO, and will own 100% of the Class F-R-2, G-R-2 and Subordinated Notes of the Saratoga CLO upsized to $500 million on the closing date. The Company’s diverse funding sources, combined with a permanent capital base, enable Saratoga Investment to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains certain forward-looking statements. These forward-looking statements are subject to risks and uncertainties and other factors enumerated in this press release and the filings Saratoga Investment makes with the SEC. Saratoga Investment undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SBIA Presents Congresswoman Grace Meng (D-NY) with Champion of Small Business Investing Award

WASHINGTON, D.C. (October 24, 2018) – On Tuesday, the Small Business Investor Alliance (SBIA), the leading association of lower middle market private equity funds and investors, recognized Congresswoman Grace Meng (D-NY) for her support of small business investment and presented her with SBIA’s Champion of Small Business Investing Award. Rep. Meng is among a group of select Members of Congress whom SBIA is honoring in recognition of their support for small business access to capital.

“Congresswoman Meng has been an incredible advocate for investment in America’s small businesses through her support of the Small Business Investment Company (SBIC) program,” said SBIA President Brett Palmer. “Small business investors empower growth and job creation across the country, and the legislative work of our Small Business Champions in Congress has been instrumental to facilitating greater capital access for America’s entrepreneurs.”

Presenting the Champion of Small Business Investing Award to Rep. Meng was SBIA member Mr. Henri Steenkamp of New York-based Saratoga Investment Corp.

SBICs provide critical growth capital to American small businesses to help them expand their operations and create jobs; they have invested more than $3.6 billion in New York businesses over the past 10 years.

###

About the Small Business Investor Alliance (SBIA)

The Small Business Investor Alliance (SBIA) is the premier organization of lower middle market private equity funds and investors. SBIA works on behalf of its members as a tireless advocate for policies that promote competitive markets and robust domestic investment for growing small businesses. SBIA has been playing a pivotal role in promoting the growth and vitality of the private equity industry for over 50 years. For more information, visitwww.SBIA.org or call 202-628-5055.

Saratoga Investment Corp. Announces Fiscal Second Quarter 2019 Financial Results

NEW YORK, October 10, 2018 – Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2019 fiscal second quarter.

Summary Financial Information

The Company’s summarized financial information is as follows:

“Our second fiscal quarter of 2019 has been a very important one for us with many important accomplishments, including continued growth of our high quality asset base, sustained industry leadership in performance metrics and a material expansion of our long-term capital structure,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “This quarter we successfully raised $40.0 million of new seven-year fixed rate notes under the ticker symbol “SAF”, and issued $28.75 million of new equity at a premium to NAV – this equity raise helped increase our total NAV to $172.7 million, and importantly also increased our share float by 1.15 million shares. In addition, we recently received a “green light” letter from the SBA for a second SBIC license. And last month we also increased our dividend for the sixteenth consecutive quarter, a $0.01 increase to $0.52 per share. Importantly, we continue to out-earn our dividend payments on a fully diluted basis factoring in the equity raise. In the current rising rate environment, we believe we are well-structured, with 82% of our interest earning investments having floating-rate interest rates and through their LIBOR floors, and all of our debt at quarter-end being fixed-rate.”

Michael J. Grisius, President and Chief Investment Officer, added, “This fiscal quarter has again demonstrated our long-term strategy to grow assets without sacrificing the quality of our investment portfolio, something we were able to accomplish this quarter with significant success. Our asset base grew by 14% since last quarter, while our credit quality remained strong at our highest levels. The asset growth also came not only in the form of follow-ons, but with investments in new platforms, with another four new portfolio companies added this quarter, bringing the total to seven since May this year. We remain confident that sticking to our long- term strategy of identifying and underwriting high quality credits will continue to garner positive results.”

As of August 31, 2018, Saratoga Investment increased its assets under management (“AUM”) to $392.9 million, an increase of 14.4% from $343.4 million as of May 31, 2018, and an increase of 18.0% from $333.0 million as of August 31, 2017. The increase this quarter reflects originations of $51.7 million, offset by amortizations of $1.0 million. Including realized and unrealized gains, Saratoga Investment’s portfolio has grown this quarter and credit quality remains strong, with a continued high level of investment quality in loan investments, with 99.4% of our loans this quarter at our highest internal rating. Included in this quarter’s originations are also four investments in new portfolio companies. Since Saratoga management has taken over the management of the BDC, $299.1 million of repayments and sales of investments originated by Saratoga have generated a gross unlevered IRR of 13.4%.

For the three months ended August 31, 2018, total investment income of $11.4 million increased $1.1 million, or 11.2%, compared to $10.3 million for the three months ended August 31, 2017. This increased investment income was generated from an investment base that has grown by 18.0% since last year. The weighted average current coupon on all investments dropped slightly to 10.8%, primarily due to an increase in equity positions on which there is generally no interest income to 9.1% from 8.2% last year. In addition, this quarter’s investment income was up 8.7% on a quarter-over-quarter basis from $10.5 million for the quarter ended May 31, 2018.

As compared to the three months ended August 31, 2017, in addition to the investment income increase of $1.1 million, there was also (i) decreased debt and financing expenses, as the growth in AUM last year was financed primarily by the revolving credit facility, while this year’s growth came from lower-cost SBA debentures and the recent equity raise, and (ii) decreased total expenses, excluding interest and debt financing expenses, base management fees and incentive fees, reflecting primarily the deferred income tax benefit generated by equity investments held in taxable blockers generating net operating losses. These benefits were offset by increased base management fees generated from the management of this larger pool of investments.

Net investment income on a weighted average per share basis was $0.74 for the quarter ended August 31, 2018. Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income on a weighted average per share basis was $0.69. This compares to adjusted net investment income per share of $0.64 for the quarter ended May 31, 2018 and $0.62 for the quarter ended August 31, 2017, reflecting increases of $0.05 and $0.07, respectively.

Net investment income yield as a percentage of average net asset value (“Net Investment Income Yield”) was 12.9% for the quarter ended August 31, 2018. Adjusted for the incentive fee accrual related to net unrealized capital gains, the Net Investment Income Yield was 11.9%. In comparison, adjusted Net Investment Income Yield was 11.1% and 11.3% for the quarters ended May 31, 2018 and August 31, 2017, respectively.

Net Asset Value (“NAV”) was $172.7 million as of August 31, 2018, an increase of $29.0 million from $143.7 million as of February 28, 2018, and an increase of $39.2 million from $133.5 million as of August 31, 2017.

- For the six months ended August 31, 2018, $9.1 million of net investment income and $0.2 million of net realized gains were earned, partially offset by $0.8 million of deferred tax expense on net unrealized gains in Saratoga Investment’s blocker subsidiaries, $1.5 million net unrealized depreciation on investments and $6.3 million of dividends declared. In addition, $27.4 million of common stock was issued, net of offering costs, and $1.0 million of stock dividend distributions were made through the Company’s dividend reinvestment plan (“DRIP”). No shares were sold through the Company’s At- the-Market (“ATM”) equity offering during the year.

NAV per share was $23.16 as of May 31, 2018, compared to $22.96 as of February 28, 2018 and $22.37 as of August 31, 2017.

- For the six months ended August 31, 2018, NAV per share increased by $0.20 per share, primarily reflecting (i) the $0.11 accretive impact of the last six months 1,196,998 share issuances, including both the equity offering and the DRIP, and (ii) the $0.7 million, or $0.09 per share increase in net assets resulting from operations (net of the $1.01 dividend paid during the first half of FY2019).

Return on equity for the last twelve months ended August 31, 2018 was 11.6%, compared to 8.3% for the comparable period last year.

Earnings per share for the quarter ended August 31, 2018 was $0.45, compared to earnings per share of $0.61 for the quarter ended May 31, 2018 and $1.15 for the quarter ended August 31, 2017.

Investment portfolio activity for the quarter ended August 31, 2018:

- Cost of investments made during the period: $51.7 million, including investments in four new portfolio companies

- Principal repayments during the period: $1.0 million

Additional Financial Information

For the fiscal quarter ended August 31, 2018, Saratoga Investment reported net investment income of $5.1 million, or $0.74 on a weighted average per share basis, and a net realized and unrealized loss on investments of $2.0 million, or $0.29 on a weighted average per share basis, resulting in a net increase in net assets from operations of $3.1 million, or $0.45 on a weighted average per share basis. The $2.0 million net loss on investments was comprised of $2.2 million in net unrealized depreciation on investments, offset by $0.2 million of net deferred tax benefit on unrealized losses in Saratoga Investment’s blocker subsidiaries. The $2.2 million unrealized depreciation is primarily due to $0.8 million unrealized depreciation on Saratoga Investment’s My Alarm Center investment, primarily the preferred equity Class B units, $0.9 million unrealized depreciation on Saratoga Investment’s Elyria Foundry investment and $0.4 million unrealized depreciation on Saratoga Investment’s Tile Redi Holdings investment. This compared to the fiscal quarter ended August 31, 2017 with net investment income of $2.9 million, or $0.49 on a weighted average per share basis, and a net realized and unrealized gain on investments of $4.0 million, or $0.67 on a weighted average per share basis, resulting in a net increase in net assets from operations of $6.9 million, or $1.15 on a weighted average per share basis. The $4.0 million net gain on investments consisted of $9.7 million in net unrealized appreciation on investments, offset by $5.8 million in net realized loss.

Adjusted for the incentive fee accrual related to net unrealized capital gains, the net investment income was $4.8 million and $3.7 million for the quarters ended August 31, 2018 and August 31, 2017, respectively – an increase of $1.1 million year-over-year, or 29.4%.

Total expenses, excluding interest and debt financing expenses, base management fees and incentive management fees, decreased from $1.2 million for the quarter ended August 31, 2017 to $0.9 million for the quarter ended August 31, 2018, decreasing from 1.4% to 0.9% of average total assets. The primary reason for the decrease was the recognition of a $0.3 million deferred income tax benefit generated by equity investments held in taxable blockers generating net operating losses.

Portfolio and Investment Activity

As of August 31, 2018, the fair value of Saratoga Investment’s portfolio was $392.9 million (excluding $43.3 million in cash and cash equivalents), principally invested in 35 portfolio companies and one collateralized loan obligation fund (“CLO”). The overall portfolio composition consisted of 58.0% of first lien term loans, 25.5% of second lien term loans, 3.1% of unsecured term loans, 4.3% of subordinated notes in a CLO, and 9.1% of common equity.

For the fiscal quarter ended August 31, 2018, Saratoga Investment invested $51.7 million in new or existing portfolio companies and had $1.0 million in aggregate amount of exits and repayments, resulting in net investment of $50.7 million for the quarter.

As of August 31, 2018, the weighted average current yield on Saratoga Investment’s portfolio for the twelve months ended was 10.8%, which was comprised of a weighted average current yield of 11.0% on first lien term loans, 12.0% on second lien term loans, 9.6% on unsecured term loans, 17.6% on CLO subordinated notes, and 3.1% on equity interests.

As of August 31, 2018, 81.5% of Saratoga Investment’s interest earning portfolio is in floating rate debt, with many of these investments having floors. For all of these investments, the relevant 1-month or 3-month LIBOR rate is currently above the floors. Pursuant to the disclosure included in Item 3 of Saratoga Investment’s Form 10-Q for the quarter ended August 31, 2018, assuming that the investments as of August 31, 2018 were to remain constant for a full fiscal year and no actions were taken to alter the existing interest rate terms, a hypothetical change of 1.0% in interest rates would cause a corresponding increase of approximately $2.8 million to interest income over twelve months.

Liquidity and Capital Resources

As of August 31, 2018, Saratoga Investment had no outstanding borrowings under its $45 million senior secured revolving credit facility with Madison Capital Funding LLC. At the same time, Saratoga Investment had $150.0 million SBA debentures outstanding, $114.5 million of baby bonds (fair value of $118.2 million) issued and an aggregate of $43.3 million in cash and cash equivalents.

With $45.0 million available under the credit facility and the $43.3 million of cash and cash equivalents, Saratoga Investment has a total of $88.3 million of undrawn borrowing capacity and cash and cash equivalents available as of August 31, 2018. The proceeds from the DRIP program totaled $0.5 million of equity investments in the second fiscal quarter of 2019. Saratoga Investment also has the ability to issue additional equity or baby bonds through the existing shelf registration statement.

On July 13, 2018, Saratoga Investment issued 1,150,000 shares of its common stock priced at $25.00 per share (par value $0.001 per share) for an aggregate total of $28.75 million. The net proceeds, after deducting underwriting commissions of $1.15 million and offering costs of approximately $0.2 million, amounted to approximately $27.4 million. The Company also granted the underwriters a 30-day option to purchase up to an additional 172,500 shares of its common stock, which was not exercised.

On August 28, 2018, Saratoga Investment issued $40.0 million in aggregate principal amount of 6.25% fixed-rate notes due 2025 (the “2025 Notes”) for net proceeds of $38.7 million after deducting underwriting commissions of approximately $1.25 million and offering costs of approximately $0.2 million. The issuance included the full exercise of the underwriters’ option to purchase an additional $5.0 million aggregate principal amount of 2025 Notes within 30 days. Interest on the 2025 Notes is paid quarterly in arrears on February 28, May 31, August 31 and November 30, at a rate of 6.25% per year, beginning November 30, 2018. The 2025 Notes mature on August 31, 2025 and commencing August 28, 2021, may be redeemed in whole or in part at any time or from time to time at our option. The 2025 Notes are listed on the NYSE under the trading symbol “SAF” with a par value of $25.00 per share.

On September 27, 2018, the SBA issued a “green light” letter inviting us to file a formal license application for a second SBIC license. If approved, the additional SBIC license would provide the Company with an incremental source of long-term capital by permitting us to issue, subject to SBA approval, up to $175.0 million of additional SBA-guaranteed debentures in addition to the $150.0 million already approved under the Company’s first license. Receipt of a green light letter from the SBA does not assure an applicant that the SBA will ultimately issue an SBIC license and the Company has received no assurance or indication from the SBA that it will receive an additional SBIC license, or of the timeframe in which it would receive an additional license, should one ultimately be granted.

On March 16, 2017, Saratoga Investment entered into an equity distribution agreement with Ladenburg Thalmann & Co. Inc., through which Saratoga may offer for sale, from time to time, up to $30.0 million of its common stock through an ATM offering. No shares were sold during the quarter under the ATM.

Dividend

On August 28, 2018, Saratoga Investment announced a dividend of $0.52 per share for the fiscal quarter ended August 31, 2018, payable on September 27, 2018, to all stockholders of record at the close of business on September 17, 2018. Since the end of fiscal year 2018, Saratoga Investment has paid two dividends, $0.51 per share for the quarter ended May 31, 2018 and $0.50 per share for the quarter ended February 28, 2018.

During fiscal year 2018, Saratoga Investment declared and paid dividends of $1.90 per share, composed of $0.46 for the quarter ended February 28, 2017, $0.47 per share for the quarter ended May 31, 2017, $0.48 per share for the quarter ended August 31, 2017, and $0.49 per share for the quarter ended November 30, 2017.

Shareholders have the option to receive payment of the dividend in cash, or receive shares of common stock, pursuant to the Company’s DRIP.

2019 Fiscal Second Quarter Conference Call/Webcast Information

When: Thursday, October 11, 2018, 10:00 a.m. Eastern Time (ET)

Call: Interested parties may participate by dialing (877) 312-9208 (U.S. and Canada) or (678) 224-7872 (outside U.S. and Canada).

A replay of the call will be available from 1:00 p.m. ET on Thursday, October 11, 2018 through 1:00 p.m. ET on Thursday, October 18, 2018 by dialing (855) 859-2056 (U.S. and Canada) or (404) 537-3406 (outside U.S. and Canada), passcode for both replay numbers: 4889246.

Webcast: Interested parties may access a simultaneous webcast of the call and find the Q2 2019 presentation by going to the “Events & Presentations” section of Saratoga Investment Corp.’s investor relations website, http://www.saratogainvestmentcorp.com/investor.html

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans, mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment Corp.’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit- driven strategies. Saratoga Investment Corp. owns an SBIC-licensed subsidiary and manages a $300 million Collateralized Loan Obligation (CLO) fund. It also owns 100% of the subordinated notes of the CLO. These diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to provide a broad range of financing solutions.

Forward Looking Statements

This press release contains certain forward-looking statements.These forward-looking statements are subject to risks and uncertainties and other factors enumerated in this press release and the filings Saratoga Investment Corp. makes with the SEC. Saratoga Investment  Corp. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Financials

Supplemental Information Regarding Adjusted Net Investment Income, Adjusted Net Investment Income Yield and Adjusted Net Investment Income per share

On a supplemental basis, Saratoga Investment provides information relating to adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share, which are non-GAAP measures. These measures are provided in addition to, but not as a substitute for, net investment income, net investment income yield and net investment income per share. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or reversal attributable to unrealized gains. The management agreement with our advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year. In addition, Saratoga Investment accrues, but do not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. As such, Saratoga Investment believes that adjusted net investment income, adjusted net investment income yield and adjusted net investment income per share is a useful indicator of operations exclusive of any capital gains incentive fee expense or reversal attributable to unrealized gains. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income, net investment income yield to adjusted net investment income yield and net investment income per share to adjusted net investment income per share for the three and six months ended August 31, 2018 and August 31, 2017.

(1) Adjusted net investment income yield is calculated as adjusted net investment income divided by average net asset value.

(2) Adjusted net investment income per share is calculated as adjusted net investment income divided by weighted average common shares outstanding.

Saratoga Investment Corp. Prices Public Offering of $35 Million 6.25% Notes Due 2025

NEW YORK, Aug. 21, 2018 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (the “Company”) (NYSE: SAR) today announced that it has priced an underwritten public offering of $35 million in aggregate principal amount of 6.25% unsecured notes due 2025 (the “Notes”). The Notes will mature on August 31, 2025, and may be redeemed in whole or in part at any time or from time to time at Saratoga Investment Corp.’s option on or after August 31, 2021. The notes will bear interest at a rate of 6.25% per year payable quarterly on February 28, May 31, August 31 and November 30 of each year, beginning November 30, 2018.

The offering is expected to close on August 28, 2018, subject to customary closing conditions. The Company has granted the underwriters an option to purchase up to an additional $5 million in aggregate principal amount of Notes. The Notes are expected to be listed on the New York Stock Exchange and to trade thereon within 30 days of the original issue date under the trading symbol “SAF”.

The Company has received an investment grade private rating of “BBB” from Egan-Jones Ratings Company, an independent, unaffiliated rating agency.

Egan-Jones is a Nationally Recognized Statistical Ratings Organization (NRSRO) and is recognized by the National Association of Insurance Commissioners (NAIC) as a Credit Rating Provider (CRP). Egan-Jones is also certified by the European Securities and Markets Authority (ESMA).

Ladenburg Thalmann & Co. Inc., a subsidiary of Ladenburg Thalmann Financial Services Inc. (NYSE American: LTS), BB&T Capital Markets, a division of BB&T Securities, LLC, and Janney Montgomery Scott LLC are acting as the joint book-running managers, B. Riley FBR, Inc., Compass Point, National Securities Corporation, a wholly owned subsidiary of National Holdings, Inc. (NASDAQ:NHLD) and William Blair are acting as joint lead managers and Maxim Group LLC is acting as the co-manager for the offering.

The Company expects to use the net proceeds from this offering to make investments in middle-market companies in accordance with the Company’s investment objective and strategies and for general corporate purposes.

Investors are advised to consider carefully the investment objective, risks and charges and expenses of the Company before investing.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, nor will there be any sale of, the Notes referred to in this press release in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. A registration statement relating to the Notes was filed and has been declared effective by the Securities and Exchange Commission.

This offering is being made solely by means of a written prospectus forming part of the effective registration statement, which may be obtained for free by visiting the Securities and Exchange Commission’s website at www.sec.gov or from of any of the following investment banks: Ladenburg Thalmann, Attn: Syndicate Department, 277 Park Avenue, 26th Floor, New York, NY 10172, or by emailing prospectus@ladenburg.com (telephone number 1-800-573-2541); BB&T Capital Markets at 901 East Byrd Street, 3rd Floor, Richmond, VA 23219 Attn: Syndicate Dept. or via email request: prospectusrequests@bbandtcm.com; Janney Montgomery Scott LLC, Attn: Syndicate Department, 1717 Arch Street, Philadelphia, PA 19103, or by emailing prospectus@janney.com; B. Riley FBR, Inc., 1300 North 17th Street, Suite 1400, Arlington, VA 22209 or via email request at prospectuses@brileyfbr.com; Compass Point Research & Trading, LLC 1055 Thomas Jefferson Street NW, Suite 303 Washington, D.C. 20007, or email at syndicate@compasspointllc.com; William Blair & Company, L.L.C., Attention: Prospectus Department, 150 North Riverside Plaza, Chicago IL 60606, or by telephone at 1-800-621-0687 or email at prospectus@williamblair.com; Maxim Group LLC at 405 Lexington Avenue, New York, NY 10174, Attention Syndicate Department, or via email at syndicate@maximgrp.com or telephone at (212) 895-3745. The prospectus contains a description of these matters and other important information about the Company and should be read carefully before investing.

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that invests primarily in leveraged loans and mezzanine debt issued by privately owned U.S. middle-market businesses, which the Company defines as companies having annual EBITDA (earnings before interest, taxes, depreciation and amortization) of between $2 million and $50 million, both through direct lending and through participation in loan syndicates. Saratoga Investment Corp.’s objective is to generate current income and, to a lesser extent, capital appreciation from our investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, a New York-based investment firm affiliated with Saratoga Partners, a middle market private equity investment firm. Within the BDC, Saratoga Investment Corporation manages both an SBIC-licensed subsidiary and a Collateralized Loan Obligation (CLO) fund. The Company believes these diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to offer a broad range of financing solutions.

Forward Looking Statements

Statements included herein may contain “forward-looking statements”. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of assumptions, risks and uncertainties, which change over time. Actual results may differ materially from those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by the Company with the Securities and Exchange Commission. Except as required by law, the Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Source: Saratoga Investment Corp

Saratoga Investment Corp. Announces Offering of Notes Due 2025 and BBB Investment Grade Rating from Egan-Jones Ratings Company.

NEW YORK, NY, Aug. 21, 2018 (GLOBE NEWSWIRE) — Saratoga Investment Corp. (the “Company”) (NYSE: SAR) announced the commencement of a registered public offering of Notes due 2025 (the “Notes”). The Company also announced that it has received an investment grade rating of “BBB” from Egan-Jones Ratings Company, an independent, unaffiliated rating agency.

Egan-Jones is a Nationally Recognized Statistical Ratings Organization (NRSRO) and is recognized by the National Association of Insurance Commissioners (NAIC) as a Credit Rating Provider (CRP). Egan-Jones is also certified by the European Securities and Markets Authority (ESMA).

The Notes are expected to be listed on the New York Stock Exchange and to trade thereon within 30 days of the original issue date under the trading symbol “SAF”.

Ladenburg Thalmann & Co. Inc., a subsidiary of Ladenburg Thalmann Financial Services Inc. (NYSE American: LTS), BB&T Capital Markets, a division of BB&T Securities, LLC, and Janney Montgomery Scott LLC are acting as the joint book-running managers, B. Riley FBR, Inc., Compass Point, National Securities Corporation, a wholly owned subsidiary of National Holdings, Inc. (NASDAQ:NHLD) and William Blair are acting as joint lead managers and Maxim Group LLC is acting as the co-manager for the offering. Investors are advised to consider carefully the investment objective, risks and charges and expenses of the Company before investing.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, nor will there be any sale of, the Notes referred to in this press release in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. A registration statement relating to the Notes was filed and has been declared effective by the Securities and Exchange Commission.

This offering is being made solely by means of a written prospectus forming part of the effective registration statement, which may be obtained from of any of the following investment banks: Ladenburg Thalmann, Attn: Syndicate Department, 277 Park Avenue, 26th Floor, New York, NY10172, or by emailing prospectus@ladenburg.com (telephone number 1-800-573-2541); BB&T Capital Markets at 901 East Byrd Street, 3rd Floor, Richmond, VA 23219 Attn: Syndicate Dept. or via email request: prospectusrequests@bbandtcm.com; Janney Montgomery Scott LLC, Attn: Syndicate Department, 1717 Arch Street, Philadelphia, PA 19103, or by emailing prospectus@janney.com; B. Riley FBR, Inc., 1300 North 17th Street, Suite 1400, Arlington, VA 22209 or via email request at prospectuses@brileyfbr.com; Compass Point Research & Trading, LLC 1055 Thomas Jefferson Street NW, Suite 303 Washington, D.C. 20007, or email at syndicate@compasspointllc.com; William Blair & Company, L.L.C., Attention: Prospectus Department, 150 North Riverside Plaza, Chicago IL 60606, or by telephone at 1-800-621-0687 or email at prospectus@williamblair.com; Maxim Group LLC at 405 Lexington Avenue, New York, NY 10174, Attention Syndicate Department, or via email at syndicate@maximgrp.com or telephone at (212) 895-3745. The prospectus contains a description of these matters and other important information about the Company and should be read carefully before investing.

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that invests primarily in leveraged loans and mezzanine debt issued by privately owned U.S. middle-market businesses, which the Company defines as companies having annual EBITDA (earnings before interest, taxes, depreciation and amortization) of between $2 million and $50 million, both through direct lending and through participation in loan syndicates. Saratoga Investment Corp.’s objective is to generate current income and, to a lesser extent, capital appreciation from our investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, a New York-based investment firm affiliated with Saratoga Partners, a middle market private equity investment firm. Within the BDC, Saratoga Investment Corporation manages both an SBIC-licensed subsidiary and a Collateralized Loan Obligation (CLO) fund. The Company believes these diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to offer a broad range of financing solutions.

Forward Looking Statements

Statements included herein may contain “forward-looking statements”. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of assumptions, risks and uncertainties, which change over time. Actual results may differ materially from those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by the Company with the Securities and Exchange Commission. Except as required by law, the Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Source: Saratoga Investment Corp

Saratoga Investment Corp. Announces Pricing of Public Offering of Common Stock

NEW YORK, July 11, 2018 /PRNewswire/ — Saratoga Investment Corp. (the “Company”) (NYSE: SAR) today announced the pricing of its public offering of 1,150,000 shares of common stock. The public offering price was set at $25.00 per share and net proceeds from the offering, after deducting underwriting discounts and estimated offering expenses payable by the Company, are expected to be approximately $27.2 million. The Company has also granted the underwriters a 30-day option to purchase up to an additional 172,500 shares of its common stock. The sale of the shares of common stock is expected to close on July 13, 2018, subject to the satisfaction of customary closing conditions.

The Company intends to use substantially all of the net proceeds of this public offering to make investments in middle-market companies in accordance with its investment objective and strategies and for general corporate purposes. The Company may also use a portion of the net proceeds to reduce its outstanding borrowings.

Ladenburg Thalmann & Co. Inc., a subsidiary of Ladenburg Thalmann Financial Services Inc., is acting as the lead book-running manager. BB&T Capital Markets, a division of BB&T Securities, LLC, B. Riley FBR, Inc., Compass Point and Janney Montgomery Scott LLC are acting as joint book-running managers, and National Securities Corporation, a wholly owned subsidiary of National Holdings Corporation, and Maxim Group LLC are acting as co-managers for the offering. Investors are advised to consider carefully the investment objective, risks and charges and expenses of the Company before investing.

This offering is being made pursuant to an effective shelf registration statement on Form N-2 that has been filed with the U.S. Securities and Exchange Commission. The offering may be made only by means of a prospectus and a related prospectus supplement, copies of which may be obtained, when available, from any of the following investment banks: Ladenburg Thalmann, Attn: Syndicate Department, 277 Park Avenue, 26th Floor, New York, NY 10172, or by emailing prospectus@ladenburg.com (telephone number 1-800-573-2541); BB&T Capital Markets at 901 East Byrd Street, 3rd Floor, Richmond, VA 23219 Attn: Syndicate Dept. or via email request: prospectusrequests@bbandtcm.com; B. Riley FBR, Inc., 1300 North 17th Street, Suite 1400, Arlington, VA 22209 or via email request at prospectuses@brileyfbr.com; Compass Point Research & Trading, LLC 1055 Thomas Jefferson Street NW, Suite 303 Washington, D.C. 20007, or email at syndicate@compasspointllc.com; Janney Montgomery Scott LLC, Attn: Syndicate Department, 1717 Arch Street, Philadelphia, PA 19103, or by emailing prospectus@janney.com. The prospectus supplement and the accompanying prospectus contains a description of these matters and other important information about the Company and should be read carefully before investing. Investors are advised to carefully consider the investment objectives, risks and charges and expenses of the Company before investing.

This press release does not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of the shares referred to in this press release in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction.

About Saratoga Investment Corp.

Saratoga Investment Corp. is a specialty finance company that invests primarily in leveraged loans and mezzanine debt issued by privately owned U.S. middle-market businesses, which the Company defines as companies having annual EBITDA (earnings before interest, taxes, depreciation and amortization) of between $2 million and $50 million, both through direct lending and through participation in loan syndicates. Saratoga Investment Corp.’s objective is to generate current income and, to a lesser extent, capital appreciation from our investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, a New York-based investment firm affiliated with Saratoga Partners, a middle market private equity investment firm. Within the BDC, Saratoga Investment Corporation manages both an SBIC-licensed subsidiary and a Collateralized Loan Obligation (CLO) fund. The Company believes these diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to offer a broad range of financing solutions.

Forward Looking Statements

Statements included herein may contain “forward-looking statements”. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of assumptions, risks and uncertainties, which change over time. Actual results may differ materially from those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by the Company with the Securities and Exchange Commission. Except as required by law, the Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

SOURCE Saratoga Investment Corp.

Saratoga Investment Corp. Announces Fiscal Year End and Fourth Quarter 2018 Financial Results

NEW YORK, May 14, 2018 – Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced financial results for its 2018 fiscal year end and fourth quarter.

Summary Financial Information

The Company’s summarized financial information is as follows:

| For the year ended and as of February 28, 2018 | For the year ended and as of February 28, 2017 | For the year ended and as of February 29, 2016 | |||||

| ($ thousands except per share) | |||||||

| AUM | 342,694 | 292,661 | 283,996 | ||||

| NAV | 143,691 | 127,295 | 125,150 | ||||

| NAV per share | 22.96 | 21.97 | 22.06 | ||||

| Investment Income | 38,615 | 33,157 | 30,051 | ||||

| Net Investment Income per share | 2.11 | 1.68 | 1.91 | ||||

| Adjusted Net Investment Income per share | 2.27 | 2.01 | 1.90 | ||||

| Earnings per share | 2.93 | 1.98 | 2.09 | ||||

| Return on Equity – last twelve months | 13.2% | 9.0% | 9.4% | ||||

| For the quarter ended February 28, 2018 | For the quarter ended November 30, 2017 | For the quarter ended February 28, 2017 | |||||

| ($ thousands except per share) | |||||||

| AUM | 342,694 | 338,838 | 292,661 | ||||

| NAV | 143,691 | 138,846 | 127,295 | ||||

| NAV per share | 22.96 | 22.58 | 21.97 | ||||

| Investment Income | 10,128 | 9,526 | 8,358 | ||||

| Net Investment Income per share | 0.53 | 0.50 | 0.19 | ||||

| Adjusted Net Investment Income per share | 0.60 | 0.54 | 0.49 | ||||

| Earnings per share | 0.89 | 0.71 | 0.22 | ||||

| Return on Equity – last twelve months | 13.2% | 10.2% | 9.0% | ||||

| – annualized quarter | 15.7% | 12.9% | 3.9% | ||||

“Saratoga Investment Corp completed a very strong fiscal year 2018. We successfully expanded our assets under management, maintained our strong investment quality, broadened our investor base, maintained our diversified sources of low-cost and fixed rate liquidity and made our pipeline of available deal sources more robust,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment. “These important achievements were in keeping with the overall long-term objectives of growing the size and improving the quality of our asset base that has guided us since taking over management of the BDC in 2010. These milestones led to us recently increasing our quarterly dividend for the 14th consecutive quarter to $0.50 per share, reflecting a 9% year-over-year increase while still overearning the dividend by 14%, with an annual fiscal year 2018 total dividend paid of $1.90 per share. Our talented business development and origination team put $108 million of new capital to work this year, enabling us to stay ahead of ongoing redemptions. Year-over-year, NAV grew by 13% and NAV per share by 4.5%. In addition, we are well structured for a potential higher interest rate environment, with almost 80% of our investments having floating interest rates and all of our currently outstanding debt fixed-rate and long-term. Our LTM ROE for the year was 13.2%, which puts near the top of all BDCs for the past year. We are extremely pleased with the strong and leading risk-adjusted investment performance we have delivered for our shareholders this year.”

Michael J. Grisius, President and Chief Investment Officer, added, “During fiscal year 2018, the steady expansion of our asset base continued, with a year-on-year increase in our investments at fair value of 17%, and a 261% increase since 2012. Despite a difficult market environment, our deal pipeline remained robust and continued to grow. Furthermore, market headwinds did not impair our consistent ability to deploy capital in high quality credits at multiples lower than the market average. We continue to see demand for financing in the lower end of the market and believe that our ongoing investments in new business development and origination capabilities will result in continued pipeline improvement, and overall growth. Our belief remains that successful investing rests on sound judgment and steady, continuous discipline, taken one decision at a time.”

As of February 28, 2018, Saratoga Investment increased its assets under management (“AUM”) to $342.7 million, an increase of 17.1% from $292.7 million as of February 28, 2017, and an increase of 1.2% from $338.8 million as of November 30, 2017. This increase reflects originations of $107.7 million new investments during the year ended February 28, 2018, offset by repayments of $66.3 million during fiscal year 2018. These investments and repayments for the year are inclusive of the $20.8 million in originations and $20.8 million in repayments during the quarter ended February 28, 2018. Since Saratoga management has taken over the management of the BDC, $249.4 million of repayments and sales of investments originated by Saratoga have generated a gross unlevered IRR of 16.2%. Saratoga Investment’s portfolio has remained strong, with a continued high level of investment quality in loan investments with 96.8% of our loans at our highest internal rating for this quarter.